PFaroe™ Portfolio Management

Register for the Course

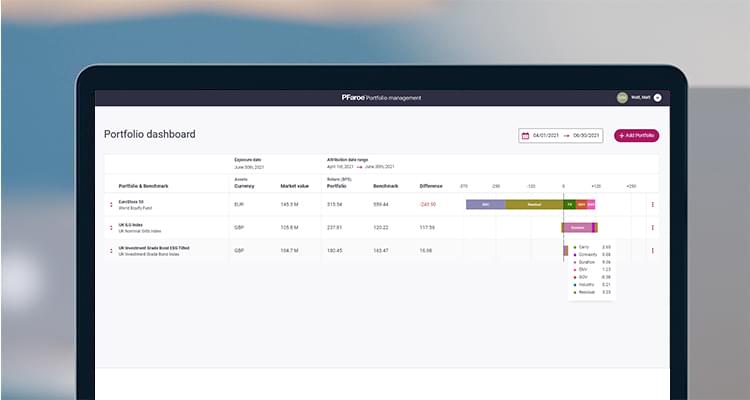

PFaroe™ Portfolio Management software is a web-based, multi-asset front-office decision support tool that takes the most sophisticated pre-trade analysis and moves it into real time. The solution enables a clear understanding of portfolio out performance drivers, identifying the trends in these drivers and helping discover new opportunities. Designed with flexibility at its core, you can tailor PFaroe Portfolio Management software to individual investment processes and to operate across multiple portfolios.

A consistent, customizable view of performance

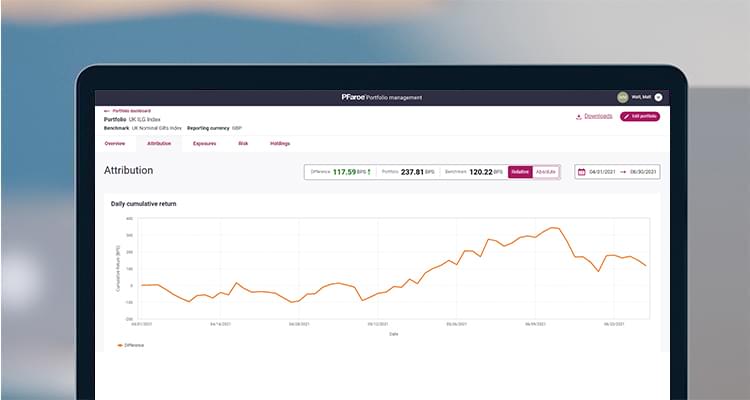

- Access fast, clear attributions results within a portfolio and across your organization at the click of a button, saving you time and creating operational efficiencies.

- Access a consistent, customizable view to ensure a meaningful reflection of the investment strategy without having to reconcile.

- Achieve close alignment of asset owner objectives with an asset manager strategy over the long term.

- Run what-if analysis, collaboration, and on-the-fly adjustments to yield better performance and eliminate the need for uncontrolled spreadsheets.

- Enjoy better data quality and attribution results for the asset owner and deeper insights across asset managers’ strategies.

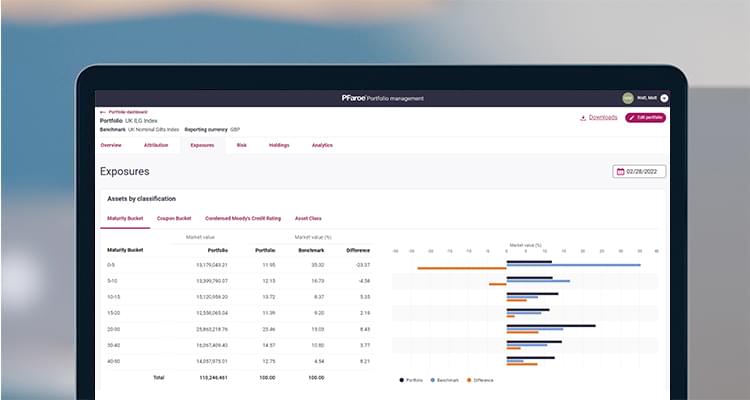

- Quantify and qualify your investment process using multiple factors with our intelligent yield curve-based model.

- Reduce costs through fast, secure integration into existing infrastructure using a web-delivered tool, with no IT footprint to manage.

Improve data quality and access real-time capabilities

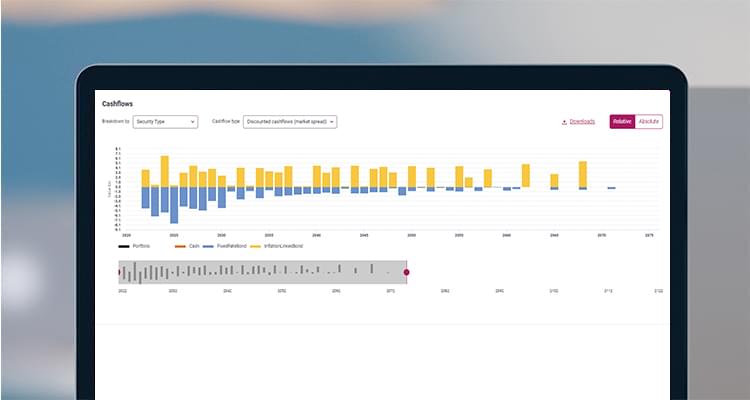

- Benefit from real-time insight as opposed to a rigid batch report run overnight.

- Communicate your portfolio’s strategy and performance with your clients and demonstrate new investment opportunities.

- Translate analysis into terms the asset owner can more easily understand with user-friendly outputs and a display of straight-through attribution results.

- Clearly quantify investment decisions using our powerful custom absolute and benchmark relative attribution models.

- Benefit from fast, efficient data management and calculations with our intelligent bitemporal memory caching.

- Capture the instruments you use in your pricing models that help manage client data with increased confidence.

- Implement effective workflow monitoring to support data quality checks.

- Align analytics to each portfolio manager’s investment process with enhanced flexibility.

Contact us for a demo

Related Solutions

Multi-Asset Portfolio Management

Moody's Analytics economic scenario and asset-liability modeling offerings support investment design and risk management activities.