EXPLORE

Aubrey Clayton

Aubrey Clayton

ERS Insurance Research

Aubrey Clayton is a part of the Moody’s Analytics Insurance Research group. His recent work has focused on applications of economic scenario generators and Least Squares Monte Carlo (LSMC) proxy techniques to multi-period problems, particularly the projection of dynamic hedge programs and economic capital. Aubrey has a PhD in Mathematics from The University of California, Berkeley with a specialty in stochastic modeling and dynamical systems.

solutions

Economic Scenarios: Moody's Analytics provides internally & globally consistent economic, regulatory, and custom scenarios. Explore the economic scenarios tool.

Economic Capital : Moody’s Analytics insurance economic capital solution provides critical insights that help evaluate solvency positions and risk-based decision making.

Insurance Asset and Liability Management : Moody's Analytics insurance asset and liability management (ALM) solution provide scenario-based asset and liability modeling for insurers.

TOPICS

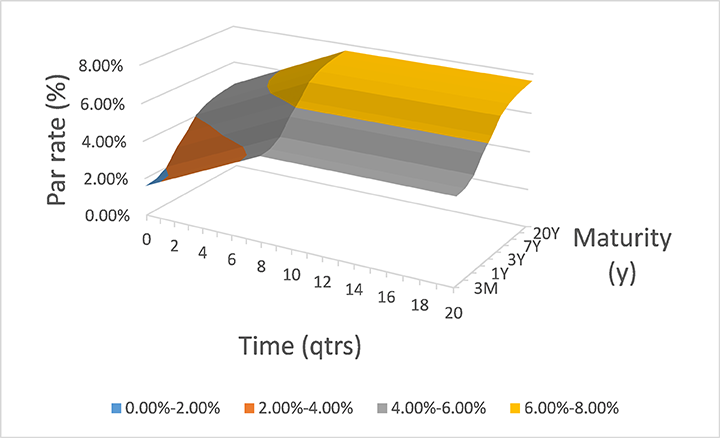

Scenario Generation: Mathematical model simulating possible paths of economic and financial market variables.

Liability Valuation: Process of valuing a company's liabilities for financial reporting purposes.

Capital Measurement & Projection: Approach for the projection of assets and liabilities for a business block to future time.

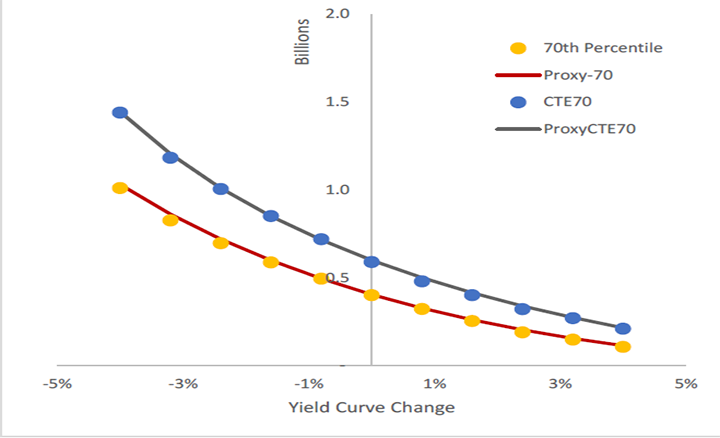

Developed techniques to calibrate proxy functions for Conditional Tail Expectation metrics, improving efficiency for reserve/capital projections

Used LSMC and neural network methods to forecast Greeks for complex Variable Annuity portfolios, enabling fast projection of dynamic hedges