SolvencyWatch™

Register for the Course

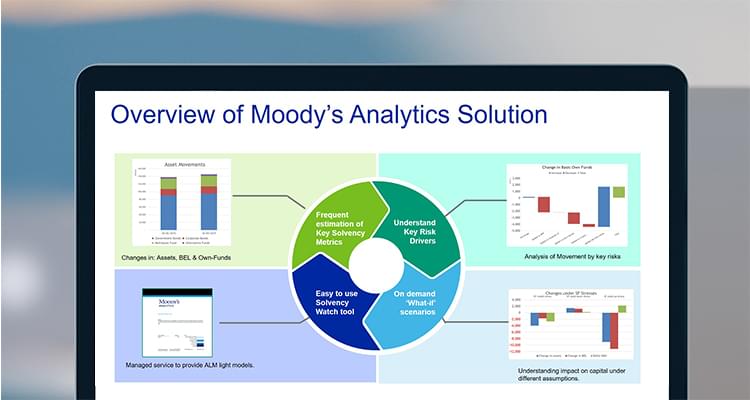

Moody’s Analytics SolvencyWatch™ solution enables insurers to effectively monitor their solvency metrics in a volatile world.

Fast and accurate monitoring capability

- Produces real-time updates of solvency metrics under the latest market conditions.

- A user-friendly dashboard enables chief risk officers (CROs) to visualize the impact on metrics under changes to market and non-market life risks.

- Delivers efficient actuarial modeling approaches for assets, liabilities, and out-of-model adjustments (for example, new business).

- Gives CROs a narrative on analysis of movements for key risks to help communicate what is driving changes in crucial metrics.

- Answers on-demand, “what-if” requests to support decision-making processes.

Cost-effective solution that delivers actionable financial analytics

- Offers greater control of the monitoring process for CROs by reducing reliance on other business areas to produce solvency updates.

- Removes the needs for frequent runs of existing model infrastructure, helping to manage costs and resources.

- Supports senior stakeholder decision-making with a business-oriented tool.

- Empowers users with an easy-to-use, modern technology platform.

Contact us for a demo

Product Brochure

Related Solutions

Business Insight

Moody's Analytics insurance Business Insight solution integrates economic scenarios with modeling solutions to generate required analytics and insurance business insights.

Regulatory Capital

Moody’s Analytics insurance regulatory capital solutions help insurers comply with Solvency II and other similar regulatory regimes.

Solvency II

The Moody’s Analytics solution supports the solvency metrics and the associated reporting from both a group and solo perspective for Solvency II compliance.