PFaroe™ E&F

Register for the Course

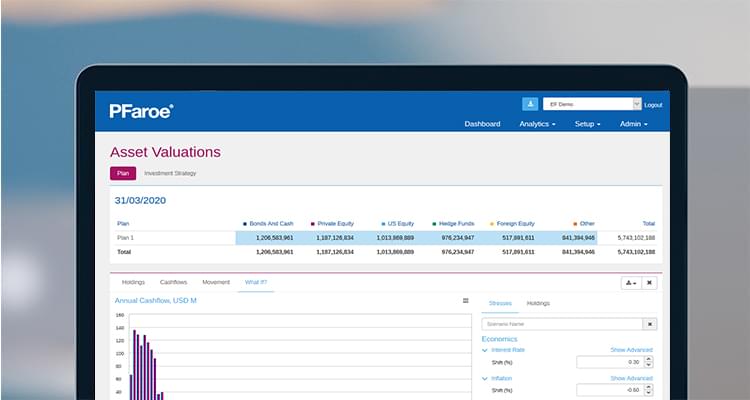

PFaroe E&F software is a web-based platform that gives endowment portfolios investment risk and simulation analytics tools. In-house investment teams and CIOs can take advantage of the resources of PFaroe to deliver a powerful framework that manages the impact of downside risk on an endowment’s corpus and spending needs.

Enhance performance and maximize market opportunities

- Test policy portfolios and optimize fund strategies and managers, employing several techniques from “what-if” scenario testing through powerful stochastic modeling using a sophisticated economic scenario generator.

- Monitor and optimize reporting on the investment portfolio and risk and speed up the Board reporting cycle, allowing CIOs to focus on portfolio management, not number-crunching.

- Assess investment solutions from multiple perspectives with several types of built-in spending formulas to produce a comprehensive suite of spending, asset, and risk analytics.

- Perform sophisticated modeling previously available only to the largest endowments and foundations.

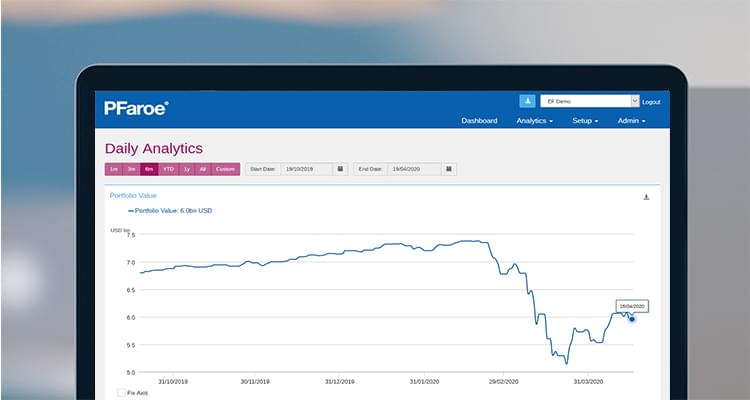

- Review new managers or investment strategies quickly, and become more responsive to investment opportunities and market dislocations through real-time analysis.

- Devise investment strategies that react to market events or economic scenarios.

Deliver operational efficiency, improve governance, and forecast mission delivery

- Define a risk framework based on how the organization measures success, such as spending goals, portfolio real value, and performance relative to a policy portfolio.

- Take advantage of faster response times to stakeholder queries by automating tailored reporting on demand and at the click of a button.

- Forecast the likelihood of endowments or foundations delivering on their mission through deterministic, stochastic projections of their portfolio’s spending contribution to the organization’s budget.

- Optimize budgeting at the CFO level by analyzing the direct impact of investment decisions, gifting patterns, and capital campaigns.

- Consolidate systems and services, eliminate manual intervention, and improve security to minimize errors and maximize cost and time savings.

Contact us for a demo

Product Brochure

Related Solutions

Multi-Asset Portfolio Management

Moody's Analytics economic scenario and asset-liability modeling offerings support investment design and risk management activities.