The Future of Small Business Lending

In this article, we provide a summary of findings from our recent market research study on small business lending, which focused on the lending process and the challenges associated with banks’ credit risk assessments. This article provides an overview of small business lending today, discusses challenges and emerging trends, and provides recommendations for addressing the challenges to create a more streamlined and automated lending process.

In a recent market research study focused on challenges of small business lending and credit risk assessment by banks, Moody’s Analytics concluded that emerging technology, innovative use of data, and expectations of an enhanced borrower experience will drive significant change in small business lending in the coming years.

The study was based on interviews with traditional lenders and emerging players in the financial technology (fintech) space on how they segment their business customers, the processes they use to evaluate credit worthiness of small businesses, and the challenges with these processes. Findings from the interviews were complemented by secondary industry research; insights from participation in banking, fintech, and small business events; and ongoing engagement with Moody’s Analytics customers.

The study had these objectives:

- Provide perspective on the current state of small business lending processes.

- Evaluate the trends affecting small business lending.

- Identify the challenges faced by banks and other financial institutions during the lending process.

- Assess the small business credit information market, including tools and solutions employed by lenders to evaluate the creditworthiness of their customers and prospects.

- Define a future state vision for efficient and profitable small business lending.

In this article, we provide a summary view of our findings based on this research.

Overview of Small Business Lending

While the definitions of small and mid-sized business borrowers vary among financial institutions, these are the typical meanings:

- Micro enterprises are defined as businesses with less than $1 million in annual revenue, and loan sizes up to $250,000. These businesses are serviced primarily by the branch network.

- Small businesses are defined as those with approximately $20 million or less in revenue or $1 million or less in exposures. These businesses tend to be serviced by the business banking group.

- Middle-market organizations tend to be defined as those with aggregate loan exposure between $1 million and $20 million. They are typically serviced by the commercial banking or enterprise banking groups.

Figure 1 summarizes banks’ definitions of businesses by size.

Figure 1. Bank definitions of small and medium-sized businesses

Source: Moody's Analytics

For small business lending above the branch banking level, most bank lenders request three years of financial statements, collected either via unaudited financial reports from the prospective borrower or in the form of tax returns for the business. Financials may be complemented with bureau data on credit utilization and payment behavior.

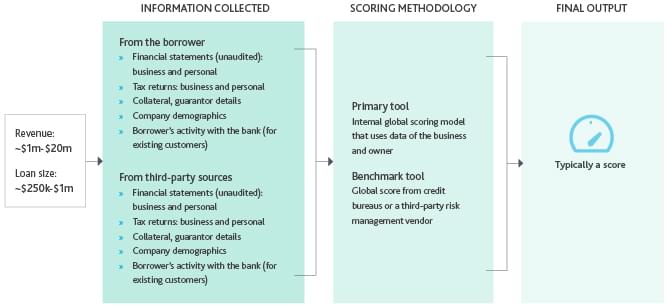

The collected data is typically applied in an internal scoring model with attributes assessing the creditworthiness of both the business and the proprietor or guarantors. This information is collected and entered manually into bank systems to produce an internal risk rating, which may be benchmarked against a number of external scores. Few banks have implemented auto-decisioning or indicated that they make small business loan decisions based primarily on a quantitative model. Figure 2 illustrates this process.

The small business lending process at most banks today is highly manual and conducted across a multitude of unintegrated systems. This results in a small business lending operation that is inefficient, inconsistent, and expensive.

Challenges in Small Business Lending

Although small business loans constitute more than a quarter of the lending volume in the US, most banks do not have effective systems and practices to accurately and efficiently assess small business risk and seamlessly conduct lending activities. The challenges generally fall into two categories: data problems and process problems. With respect to data, these challenges exist:

- The credit information vendor market is fragmented, meaning financial providers and small businesses do not have a single source of credit information to meet their growing need for quality data.

- Banks use manual, time-consuming, and antiquated processes for collecting information from prospective borrowers.

- Once information is gathered, underwriters or credit managers spend significant time reconciling and merging data from various sources.

- Often, information on the credit risk of the owner or proprietor of a small business is used as a proxy for the risk of the business. Existing scoring models that are heavily weighted to consumer data lack credibility at levels above micro-businesses and generate high levels of manual overrides.

Figure 2. Small business credit assessment process in banks

Source: Moody's Analytics

Even when lending decisions are made, a gap remains in terms of systems needed to document, monitor, and report on portfolio performance.

Banks may encounter challenges through every step of the lending cycle, from information-gathering through monitoring and portfolio management. These challenges are summarized in Figure 3.

Small businesses also face a unique set of challenges that make the process of getting credit difficult, including:

- Lack of knowledge of their credit risk and how they can improve their business credit standing.

- Opacity of banks’ credit assessment process and expectations.

- Inconsistent requirements among banks in terms of the lending process, necessary data, and documentation.

- Difficulty in maintaining current and accurate financial reporting due to manual processes and lack of expertise.

Figure 3. Pain points faced by banks in the small business lending process

Source: Moody's Analytics

Emerging Trends in Small Business Lending

Small businesses are searching for easier access to loans in the face of shrinking funding and a lukewarm response from traditional banks, which are struggling to buoy margins in a low interest rate regime. Alternative lenders are emerging at a feverish pace to fi ll this funding gap, but they have the challenge of creating reliable credit assessment models and bracing themselves for increased regulatory scrutiny. Against this background, we identified four categories of trends that will drive significant change in small business lending in the coming years (Figure 4).

Figure 4. Emerging trends in small business lending

Source: Moody's Analytics

Addressing the Challenges

Lending organizations have opportunities to improve the small business lending process in all parts of the credit life cycle. Organizations currently have these main opportunities for improvement:

- Streamline the collection of borrower information. Lenders commonly complain that small business information does not provide sufficient detail to make a lending decision. Borrowers argue that the information they produce is sufficient for them to run their business successfully, and that they do not have the resources to produce additional analysis. Banks can rethink the required information and more effectively differentiate the level of information requested based on the potential risk exposure. They can also explore new tools and data sources that facilitate data- gathering.

- Leverage proven rating models for standard loans. Models are only as good as the quality and richness of the data that drives them. It is important to have proven and valid benchmarks based on a substantial and reliable dataset reflecting historical small business defaults. Individual lending institutions cannot – and should not – reinvent this wheel.

- Update processes. The key issue here is the time it takes for a lender to process a loan application and disburse funds – the time-to-money. Banks should focus on automation of manual processes and implementing rule-based decisioning to fast-track simpler and lower exposure loans and refocus precious resources on higher-value activities.

- Upgrade infrastructure. Systems-related efforts should focus on removing duplicate tasks (e.g., multiple instances of keying in the same data) via integration and implementation of solutions with a lower overall cost of ownership. Outsourced or cloud platforms can offer an attractive alternative since they typically do not require new hardware or additional IT staff, and they are automatically updated and backed up. Advanced software-as-a-service (SaaS) systems can provide a single, integrated solution for managing the entire credit life cycle.

- Learn from the data. High-performing organizations will extract meaningful data to understand key performance indicators and meet audit and reporting requirements. Doing this effectively requires two things: first, a keen focus on exactly what data is the most meaningful; and second, data structures and systems that capture the right data and make it readily available for analysis. In addition, strict discipline and well-defined processes are necessary to ensure that the data is accurately captured and maintained.

The Path Forward: The Future State of Small Business Lending

Based on the findings of our research, including emerging trends and opportunities for improvement, the Moody’s Analytics view of the future state of lending focuses on these elements:

- Tools to automate gathering and structuring of small business data from financial statements, tax returns, and other documents.

- Development of credit models using data and factors beyond financial information, and broader use of all data sources to optimize decisioning.

- Rule-based tools to automate processes and decisions, and workflow functionality to track tasks and requirements.

- Enhanced early warning, portfolio monitoring, and business intelligence capabilities.

Figure 5 shows how these aspects contribute to the future small business lending process.

To meet the challenges of a rapidly changing market, banks will need to adopt tools and technologies for enhanced data collection, process automation, automated scoring, and rule-based decisioning. Transforming the small business lending process will also require banks and their partners to leverage new credit information solutions and rethink the way they collect and use customer and prospect data to create credible, quantitative, and demonstrably validated credit decisioning frameworks.

Figure 5. The future state of small business lending

Source: Moody's Analytics

Anju Govil contributed research to this article.

Featured Experts

Hasio-shan Yang, Ph.D.

Senior economist; commercial real estate; credit risk modeling; data infrastructure; machine learning; quantitative modeling and thought leader.

Thomas LaSalvia, Ph.D.

Head of CRE Economics; commercial real estate; emerging trends; housing sector; thought leader; capital markets; office.

As Published In:

Devoted to the convergence of risk, finance, and accounting disciplines with regard to the new impairment standard, Financial Instruments -- Credit Losses, commonly known as the current expected credit loss (CECL) approach.

Related Articles

SBA's PPP Loan Program - Challenges and Successes

Join Moody's Analytics and our panel of financial institution executives, as they share their challenges and successes in navigating the second round of the SBA's PPP Loan Program, as well as the potential for the third and fourth round of stimulus for small businesses.

The Future of Small Business Lending

Learn how leading organizations are leveraging technological advances and risk assessment to: streamline processes; build more efficient, consistent, and profitable small business lending practices; and, enhance the customer experience and provide more value to their constituents.

Seven key challenges in assessing SME credit risk

Assessing the credit risk of small and medium size enterprises (SMEs) is one of the most challenging tasks in banking. The difficulties stem from fragmented financial data, the strength of risk models, length of the process, and broader issues such as the tension between sales and credit. The competitive lending environment, regulatory requirements, different geographies, and positions in the economic and credit cycles also have an impact. This paper discusses how these challenges might be addressed from a Moody's Analytics perspective, which has been developed over time with our extensive experience in assessing credit risk.

Global Banking Regulatory Radar

The Global Banking Radar highlights the busy regulatory agenda that banks will face over the next couple of years. The trend of increased regulation that began in the EU and the US is now spreading to other regions, requiring banks worldwide to comply with increasingly stringent and complex requirements.