Automation has become the latest industry buzzword, but what does this mean? How can automation streamline your commercial loan origination process, increase the productivity of your lending officers and make your customers happier?

Introduction

In the current commercial lending market, there are many software applications that serve the loan origination and credit assessment requirements of traditional and non-traditional lenders. Financial institutions are increasingly mindful of improving their practices in these areas to increase efficiency, decision speed, and productivity, and to enhance their customer experience.

In this paper, we outline the challenges of traditional lending practices and examine each stage of the credit process to see how automation can improve and standardize underwriting procedures.

What we know already – Problem Diagnosis

Commercial lending is about generating economic benefit through the funding of enterprises, while ensuring the lender can make a profit, create shareholder value, and manage risk. Assessing the creditworthiness of any business can be a challenging task. The tools a financial institution uses to do so can impact underwriting standards, timely approval, cost, and the scale of any unpredicted losses. By streamlining and automating the lending process, financial institutions are looking for applications that help them overcome these challenges, increase the quality of the loan portfolio, and deliver customer satisfaction.

Why are so many banks today struggling to achieve these objectives?

Many lenders use manual and paper-based loan approval procedures that now seem out of step with a digitized world. As a result, they have slower decision times than what many customers want, and an internal data management problem that creates more work for bankers and causes opacity for both management and external examiners alike.

Commercial loans can range in size and complexity. Let us take one of the most commonly used manual underwriting methods, spreadsheets, as a typical illustration of today’s lenders’ challenge. Spreadsheets are great tools and probably one of the best single “go to” models of software today. Yet it was unlikely their creators had loan underwriting in mind when designing their application.

Using a spreadsheet to underwrite credit in any form can be cumbersome. Data and financial entry can be time consuming and might lose uniformity over time. Data entered into a spreadsheet is sometimes reentered directly into a lender’s other core systems, doubling effort and creating duplicate records of the same data. From a storage, lineage, retrieval, and portfolio insight perspective, this method has serious flaws.

Let us see how:

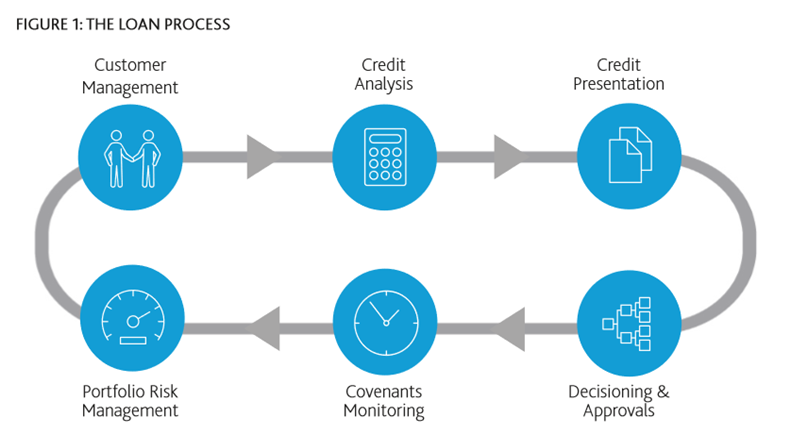

Figure 1 illustrates a typical commercial lending process. Every banker reading this article can immediately recognize the stages and visualize each step in their own organization. Think about each major step in terms of the number of personnel involved, where process bottlenecks appear, which steps are the most challenging, and how long it typically takes for a loan application to move between stages.

Customer Management

The first step in any loan decision or new relationship is collecting the financial and other necessary information from the prospect or customer. Today, this task can be labor-intensive and difficult to complete. Often it is dominated by form filling, electronic or printed documents, and a physical customer file. The more often the information contained in these electronic and paper documents is entered and re-keyed into the lender’s systems, the greater the possibility of inaccurate data being recorded.

In a recent poll conducted by Moody’s Analytics, the question was asked “What is your biggest challenge in initiating the loan process?”, to which 56% of bankers surveyed answered the manual collection of data and subsequent back and forth with the client.

Automation can mitigate the inconsistency and delays of manually collecting financial data and other mandatory customer information. Customer-facing web-based portals and application program interfaces (APIs) can facilitate digital onboarding of new prospect and existing customer data straight to the lender’s loan origination platform. After data is received, lender-defined business rules can automate the next step in the process, differentiating between loan applications that are ready for decision and loan applications that require more documentation.

More advanced automated loan origination platforms are also capable of receiving data feeds that pre-populate customer information fields within the origination platform. One of the more useful applications is the import of customer ownership hierarchies. Organization diagrams, visually depicting the key entities within a group and the inter-relationship between parties, can be uploaded to create the customer ownership hierarchy automatically. For complex borrowers, importing such information can relieve a huge administrative burden.

How many times do bankers rekey information from the CRM system in to the credit application after changes to a borrower’s details or ownership structure? Would it not be simpler and less susceptible to error for the CRM system to integrate seamlessly with the loan application system and for data in one system to flow natively in to the other? The best loan origination platforms enable this form of integration with a lender’s CRM.

In many financial institutions, it is normal practice for the business front office and the risk department to maintain their own separate records for the same customer. The latter might restrict access to certain information for compliance reasons, but usually this duplication leads to unnecessary inefficiency and inaccuracies. An automated credit origination platform enables multiple teams across departments or locations to access the same customer documents electronically, according to their need and purpose, creating a single source of truth. The application of user identity and access protocols within the system can be effective, maintaining the integrity of the customer information and ensuring only those individuals with the correct privileges gain access information. From an audit and control perspective, this satisfies examination considerably more than open access file directories.

Credit Analysis

One of the most important stages of the commercial risk assessment process is spreading the financial data you have received from your prospect or customer, typically another manual and repetitive task. In our recent poll the question we asked was: “How much of the loan process are you automating today?” The result was astonishing in that 50% of bankers surveyed said that they were not using any automation tools whatsoever, and only 31% indicated that they were using automated credit analysis and decisioning techniques.

How can automation play a role in helping the credit analyst to create accurate financial spreads on which to base risk assessment and lending appetite?

Today’s advanced loan origination software has enhanced technology that, with appropriate permissions, allows the lender to interact via a web portal with its commercial customer’s systems. For example, it can extract the relevant financial data required for a credit risk assessment from accounting software, tax returns, and other documents.

The process can occur almost instantaneously and even allow the lender to pre-screen, score the borrower, and provide an in-principle credit decision in a matter of minutes.

The real benefit of electronic data collection and automated financial spreading are in giving more time back to the analyst to perform their risk assessment work. This may include data interpretation, ratio analysis, and forecasting models to gauge the financial risk of the borrower and its capacity to repay the loan. Credit analysis can also include automated risk rating based on probability of default (PD) and loss given default (LGD) models, tools that instantaneously deliver essential risk metrics for loan assessment.

Moreover, when automated customer management and credit analysis tools are combined in the same origination platform, the benefits compound. One example in the commercial lending environment is the case of borrower groups where each entity in the group traditionally has to have its own financial statements assessed individually to have a risk rating assigned. Where the lender’s policy allows, an automated loan origination platform that applies instantaneous group ratings based on the consolidated financial strength of the lead borrower and the application of cascaded or distributed ratings from the parent entity, can save considerable time in the rating process.

Credit Presentation & Decisioning

Automation in the commercial loan approval process is about mining the appropriate data and information, and presenting it clearly to make a credit decision. Being able to automate your lending process from start to finish, captures the benefits of accuracy, near real-time data, increased efficiency, and reduced decisioning times.

After gathering information on your customer or prospect, spreading the financial statements, running the ratio analysis, performing some projected scenarios and undertaking a risk rating, most bankers have a good idea of what their lending appetite looks like. Assuming it is positive, the next step is to prepare a credit presentation, or application, for decisioning by the risk department.

For many lenders, the credit application represents another manual exercise in preparing and collating several separate, yet related, pieces of paper, often in a highly prescribed fashion, adding to the processing time for approval, especially for a new relationship.

An automated credit application solution combines the previously discussed elements of the customer management module, financial analysis, and risk assessment with some form of loan structuring tool, collateral management system, and electronic credit memorandum. An automated credit application does not need to be as complex as it at first sounds. Best-in-class origination platforms also integrate with existing systems or applications the lender already has in place for these functions.

In today’s banking software landscape, there are a few applications that package all the stages together for credit approval. However, by using the data and information already stored in the origination platform, pre-configured document templates mirroring a lender’s paper-based credit forms can be automatically produced to conduct their analysis.

The final step, the decision to approve or decline the loan, has also been made-over by software vendors. In the world of commercial lending, two loans are never the same. At the high volume/low loan value end of the spectrum, it is possible to see the emergence of auto-decisioning based on the particular policies and business rules of the lender. In the retail credit environment, automatic decision making is already commonplace.

The commercial loan market today remains predominantly a domain of human judgment when loan decisioning. Automation is playing a significant role in pre-screening applications and assisting loan officers to assess risk and prepare the proposal for the decision maker. Mobile enablement, in particular, is increasingly used in the decision-making step. Lenders of all sizes are arming their executives with laptops, smart phones, and tablet devices fully loaded with applications enabling them to make lending decisions while on the move, once again driving down the time to approval.

Covenants/Monitoring

After the loan origination process, the asset itself still has to be managed and the risk monitored annually, quarterly, or even monthly. One of the major challenges banks face is to identify a standardized process of collecting financial data to satisfy ticklers, covenants, and policy exceptions. Tracking can be inefficient, not to mention risky, when processes are not clearly defined and rely on manual tools. Moody’s Analytics, has seen examples of mid-tier lenders grappling with portfolios containing several thousand loan covenants still being tracked on spreadsheets. Examiners distrust such methods and often demand that a more robust solution is implemented.

Automated covenant solutions can exist outside of an origination system, but for data accuracy, efficiency and effectiveness, they are better as part of the overall solution. Recording the required covenants as part of the loan application process saves rekeying and anchors the details of the covenant to the approval record for audit purposes.

An automated covenant/tickler feature provides peace of mind that the correct information can be collected in a timely manner through an in-built calendar alert. Automated notifications go out if the appropriate documentation is not collected or if various covenants are not met. Automated testing can also be applied so that an immediate or impending breach is red-flagged via dashboard alerts when the data enters the system.

Portfolio Risk Management

With traditional manual, paper-based loan underwriting methods, lenders often struggle to see what exposures are in the portfolio and to see how these exposures change over time. All lenders have stated risk appetite tolerances and most set appropriate risk-based portfolio limits to guide their loan officers. However, formulating these rules is an academic exercise, unless the lender has an accurate portfolio reporting tool at their hand.

A powerful rationale for automating the loan origination process rests with the improved data integrity, data lineage, and overall governance that comes with a best in class origination platform. We have already discussed how data integrity is compromised when several systems are used to store the same data. The amount of keying and rekeying is multiplied and data is stored in sub-optimal systems. When conditions such as this exist, lenders spend considerable time and resources reconciling their portfolio data before they can usefully analyze it. Several weeks can elapse before an accurate picture emerges, by which time it might be too late and costly to address a particular issue or problem.

The cost benefits attributable to the accurate measurement of a loan portfolio in terms of capital usage must not be underestimated. Overstating risk weighted assets on your balance sheet has a substantial direct cost to it. We are aware of at least one large European bank who gained capital savings of several hundred million dollars after it had undertaken a major portfolio data cleansing project. However, the real lesson is not to allow things to get to that stage.

Automating key stages of the loan origination process helps ensure that risk data is subject to robust governance and control. Further automating, to deliver key business insights through a powerful business reporting tool can add significant value as well.

Conclusion

Automation has increased the efficiency of numerous industries worldwide. Banking was, in many ways, an innovation pioneer, however the business of originating small business and commercial loans is still carried on much the same way it was decades ago.

The landscape for commercial lending is now changing. Spurred on by the emergence of more technology enabled competitors, many traditional lenders are getting in on the act by adopting automation methods in their loan origination processes. Competition is far from the only impetus. Lenders that recognize a need to be more efficient, productive, and responsive to their customers, with higher levels of service, also look to implement technological solutions. These lenders are also driven by cost savings and requirements to meet more stringent regulatory exam standards. For others, the ability to take back control of their data and to gain sharper, more accurate business insights is the motive.

We find few, if any, lenders are prompted to apply automation as a way to reduce human intelligence in the commercial lending arena. Rather, most see it as an enabler to retain talent and engage bankers’ time on things that matter, such as risk analysis and customer relationship management, instead of administration.

Finally, while automating loan underwriting procedures can present some challenges, doing so can enhance the brand of the institution as an innovator and market leader among peers.