CDOnet

Register for the Course

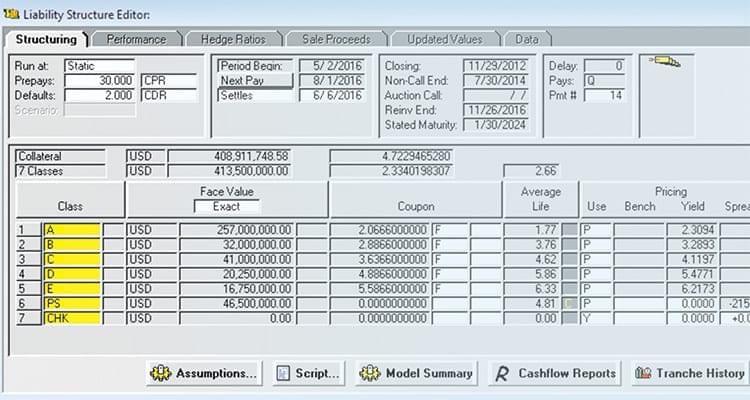

The CDOnet solution is a comprehensive and flexible software platform for cash flow analytics. With its extensive deal library, industry-leading analytics, powerful API, and dedicated customer support, the CDOnet platform improves your ability to monitor collateralized debt obligation (CDO) holdings, understand your risk concentrations, and value your portfolio.

Leverage a comprehensive platform for CDO cash flow analytics

- Robust analytics enable you to perform in-depth analyses of your portfolio, including multi-deal scenario analyses, Monte Carlo analyses, and price and yield sensitivities.

- Integrated credit models, using alternative methodologies from the Moody's Analytics team and publicly available rating methodologies from Moody's Investors Service, assess underlying collateral at the touch of a button.

- Comprehensive library provides access to deal waterfalls and monthly, updated loan-level performance data that has been normalized and quality checked by our financial engineers.

- Flexible architecture allows you to view and modify collateral, deal waterfalls, and other assumptions, so you can be confident that the deal is modeled to your specifications under any scenario.

- Robust application program interface (API) lets you automate tasks, customize report templates, access the CDOnet platform through Microsoft Excel software, and integrate the software and other systems.

- Dedicated customer support.

Gain industry-leading analytics with unparalleled customization capabilities

- Identify potentially undervalued or overvalued securities by simultaneously analyzing multiple deals under a range of scenarios.

- Hedge exposure to a particular industry or issuer by identifying collateral overlaps in their holdings.

- Develop insight about tranche cash flows with break-even, duration, and first-dollar loss analyses.

- Automate the monitoring process to address recurring reporting needs.

The CDOnet solution supports asset managers, trustees, and underwriters

- The CDOnet software enables asset managers to run compliance tests, analyze hypothetical trades, and perform cash flow analyses.

- Underwriters may use the software to structure deals and assess credit quality.

- The CDOnet platform enables trustees to calculate bond payments for the next period, verify payment-date waterfalls, check compliance tests, and oversee asset manager trades.

Product Brochure

Related Solutions

CLO Solutions

Moody’s Analytics provides CLO data with award-winning, end-to-end CLO solutions, available via multiple delivery methods. Find out more.

Structured Finance Buy-Side Solutions

Moody's Analytics provides dependable, integrated, and comprehensive solutions for Structured Finance investors.

Structured Finance Origination

Moody's Analytics structured finance credit origination solutions offer structured finance market participants transparency, integration, and flexibility.

Structured Finance Sell-Side Solutions

Moody’s Analytics offers a number of solutions for sell-side structured finance market participants