RiskIntegrity™ Standard Formula

Register for the Course

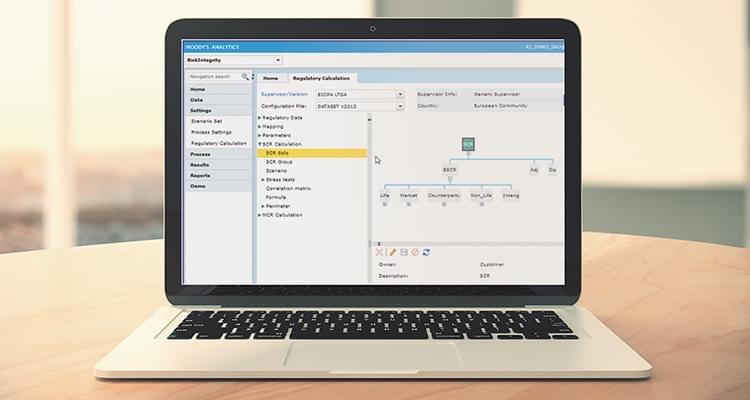

The RiskIntegrity Standard Formula module supports insurers in the automation of processes to calculate and report their standard-formula solvency capital requirement (SCR), minimum capital requirement (MCR), and risk margin, as defined under various global regulatory regimes.

Calculate group and solo SCR, MCR and risk margin in a controlled environment

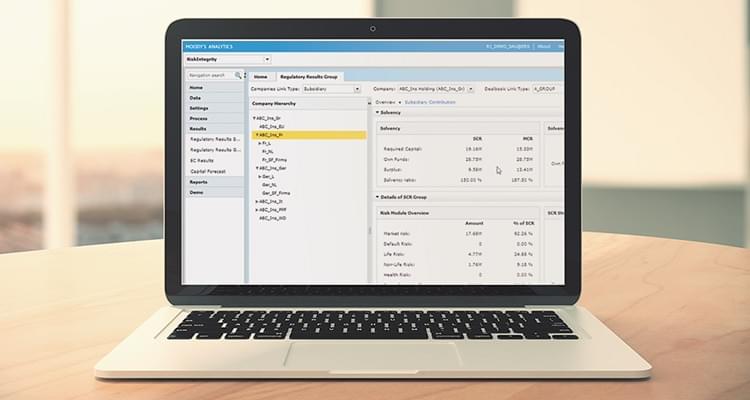

- Supports group and solo calculations of SCR, MCR, and risk margin through the combination of the calculation engine and corresponding regulatory dataset.

- The calculation engine and regulatory datasets deliver the regulatory methodologies and associated parameters covering stresses, formulas, correlation matrices, and capital calculations.

- Manage business processes via its workflow technology and deliver an optimized risk and finance datamart to support business analytics and standardized reporting.

- Check for integrity, coherence, and validity of data with embedded data quality and audit features.

- Utilize business analytics capabilities, including the ability to view and export intermediate results.

Deliver group and solo calculations

- Mitigate ongoing cost and resourcing impact of having to update datasets each time regulations are updated.

- Use with our Regulatory Reporting to support delivery of group and solo entity reporting requirements within a single solution.

- Use with our RiskIntegrity Capital Aggregator to support modeling a partial internal model SCR.

Product Brochure

Related Solutions

Regulatory Capital

Moody’s Analytics insurance regulatory capital solutions help insurers comply with Solvency II and other similar regulatory regimes.

Solvency II

The Moody’s Analytics solution supports the solvency metrics and the associated reporting from both a group and solo perspective for Solvency II compliance.