RiskIntegrity™ Proxy Generator

Register for the Course

The RiskIntegrity Proxy Generator is an enterprise solution that calibrates proxy functions to model metrics such as asset and liability values. This reduces an insurer’s reliance on full asset liability management (ALM) cash flow models for applications such as interim valuation, capital calculations, or hedge effectiveness.

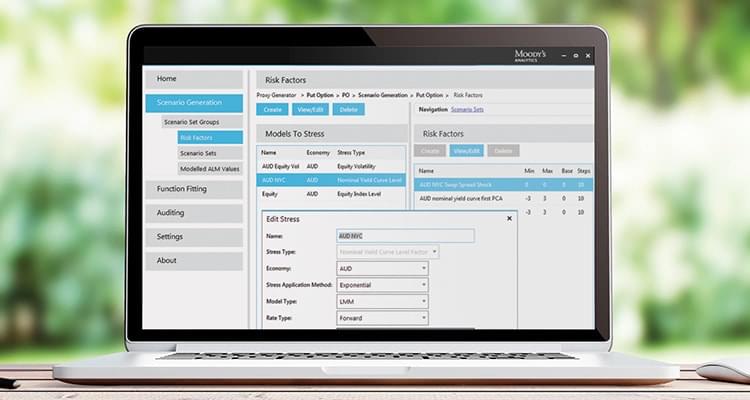

Calibrate proxy functions using curve fitting or Least Squares Monte Carlo approaches

- Calibrate proxy functions (e.g., asset and liability values) for a range of uses, including capital calculation and supporting calibrations of both t=0 and multi-year proxy functions.

- Supports both curve fitting and Least Squares Monte Carlo approaches, including both market and non-market risk factors.

- Produces the real-world fitting points and associated inner scenarios to feed into ALM systems.

- Fits the proxy functions, using a wide range of regression algorithms that link the real-world fitting points and the results from the ALM system.

- Access an enterprise-level software solution that uses a centralized database and service-oriented architecture to support large-scale, multi-user deployments.

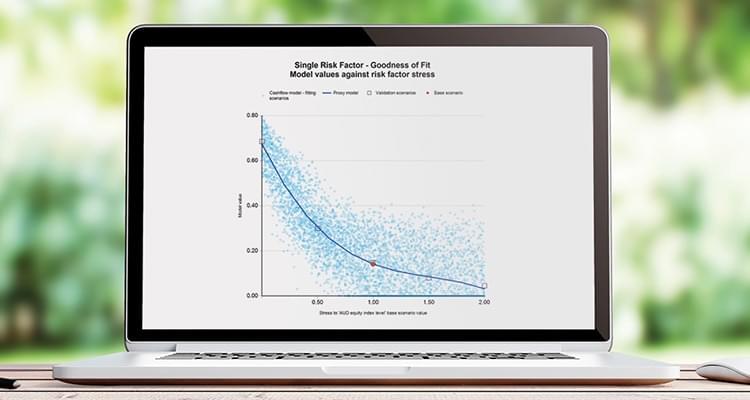

Efficiently produce large numbers of proxy functions, even for complex portfolios

- Produce proxy functions that provide a very good fit for even the most complex books of liabilities.

- Support the generation of hundreds of proxy functions to meet production timetables, using a range of configurable fitting algorithms and statistical parameters.

- Provides integrated Economic Scenario Generator for generation of both outer real-world and associated inner-market-consistent fitting scenarios in formats for a range of third-party ALM engines.

- Rely on a high-performance and scalable architecture that makes efficient use of computational resources for both scenario generation and function fitting.

- Gain an enterprise technology platform, allowing for quick and easy integration with existing business solutions.

Product Brochure

Related Solutions

Economic Capital

Moody’s Analytics insurance economic capital solution provides critical insights that help evaluate solvency positions and risk-based decision making.

Insurance Asset and Liability Management

Moody's Analytics insurance asset and liability management (ALM) solution provide scenario-based asset and liability modeling for insurers.

Regulatory Capital

Moody’s Analytics insurance regulatory capital solutions help insurers comply with Solvency II and other similar regulatory regimes.

Solvency II

The Moody’s Analytics solution supports the solvency metrics and the associated reporting from both a group and solo perspective for Solvency II compliance.