Sponsor

Infopro Digital, the publisher of Risk Magazine and Risk.net, is a leading player in business-to-business information and services. It offers multimedia products and solutions such as analysis and insight, events, and training.

How Winners Are Chosen

The Risk Technology Awards focus on market risk, trading, and investment risk technology. The award winners are decided by a panel of judges selected by the editors of Risk.net.

"Moody’s Analytics suite of credit-scoring models and solutions address wholesale market needs from small businesses to large private and public companies, as well as commercial real estate, insurers, financial institutions and project finance."...

“It is particularly gratifying that these awards recognize both our longstanding capabilities, like credit data and modeling, and newer offerings like pensions ALM and IFRS 9 accounting.”...

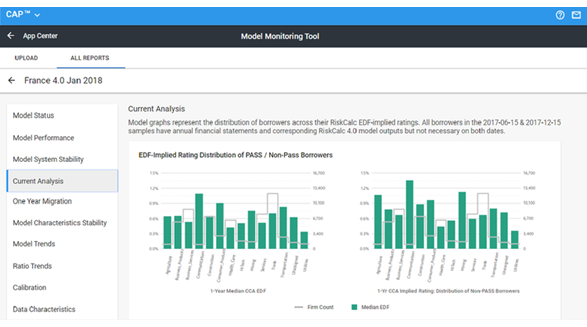

The RiskCalc solution offers a comprehensive approach to assessing the default and recovery of private firms, financial institutions, and project finance transactions. Our RiskCalc models generate forward-looking probability of default or EDF™ (Expected Default Frequency) calculations, loss given default, and expected loss credit measures.

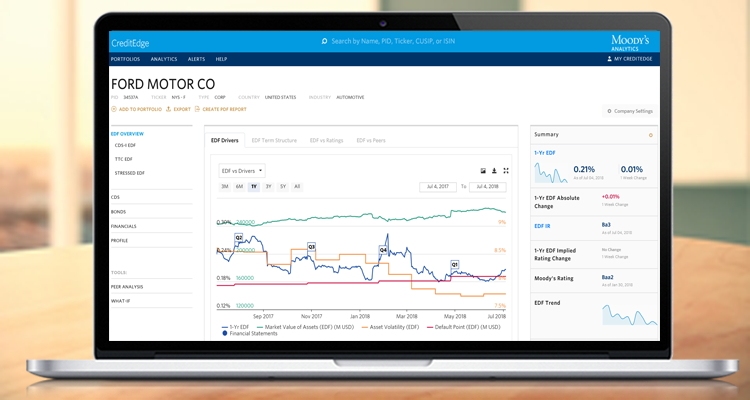

“Every customer’s credit data challenges are unique. As exemplified by these awards – our third year in a row for both – Moody’s Analytics remains successful in helping them solve those challenges. Our credit data capabilities are represented in a range of award-winning solutions, starting with Data Alliance, one of the world’s largest and most comprehensive data consortia, whose members share data across many asset classes and receive benchmarking metrics in return. Providing visibility into private companies is Orbis, from Bureau van Dijk, with information on more than 375 million companies and other entities. Many of our customers need to assess the credit risk of private entities and turn to our RiskCalc credit-scoring platform, which combines fundamental and financial market information into a predictive risk score. For those managing the daily credit risk of public firms and sovereigns, the Moody’s Analytics CreditEdge tool offers a leading probability-of-default model and advanced analytics covering more than 60,000 publicly traded entities. Finally, our model lifecycle management platform, CAP, puts our award-winning credit data and modelling, validation and monitoring frameworks in the hands of our clients, allowing institutions to combine their own experiences with our tools."