PFaroe™ DB

Register for the Course

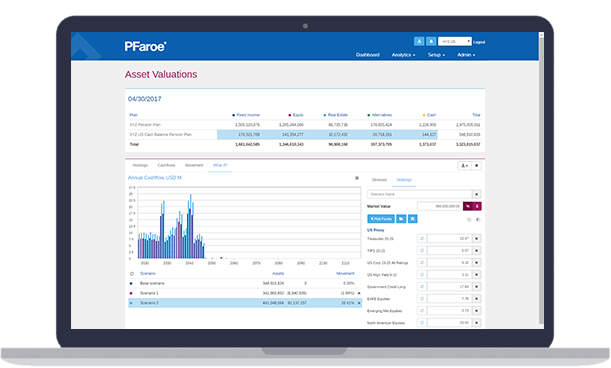

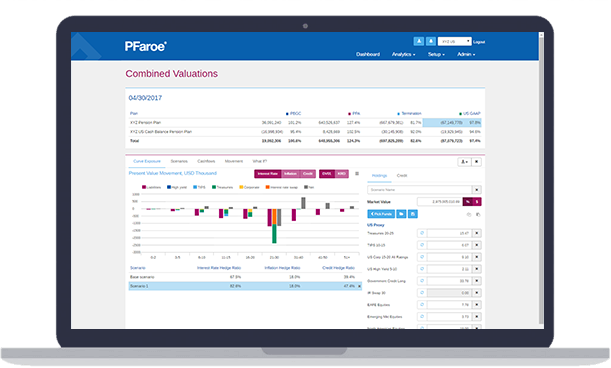

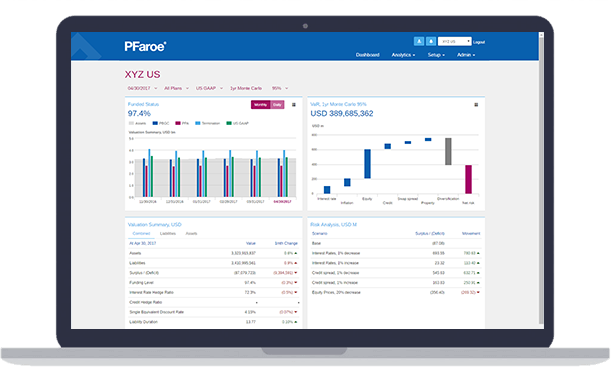

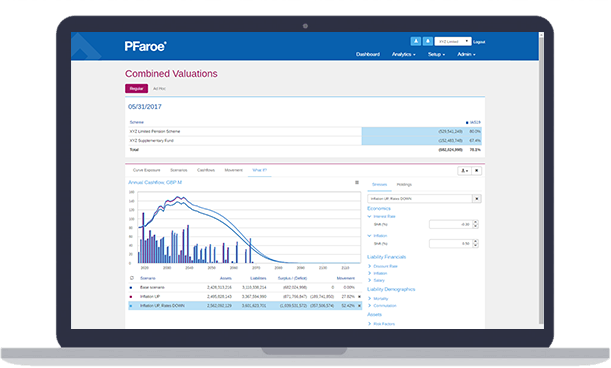

PFaroe DB software is a web-based cross-balance sheet asset, liability, and risk management platform, built with the needs of the asset owner in mind. In use across the US, Canada and the UK, it empowers the pension fund, endowment, consultant, or investment manager to identify individual risk factors and perform “what-if” stress testing and at-a-glance analysis of the specific risk exposures confronting the fund.

Understand the impact of risk drivers on investment and funding strategies

- Access a snapshot dashboard of the pension fund’s funding level and risk attributes—essential information for CFOs, CIOs, and Treasury Directors.

- Conduct and monitor liability valuations and assess sensitivity to changing market conditions.

- Monitor pension fund assets and assess the impact of fluctuating market conditions using automatic monthly valuations, what-if stress testing, and analysis of portfolio movement features.

- Move beyond an isolated view of liabilities and assets and examine the combined effects on hedging, liquidity, and funded status volatility.

- Analyze pension fund risk attributes and align the investment portfolio with risk and return objectives, including value at risk (VaR) attribution and distribution, analysis of historical market events, and what-if stress testing.

- Perform powerful forecasting analysis for asset-liability studies. Evaluate the impact of highly customizable investment and funding strategies over time.

- Construct an optimally hedged or cashflow-matched investment portfolio.

Inform decision-making and improve results

- Consolidate previously disparate sources of information through a single platform that gives pension plan stakeholders a unified view.

- Change assumptions in real time to test a range of outcomes and deepen understanding of risk exposure using an extensive range of risk metrics.

- Provide stakeholders with up-to-date funding, risk, and market information to seize opportunities when market conditions change.

- Receive automatic notifications when triggers are hit, enabling funds to react more quickly and confidently than ever.

- Create a superior governance framework to monitor and review regularly to help define actions for fund security.

- View historic valuation and risk and report on demand. Our central repository helps fund sponsors build the necessary controls and facilitates their efforts to meet their governance obligations.

- Access the clear, easy-to-use interface to help users understand complex issues, get information, and test scenarios without needing expert actuarial resources.

Contact us for a demo

Product Brochure

Related Solutions

Pension Plans, Endowments and Consultants

Moody's Analytics solution enables defined benefit pension managers managers, advisers, endowments and foundations measure market risk exposure, allowing for investment strategy, funding strategy, and liabilities