Capital Risk Analyzer for Stress Testing and Capital Planning

Register for the Course

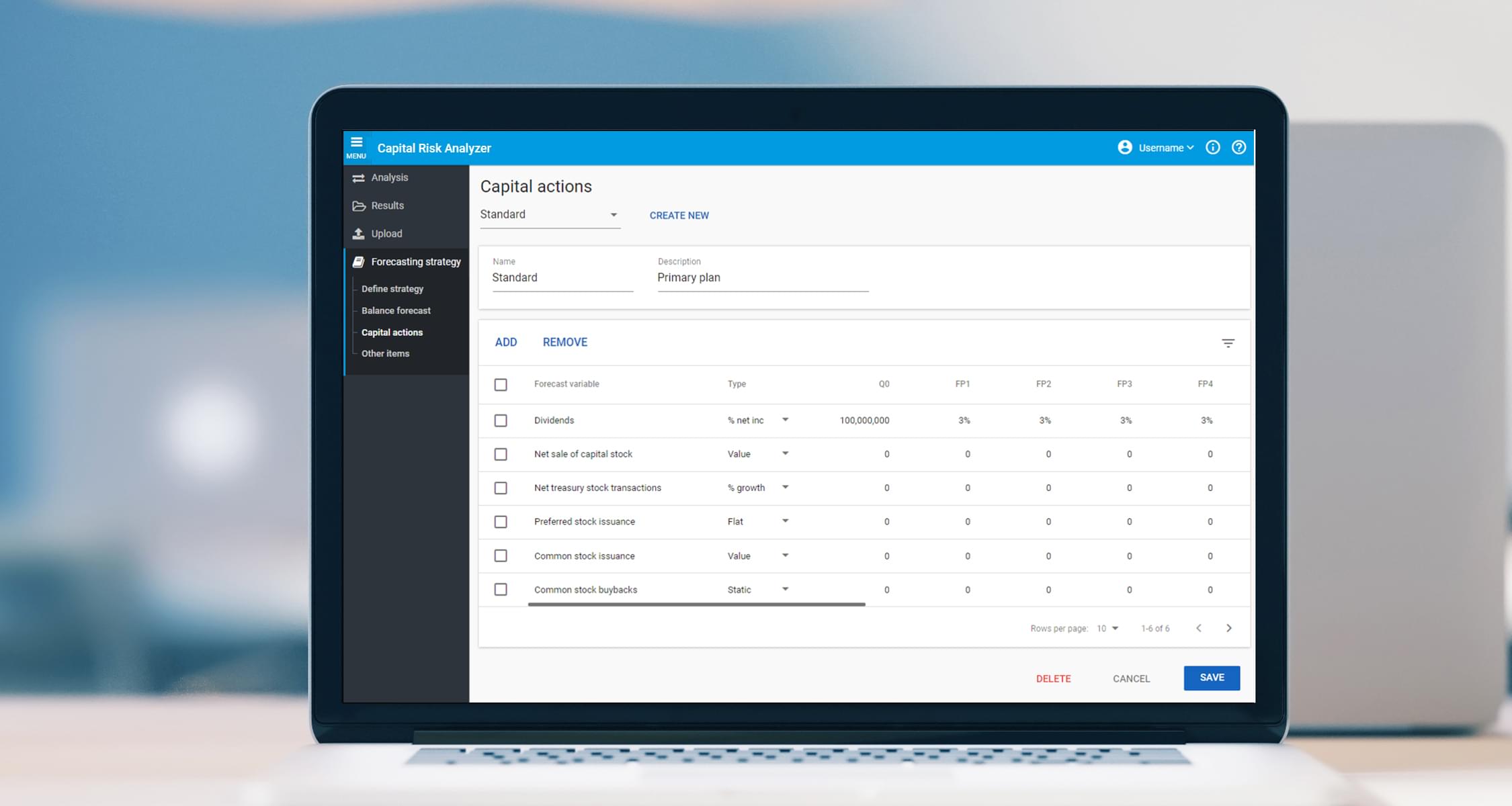

Moody's Analytics Capital Risk Analyzer solution combines economic, credit, and accounting know-how to help organizations evaluate strategic decisions based on financial and regulatory metrics for capital planning and stress testing (DFAST, EBA).

Optimize business strategies with an integrated solution designed for stress testing, risk management, and strategic planning

- Complete financial statement forecasts for regulatory stress testing and benchmark purposes.

- Assess the impact of multiple scenarios that consider macroeconomic condition and firm-specific factors, for a quick and detailed strategic analysis.

- Visualize the impact of credit losses, interest income, loan balance growth, and risk-weighted assets (RWA) projections on capital ratios and balance sheet forecasts.

- Understand sensitivities that give users the ability to define and modify their planning structure at the macro- and micro-level.

Assess business strategies for optimal profitability and capital levels

- Recognize balance sheet implications under various economic scenarios by projecting results in line with stress testing requirements.

- Enhance decision making by considering economic scenarios, in addition to regulatory requirements, when iterating and optimizing capital strategy.

- Forecast impairments to gain insight on the impact of new accounting standards like CECL and IFRS 9 across key metrics.

- Identify scenarios that are likely to cause a breach of certain risk limits.

- Understand the impact of economic changes on dividend forecasts to better manage shareholder expectations.

Leverage advisory services with extensive risk management and credit experience

Our advisory services provide software implementation, custom modeling, economic capital and risk management consulting, regulatory and process support, and training customized to each client's unique requirements. These services, combined with world-renowned credit research, empower clients to improve their credit portfolio risk management strategy and bottom-line performance.

Product Brochure

Related Solutions

Portfolio Optimization

Quantify diversification benefits across portfolios and define risk types that inform risk management and active asset allocation decisions.

Strategic Capital Planning

Moody’s Analytics strategic capital planning solutions provide key capital ratio and credit metric projections based on a variety of strategic and economic scenarios.