Banking Cloud Credit Risk

Register for the Course

Banking Cloud Credit Risk is a cloud-native calculation and reporting engine that helps banks comply with current and upcoming regulatory capital requirements, including the latest Basel Committee on Banking Supervision (BCBS) standards and European Banking Authority (EBA) Capital Requirements Regulations (CRR), as well as the national discretions of their domestic supervisors. It provides a comprehensive, streamlined, and cost-efficient regulatory compliance solution.

Leverage a powerful credit risk calculation and reporting engine

- Load, transform, and reconcile your data to ensure data consistency and create a single source of truth for all of your reports.

- Leverage the incorporated calculation and reporting engine with predefined regulatory rules per jurisdiction.

- Compute both the Standardized approach and Internal Rating Based (IRB) risk-weighted asset (RWA) numbers.

- Calculate your Counterparty Credit Risk exposure at default (EAD) to comply with the latest standardized approach to counterparty credit risk (SA-CCR) regulations and the Current Exposure Method (CEM).

- Analyze and validate any potential variance in your results when comparing different reporting dates, software versions, or regulatory configurations, using the comparison and validation capabilities.

- Use the extensive Pillar 1 and Pillar 3 risk regulatory reporting templates, as well as the built-in support for regulator-defined report validation rules.

- Take advantage of the comprehensive report validation and submission functionality, including the technical format of submission, such as XBRL.

Deliver an efficient, cost-effective regulatory calculation and reporting process

- Reduce time, effort, and cost of compliance by using the SaaS model.

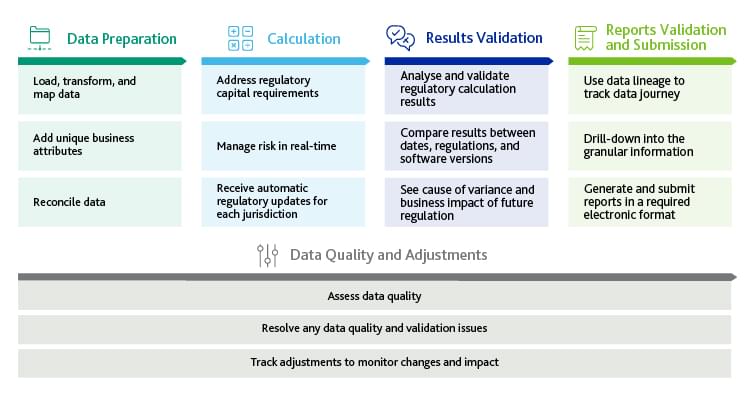

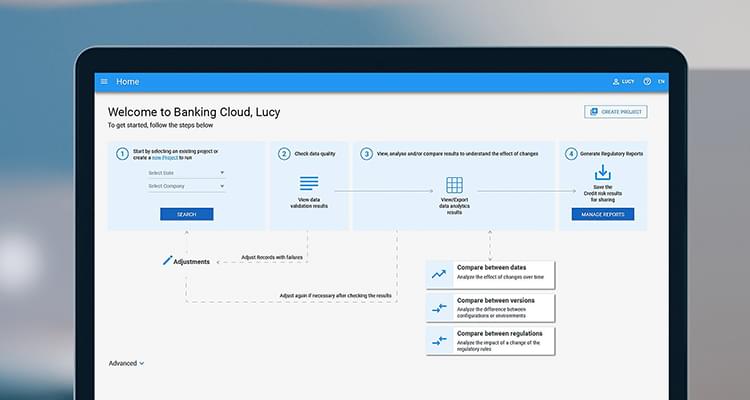

- Implement a comprehensive solution that gives you a complete regulatory compliance workflow, including data preparation, data quality assessment, data enrichment, regulatory calculation, reports production, validation and adjustments, and submission.

- Use the benefits of cloud-native technology for a fast, scalable solution that can efficiently handle any data volume and quickly generate all required reports.

- Benefit from the range of services offered as part of the annual subscription, including continuous regulatory updates and training, regular technical upgrades, and software maintenance and support.

Ongoing Regulatory Maintenance for 50 jurisdictions

As part of our ongoing regulatory maintenance commitment, we continuously monitor regulatory updates, adjust our solution’s configuration, and regularly implement and integrate these changes to make sure our clients remain compliant. Moody’s Analytics functional and technical teams fully manage regulatory updates and software maintenance, keeping clients up-to-date with the latest regulatory rules and reports, as well as software features.

Related Solutions

Basel I, II, and III

Moody's Analytics Basel solution delivers comprehensive, automated, and streamlined regulatory capital compliance and reporting for Basel I, II, and III.

Regulatory Reporting

Moody's Analytics regulatory reporting solution delivers comprehensive, automated, and streamlined regulatory reporting.

Liquidity Compliance

Moody's Analytics offers a liquidity compliance solution to help banks address the complex liquidity compliance requirements under Basel III.

Regulatory Capital

Moody’s Analytics offers automated, streamlined, and integrated regulatory capital calculation and reporting solutions for a wide range of banking regulations.