Certificate in Derivatives Market Strategies (CDMS)

Register for the Course

Boost your career with a valuable certification in derivatives

What will I learn with the CDMS?

- Analyze and learn about derivative instruments, including options, futures and swaps.

- Learn how to use derivatives to manage interest rate, equity, currency and commodity risk.

- Gain a deep understanding of various underlying financial and commodity markets.

- Understand the supply and demand fundamentals of various financial and commodity markets.

- Study the application of derivatives in managing risk, trading and product construction.

- Become competent in the various trading techniques using options and futures.

- Learn how to use derivatives to create structured products.

- Distinguish yourself as a derivatives specialist.

How is the CDMS tailored to my learning needs?

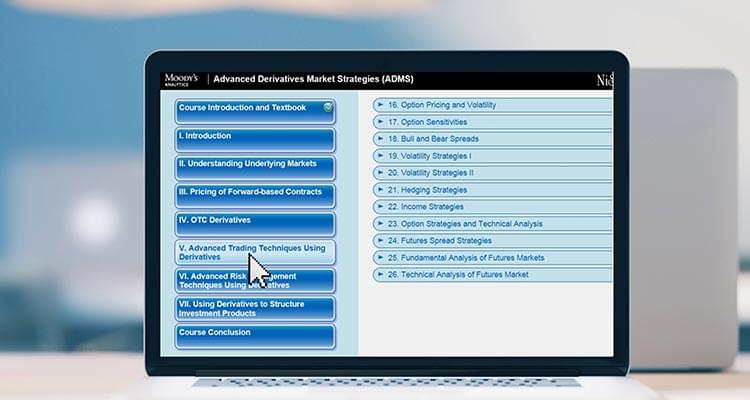

- CDMS consists of six eLearning modules and a final certification exam.

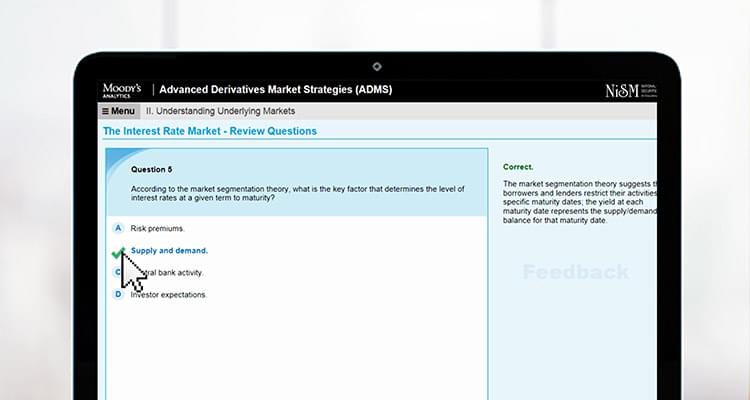

- Each module includes an online quiz to test your understanding of the course content.

- You’ll earn Moody’s Notice of Completion on completion of each module.

- You can access the course material through mobile devices.

- Complete a 3-hour in-person certification exam to earn the CDMS certificate.

- The estimated study time ranges from 60 to 80 hours.

Who is taking the CDMS?

- Institutional Traders

- Investment Advisors

- Risk Management Professionals

- Corporate Officers

- Corporate Finance Specialists/Analysts

- Portfolio Managers

About CDMS

The Certificate in Derivatives Market Strategies comprises of six modules and a final certification exam. Below is an outline of the topics covered in each module:

1. An Overview of Derivatives

Learn how to identify the key features of derivatives, understand its evolution and the similarities and differences among the various types of derivatives—including forward and option-based, as well as exchange-traded and OTC derivatives.

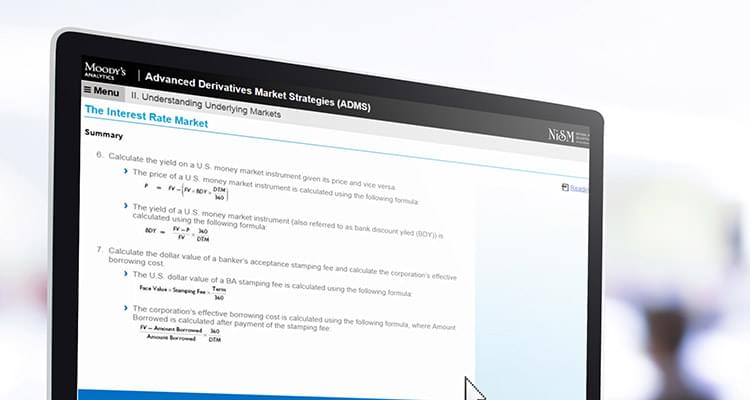

2. Understanding Underlying Markets

Understand the structural foundations and several supply and demand factors affecting markets that underlie the most significant international derivatives contracts. Some of the markets examined include crude oil, natural gas, gold, agricultural commodities, interest rates and foreign exchange.

3. Pricing of Forward and Option-Based Contracts

This module covers the unique aspects of the pricing of both forward and option-based derivatives. It also includes the unique pricing features of each of the various financial, energy, metal and agricultural derivatives.

4. OTC Derivatives

This module provides an in-depth understanding of interest rate, currency, equity and commodity swaps, forward rate agreements, and OTC options such as caps, floors and collars. It explains how these instruments are structured, traded, priced and used.

5. Advanced Trading Techniques Using Derivatives

Understand how options are priced and how they are used to create bull and bear spreads. You’ll also learn about volatility, income, and hedging strategies, and how technical analysis can is as a tool for both options and futures trading.

6. Advanced Risk Management and Product Structuring Techniques Using Derivatives

Gain the knowledge and skills to use derivative instruments to mitigate interest rate, currency, equity, energy, metal, and agricultural price risk faced by organizations involved in these underlying markets. The module also covers option and forward-based derivatives, exchange-traded and OTC derivatives. It explains the benefits and risks of the increasingly common use of derivatives to investors.