Moody’s Analytics Banking Cloud Credit Risk is a calculation and reporting engine that helps you to comply with current and upcoming regulatory capital requirements including the latest Basel Committee on Banking Supervision (BCBS) standards and European Banking Authority (EBA) Capital Requirements Regulations (CRR), as well as the national discretions of your domestic supervisors.

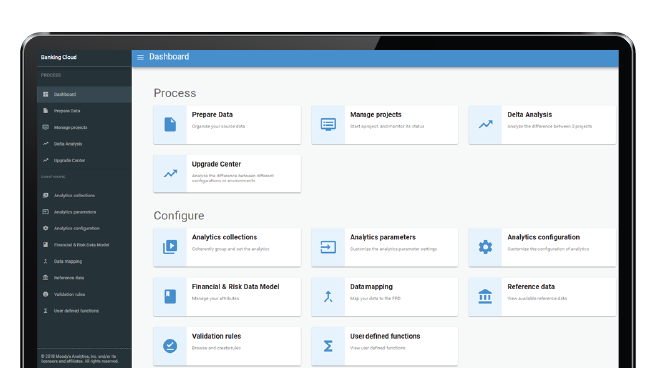

A cloud-native and scalable solution, Banking Cloud Credit Risk streamlines your regulatory compliance process and allows you to address your specific regulatory capital and reporting requirements in a timely and cost-efficient manner. Combining our decades of expertise in credit risk and reporting with the power of automation, Banking Cloud Credit Risk is designed to create efficiencies and transform your regulatory compliance and add value.

Compute, report, and perform parallel runs on your Risk Weighted Assets (RWA) numbers according to Standardized and Internal Rating-based (IRB) approaches for all asset classes

Calculate Counterparty Credit Risk Exposure to comply with the latest SA-CCR regulation and previous Current Exposure Method (CEM)

Assess concentration risk and identify Large Exposures to be reported

In just a few clicks, you can see what has changed and why it has changed, giving you a deeper and more detailed understanding of the risk drivers behind the variance.

In our solution, you can perform Quantitative Impact Studies (QIS) to evaluate the impact of future regulations (e.g., Revised Basel 3, CRR II, and CRD V) on your business.

Reconcile data to achieve consistency and create the single source of truth for all your reports

Track data lineage to see what information contributed to the data points on your reports

Drill down into data points to understand the underlying logic

Resolve data quality and validation issues by using our smart adjustment capabilities

If you require immediate assistance, please contact our Client Services desk.

Americas | +1.212.553.1653 | [email protected]

EMEA | +44.207.772.5454 | [email protected]

Asia Pacific | +852.3551.3077 | [email protected]

Japan | +81.3.5408.4100 | [email protected]