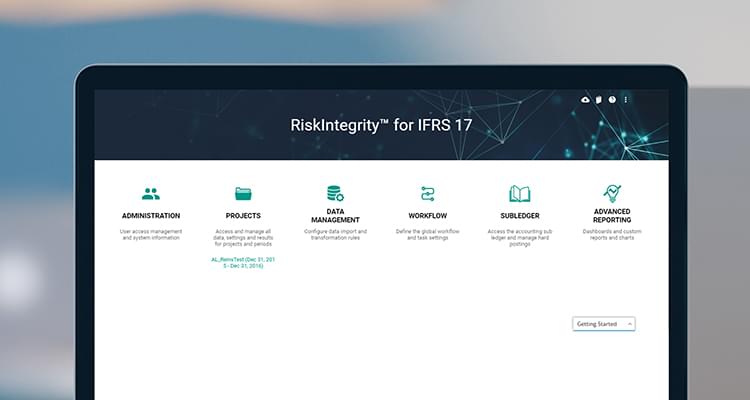

RiskIntegrity™ for IFRS 17

Register for the Course

The RiskIntegrity™ solution for IFRS 17 helps insurance companies make the transition from current insurance accounting frameworks to IFRS 17. It helps insurance entities of any size—from large international groups with life and non-life businesses to small monoliners—efficiently meet the new reporting challenges. This solution integrates seamlessly into your existing infrastructure, connecting data, models, systems, and processes between actuarial and accounting functions. It addresses the needs of life and property and casualty companies, as well as reinsurers.

Kickstart your IFRS 17 Implementation with a modular end-to-end solution

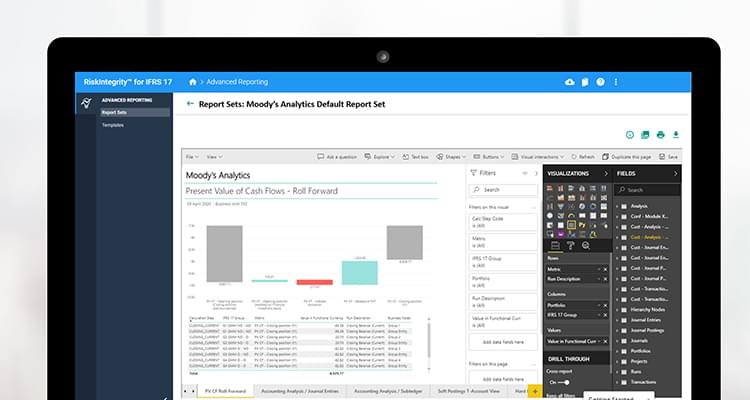

- Calculate and roll-forward insurance contract liabilities for the general measurement model (GMM)/building block approach (BBA), variable fee approach (VFA), and premium allocation approach (PAA) from fulfilment cash flows.

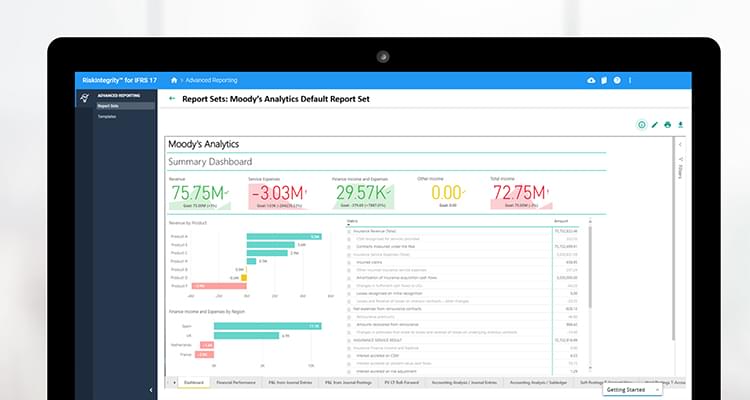

- Produce reports for entity- or group-level disclosures, and analyze changes in CSM, Liability for Remaining Coverage (LRC), and Liability for Incurred Claims (LIC) for management oversight.

- Load cash flow input from existing actuarial tools or derive cash flows based on claim run-off triangles, loss development factors, allocation rules, payment patterns, and claims seasonality factors.

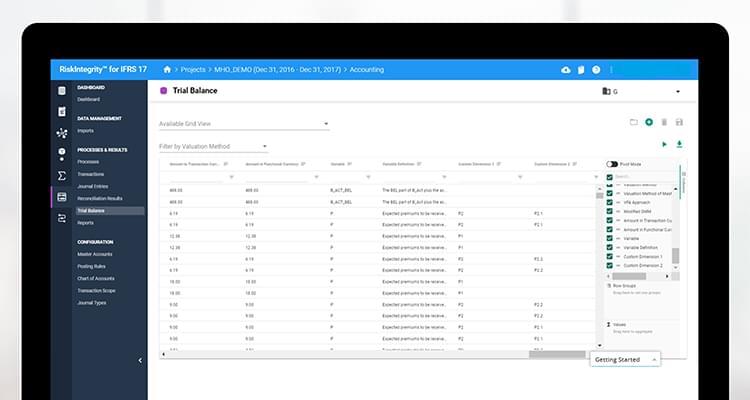

- Create mapping between your own chart of accounts and the solution’s fast, intuitive accounting logic.

- Generate both soft and hard journal entry postings, transaction files, and disclosures using the controlled workflow in the IFRS 17 accounting sub-ledger module, which includes reversals, adjustments, and support for multiple currencies.

- Ensure consistency, quality, and accessibility of finance and actuarial data (both current and historic) using centralized data storage and data quality management.

- Import data from multiple actuarial systems, consolidating information to provide comprehensive and coordinated IFRS 17 calculations for both insurance groups with multiple lines of business and entities.

- Gain an efficient audit trail, better support the reporting process, and reduce costs and manual errors with process automation and governance.

The RiskIntegrity solution for IFRS 17 difference

- Out-of-the-box calculations, master accounts, and posting logic and analytical capabilities that comply with initial IFRS 17 requirements and interpretations, as well as a commitment to address future updates from IASB.

- Future-proof technology that is cloud-enabled, highly scalable, modular, and designed to address the demanding data volume and performance requirements of IFRS 17.

- Integration that maximizes return on your investment in existing actuarial models, accounting systems, and processes that are unified by a robust data dictionary.

- A history of delivering high-performance, cloud-based, and award-winning technology projects in the insurance industry, including our AXIS™ actuarial modeling system, RiskIntegrity™ Suite for Solvency II compliance, and Credit Loss and Impairment Analysis Suite that helps financial institutions to comply with the requirements of CECL and IFRS 9.