RiskFoundation™

Register for the Course

The RiskFoundation platform provides the infrastructure needed to implement a world-class risk management system. It supports compliance with regulatory guidelines and is central to many of Moody’s Analytics comprehensive enterprise risk solutions for financial institutions.

Consolidate, centralize, and cleanse risk and finance data

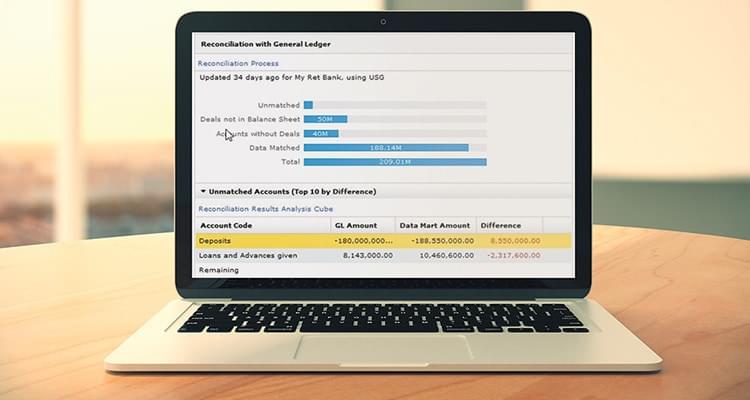

- Consolidate risk and finance data from different source systems – including loan accounting and credit risk mitigants – into a single, common system of record, your financial and risk datamart.

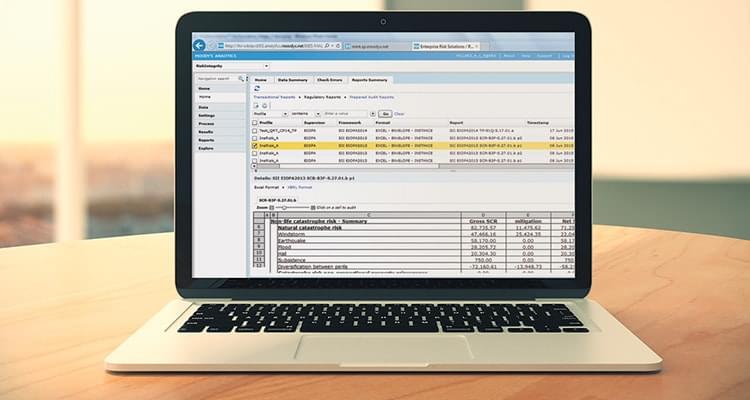

- Answer sophisticated analytical queries across your portfolio, and design reports on the fly – both at an aggregate level and at a transactional level – for flexible reports and dashboards.

- Minimize IT investments by sharing industry-standard hardware resources across the entire enterprise risk solutions suite, using a shared grid computing environment.

- Leverage the built-in regulatory workflow management capability to define and automate key decision steps, approval rules, and ongoing monitoring.

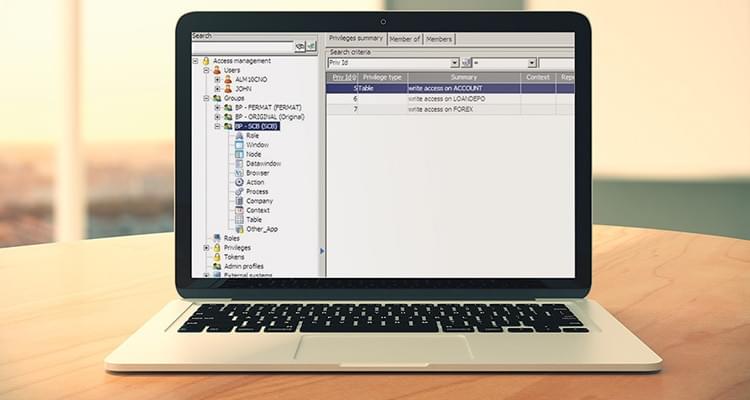

- Deliver a standardized single point of control for performing all administrative tasks across the RiskFoundation platform using the administrative console.

Measure risk across all business lines and regions

- Consolidate risk and finance data from a range of different source systems to allow you to view enterprise risk holistically.

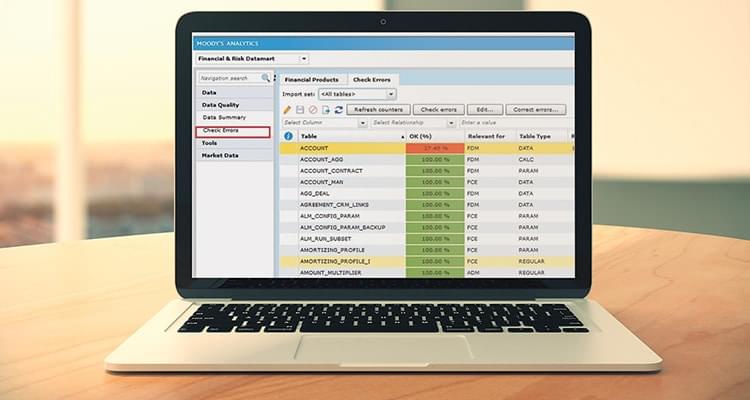

- Benefit from over 3,000 data quality checks during the data consolidation phase, highlighting data points that do not match your data quality standards.

- Leverage industrial strength grid computing capabilities to scale the performance of your risk management solution as your business develops.

- Leverage powerful toolkits and APIs to align the solution precisely to your needs and organization.

Integrate data from across the enterprise into one platform

Many Moody's Analytics applications integrate with the RiskFoundation platform, sharing the same functional data model. This architecture improves performance and handling of large volumes of data, enabling financial institutions to efficiently operate a consistent enterprise-wide risk management solution.

Product Brochure

Related Solutions

Data Visualization

Moody's Analytics data visualization and discovery solutions deliver comprehensive, enterprise-wide visibility into risk and finance data.

Data Warehouse

Moody's Analytics offers a powerful data management platform to help financial institutions manage risks and regulatory compliance effectively.

Stress Testing

Moody’s Analytics helps financial institutions develop collaborative, auditable, repeatable, and transparent stress testing programs to meet regulatory demands.