Realize your strategic vision and gain a competitive advantage

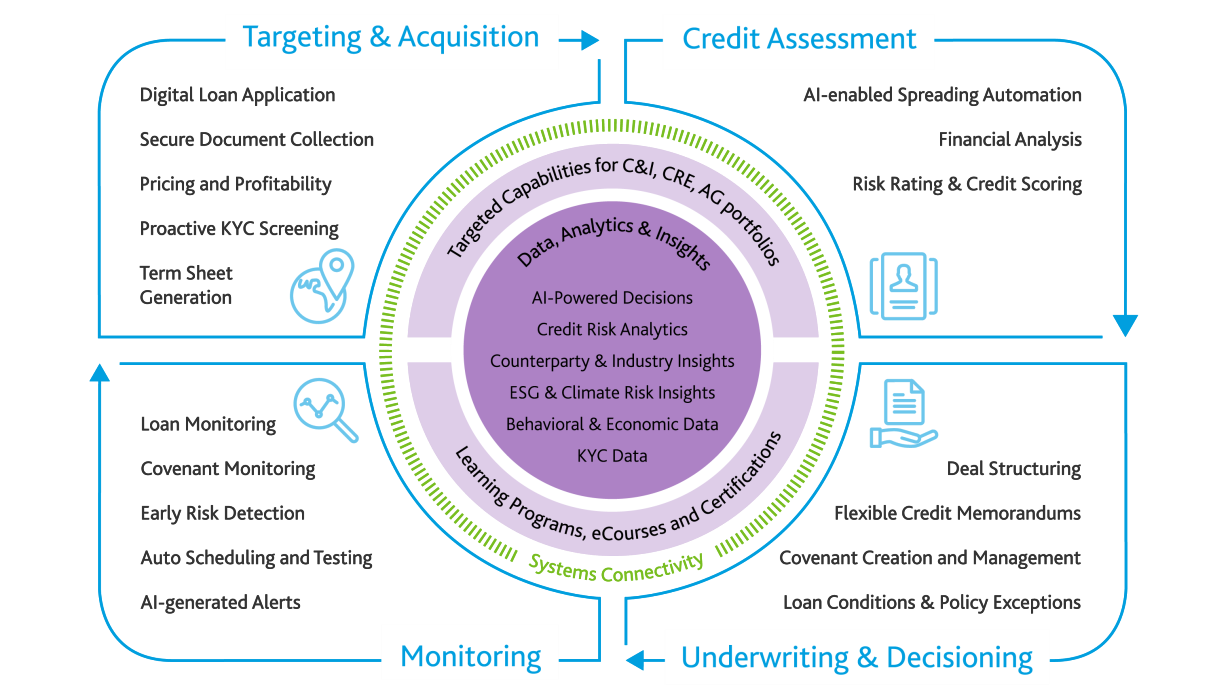

Your organization has customers, strategic initiatives, and growth goals that all need your attention. We help you focus your efforts on building relationships and maximizing new opportunities without sacrificing credit risk management.

Integrated risk metrics – including credit, KYC, ESG, climate and economic data – allow you to effectively score credit applications. Data visualization and early warning insights along with access to our industry and credit experts help you identify and understand areas of risk and opportunity.

Improve time to decision with seamless approval workflows and comprehensive credit memos. Integration between the Lending Suite and your existing systems help to enhance data integrity and information transparency across teams.

Free yourself from manual data entry and tedious analysis and focus on high-value activities to support your organization’s growth initiatives. We can help you deploy AI-enabled automation – like automated spreading and covenant and loan monitoring alerts – across the credit lifecycle.

Upskill your workforce through a wide range of immersive training programs for both retail and commercial banking. Develop knowledge and confidence in your teams so they can better serve your customers.

Recognition

Moody’s Analytics is proud of the awards and recognition we’ve received from organizations around the world. Spanning all areas of our business — data, research, analytics and software — this recognition highlights our important role in the global capital markets and reflects the contributions of all our employees.

Related Solutions

Many of the integrated SaaS solutions and data sets that make up the Lending Suite are available as standalone offerings. Learn more below:

Assessment, Underwriting & Decisioning

Integrated Data & Analytics

- Climate and ESG Risk Assessment

- EDF-X

- Data Solutions

- KYC & Compliance: GRID

Better understand the risk and impact of each credit decision on your loan portfolio and execute that decision quickly across teams. Contact us today to see how we can help.

The Moody's Difference

Moody’s brings together the best of data, experience and best practice capabilities, with our specialized and agile intelligence, to empower banks like yours to have the confidence to act on plans.

Intelligence

We have more data and better insights than our competitors – from private and public financial statements, to award-winning models, economic scenarios to Climate and ESG data. The power of this data is integrated into all of our solutions giving you a superior understanding of your credit book.

Expertise

We’ve been a trusted collaborator for financial institutions for over 100 years. Our in-house industry and credit experts help direct our product development and are available to help clients through our advisory services. Your success is our success.

Guidance & Training

Leveraging our long history in risk expertise, our expansive resources, and an innovative application of technology, we offer a wide range of immersive training programs for retail and commercial bankers. We create confidence in thousands of organizations worldwide with our commitment to excellence, open mindset approach and focus on meeting customer needs.