Data Alliance

Register for the Course

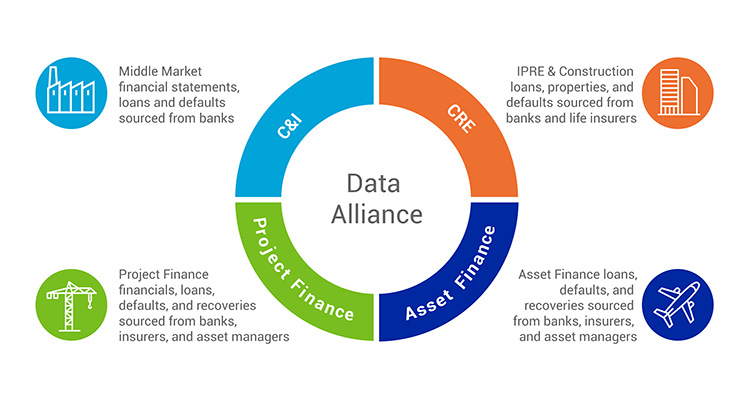

Data Alliance is a collaborative effort of leading financial institutions and Moody's Analytics to create the world's largest collection of private credit risk data. Augment internal datasets, discover gaps in data quality, and compare portfolio risk and lending practices to peers for actionable insights on your portfolio and private credit markets.

Use our comprehensive dataset

- Join over 90 of the world’s leading banks, insurers, asset managers, and multi-lateral development banks.

- Database contains nearly 100 million financial statements representing more than 20 million global private firms, with over 2.9 million defaults

- Large income-producing real estate (IPRE) and construction commercial real estate (CRE) dataset with $372B+ in loan volume and over 66,000 properties covering 354 metropolitan areas

- Access over 6,000 project finance transactions and 450+ defaults, representing over 63% of all project finance loans since 1983.

- Broad asset class coverage includes commercial and industrial (C&I), CRE, middle-market (SME) private firms, and project and infrastructure finance.

Access both research and analytics

- Data validation and qualitative assessments

- Industry benchmark analytics and consensus estimates

- Data pools

- Customized model validation and calibration services, using pooled data and models

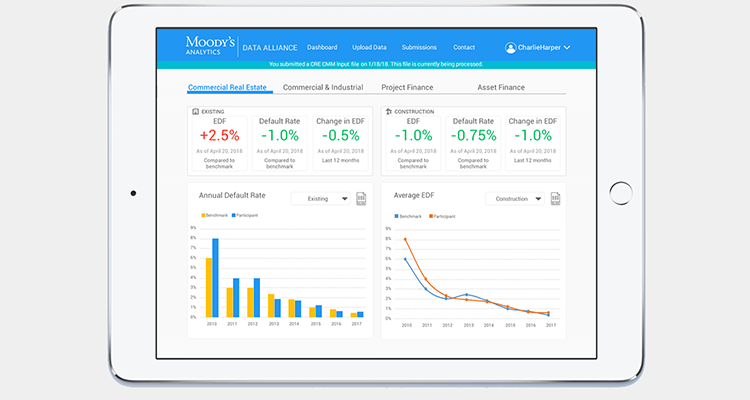

- Suite of data visualization dashboards for custom analytics

Personalize Your Data Alliance Experience

Moody’s Analytics works closely with all members to guide the process of data submission and delivery. Our team helps members refine data requirements for processing and provides valuable reports and analyses available only through membership in the Data Alliance.

Product Brochure

Related Solutions

Credit Research

Tap into comprehensive credit research from Moody's Analytics and Investors Service, and gain detailed insights into our views on credit-related topics.