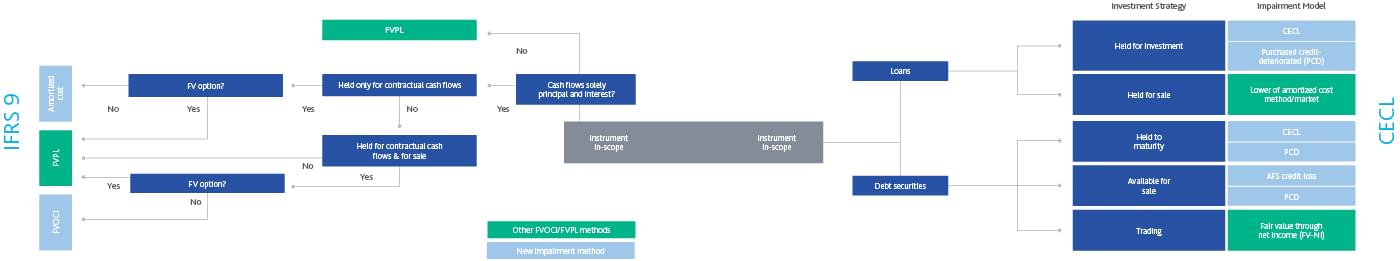

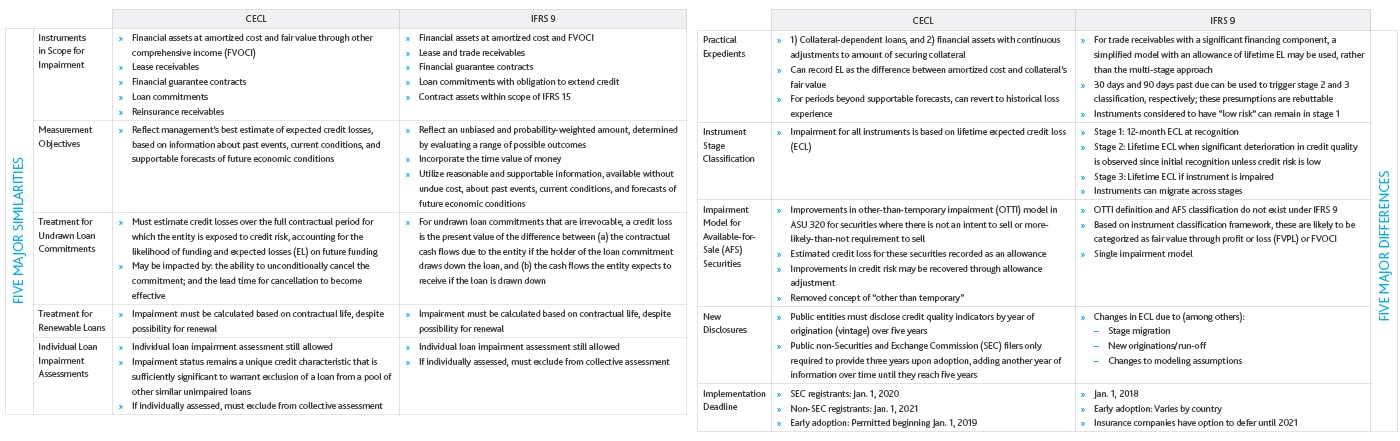

CECL vs. IFRS 9

Featured Experts

Scott Dietz

Scott is a Director in the Regulatory and Accounting Solutions team responsible for providing accounting expertise across solutions, products, and services offered by Moody’s Analytics in the US. He has over 15 years of experience leading auditing, consulting and accounting policy initiatives for financial institutions.

Laurent Birade

Advises U.S. and Canadian financial institutions on risk and finance integration, CCAR/DFAST stress testing, IFRS9 and CECL credit loss reserving, and credit risk practices.

María Cañamero

Skilled market researcher; growth strategist; successful go-to-market campaign developer

As Published In:

Devoted to the convergence of risk, finance, and accounting disciplines with regard to the new impairment standard, Financial Instruments -- Credit Losses, commonly known as the current expected credit loss (CECL) approach.

Previous Article

CECL Survey ResultsRelated Articles

How to Unlock Benefits from CECL Compliance: 5 Principles

The primary objective of FASB’s CECL standard is to provide investors with more meaningful and timely information regarding credit risk, but it also presents a unique opportunity for financial institutions to advance credit risk practices, break down silos and strengthen business decisions.

Empowering Users, Satisfying Auditors for CECL Presentation Slides

In this presentation, Emil Lopez and Olivier Brucker from Moody's Analytics, demonstrates how the Moody's Analytics Credit Loss and Impairment Analysis suite helps financial institutions overcome challenges with CECL and implement best-practice allowance processes.

Empowering Users, Satisfying Auditors for CECL

In this webinar, Emil Lopez and Olivier Brucker from Moody's Analytics, demonstrates how the Moody's Analytics Credit Loss and Impairment Analysis suite helps financial institutions overcome CECL challenges and implement best-practice allowance processes.

CECL Quantification: Commercial & Industrial (C&I) Portfolios

In the third webinar in our CECL quantification webinars series, our experts discussed which commercial and industrial (C&I) models and methodologies can be leveraged to fulfill CECL requirements, and key considerations in transitioning these models.

Introduction to CECL Quantification Webinar Slides

In this presentation, our experts Emil Lopez and Jing Zhang, introduce some key CECL quantification methodologies and enhancements that can be made to existing approaches to make them CECL compliant.

CECL Webinar Series: Introduction to CECL Quantification

In this presentation, our experts Emil Lopez and Jing Zhang, introduce some key CECL quantification methodologies and enhancements that can be made to existing approaches to make them CECL-compliant.

NIIF 9: Un cambio fundamental en la contabilización de pérdidas de crédito

NIIF 9 introduce cambios en la contabilidad de riesgo crediticio que prometen aumentar la transparencia y confianza en los estados financieros.

Getting Ready for CECL

The FASB’s new impairment standards won’t take effect until 2020, but institutions should start planning now. This webinar outlines key considerations for early CECL preparation, including: main challenges; expectations of auditors, regulators, and investors; planning in firms of varying sizes; and how to get started.

CECL: The Road to CECL

In this webinar, we discuss what the new CECL standard is and why the FASB is changing Impairment Accounting. Key topics include the timeline for implementation, key differences are in the new impairment models compared with the existing ones, and how the allowance calculation process is likely to change.

CECL Spotlight with Emil Lopez

Listen in as Emil Lopez identifies key steps firm can take as they prepare for CECL implementation.