Scenario Analyzer

Register for the Course

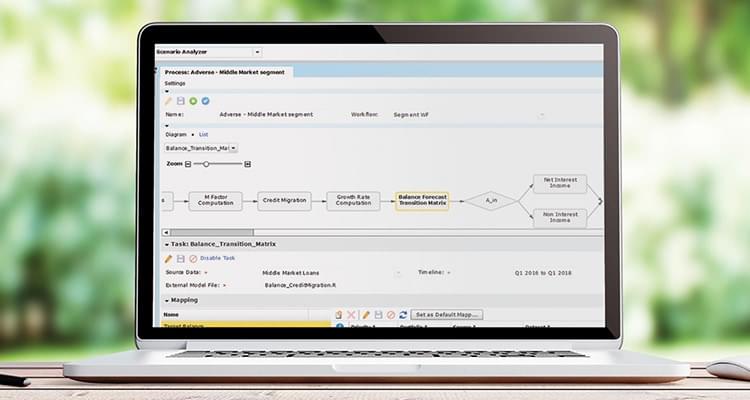

Scenario Analyzer enables financial institutions to implement transparent, repeatable, and auditable stress testing processes that integrate data, models, and reports. It allows banks to facilitate end-to-end bank-wide stress testing and capital planning exercises, with a workflow to orchestrate and review data ahead of regulatory submissions (such as for CCAR, DFAST, EBA, and PRA). Scenario Analyzer supports the capital projection process and the development of realistic and strategic capital plans. Its framework for data aggregation and consolidation across multiple systems facilitates improved model management and governance.

Coordinate and integrate your stress testing value chain activities from a single platform

- An open architecture with a centralized model catalogue allows the integration and validation of Moody’s Analytics models as well as internally developed models.

- The central data repository acts as a single source where institutions can store economic, financial, and risk data.

- Granular forecasting capabilities use multiple hierarchies and dimensions that span all lines of business involved in running the stress testing process.

- Integrated regulatory reporting and business intelligence capabilities offer a report submission service and key business strategy reporting functionality.

- Automated notifications signify when the results of an analysis become available.

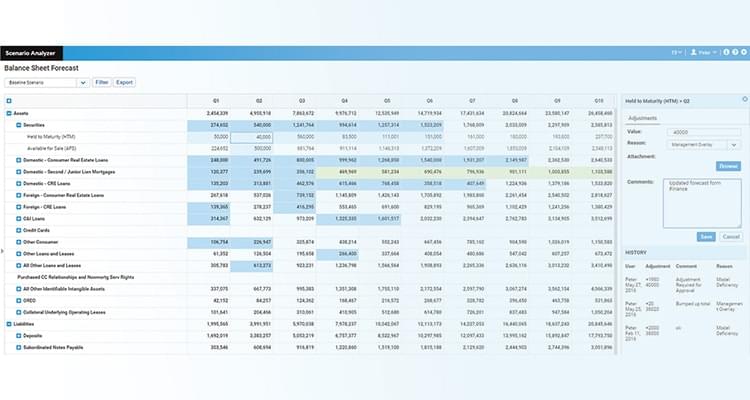

- Expert adjustments can be performed securely.

Supports sophisticated stress testing regimes with a robust infrastructure for repeatability and auditability, enabling improved insight into balance sheet performance

- Achieve transparency with a top-down or bottom-up view of risk across the organization.

- Reduce dependency on manual, Microsoft Excel software-based work and the associated potential for operational risk.

- Determine the performance of portfolios under different macroeconomic scenarios for improved firm-wide and business-line strategy.

- Improve process efficiency by allowing the development of comparative measures for the impact that exogenous shocks have on regulatory capital, the bank’s balance sheet, key portfolios, and single exposures.

- Demonstrate internal controls and a transparent stress testing program with auditing capabilities including data adjustments and related comments and documentation.

Part of Moody’s Analytics Stress Testing Suite

Moody’s Analytics Stress Testing Suite of modular, integrated solutions drives stress testing programs at financial institutions around the globe. Its data integrity, analytics, and regulatory reporting solutions streamline, strengthen, and transform your stress testing program from a regulatory compliance exercise into a strategic advantage.

Product Brochure

Related Solutions

Regulatory Capital

Moody’s Analytics offers automated, streamlined, and integrated regulatory capital calculation and reporting solutions for a wide range of banking regulations.

Stress Testing

Moody’s Analytics helps financial institutions develop collaborative, auditable, repeatable, and transparent stress testing programs to meet regulatory demands.