RiskCalc™ Scorecard Suite

Register for the Course

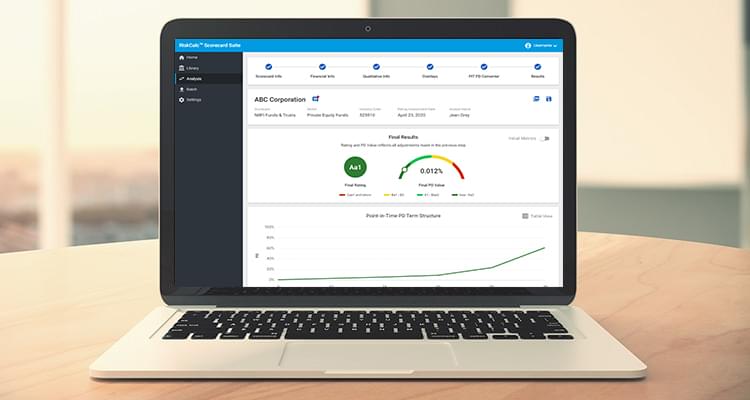

The RiskCalc Scorecard Suite provides a scalable, intuitive, and accurate framework for evaluating the default risk of niche asset classes. Credit risk professionals can assess probability of default (PD) across different sectors including Non-Banking Financial Institution (NBFI) and Project Finance transactions.

Use as a standalone model, as an input to internal scoring, or as a benchmarking tool

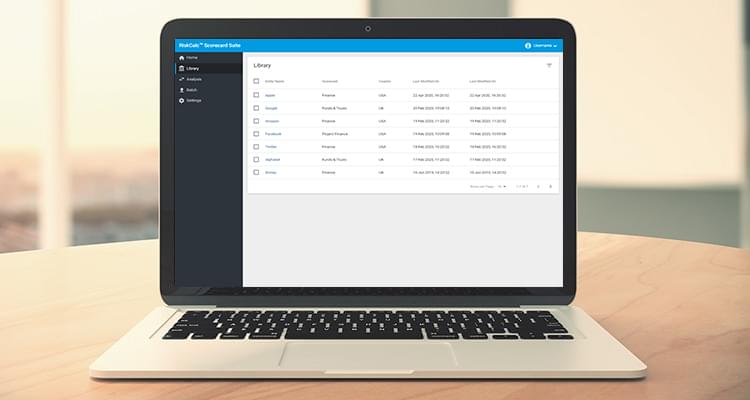

- Process multiple entities quickly with a user-friendly, flexible solution.

-

Use term structure metrics to help monitor how the default risk changes over long time horizons.

-

Access details on key risk drivers that affect the credit risk of an entity to help make objective credit decisions and eliminate assumptions.

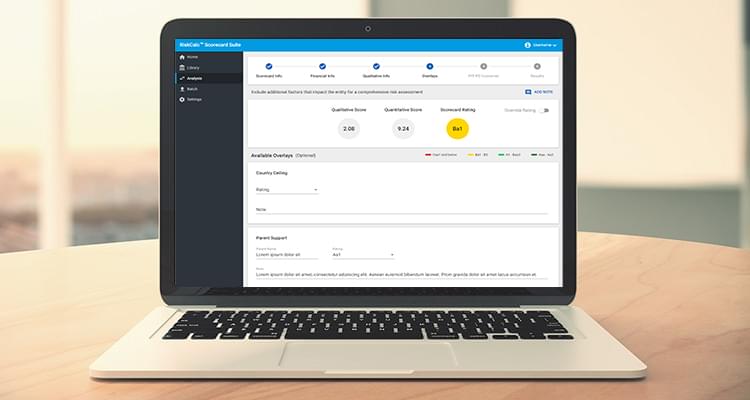

- Take advantage of embedded additional overlays to account for affiliate, government, or parent support that considers sector-specific characteristics. .

Increase efficiency and gain confidence in your credit risk management process

-

Overcome modeling challenges with our ready-to-use solution that can be integrated easily into your existing risk management framework.

- Improve efficiency across the organization by enabling your teams to focus on results, not time-consuming processes.

-

Adopt forward-looking views of risk for efficient monitoring of your portfolio.

-

Gain confidence in your credit risk management process with extensive training and support from our expert team.

Contact us for a free trial

Product Brochure

Related Solutions

Credit Risk Modeling

Moody’s Analytics delivers award-winning credit models and expert advisory services to provide you with best-in-class credit risk modeling solutions.