Credit Risk Calculator

Register for the Course

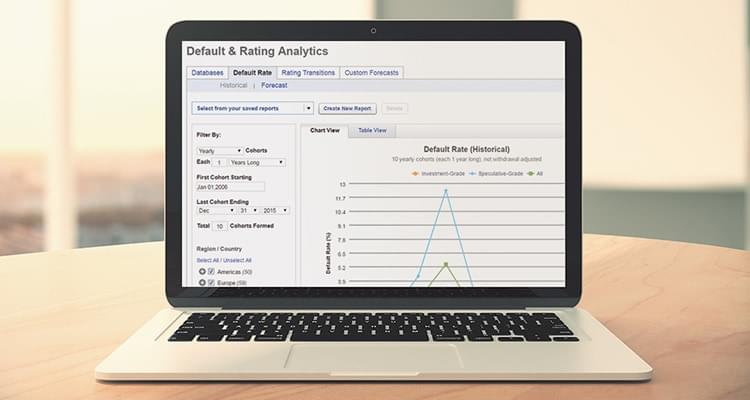

Moody's Analytics Credit Risk Calculator (CRC) is an easy-to-use, web-based tool that allows you to quickly derive rating transition matrices and calculate default rates, customized to your specific risk management needs.

Flexible Analyses Tailored to Your Needs

- Cut data by region, country, and industry. Cut time data by region, country, industry, time frame, cohort spacing, accumulation periodicity, letter, and alphanumeric views.

- Utilize a range of default data, such as counts, marginal default rates, cumulative default rates, weighted average cumulative default rates, and time series. Easily calculate multi-year bond default rates, compare exposures across sectors, and input high quality data into pricing models.

- Easily calculate multi-year bond default rates, compare exposures across sectors, and input high quality data into pricing models.

- Maximize Moody's Investors Service extensive historical data by incorporating all available credit rating and marginal default rate data and long-horizon, cumulative default rate averages.

- Deepen understanding with the drill-through feature. Click on numbers to see the issuers that make up that number and their corresponding credit rating history.

Robust Analyses, Based on Nearly 100 Years of Credit Rating Data

- Easily navigate large volumes of data, including time, geography, industry, and more, to gain different perspectives.

- Deepen default rate understanding with data, including counts, marginal default rates, cumulative default rates, weighted average cumulative default rates, and time series.

- Compare exposures across sectors and time frames and input accurate data into pricing models.

- Select an issuer's name to quickly access Moody's Investors Service research on that issuer.

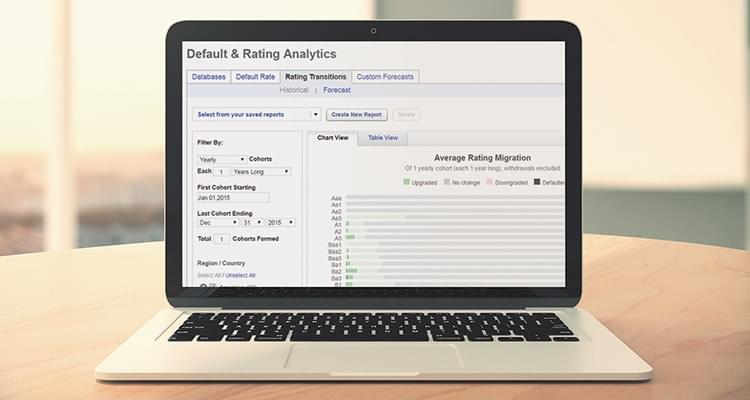

Develop Custom Rating Transition Matrices and Default Rate Reports

Credit Risk Calculator enables you to modify different parameters, including industry, country and the time-frame data, to meet your needs. Resulting rating transition matrices are tailored to reflect your portfolio's credit risk, based on specific model inputs.