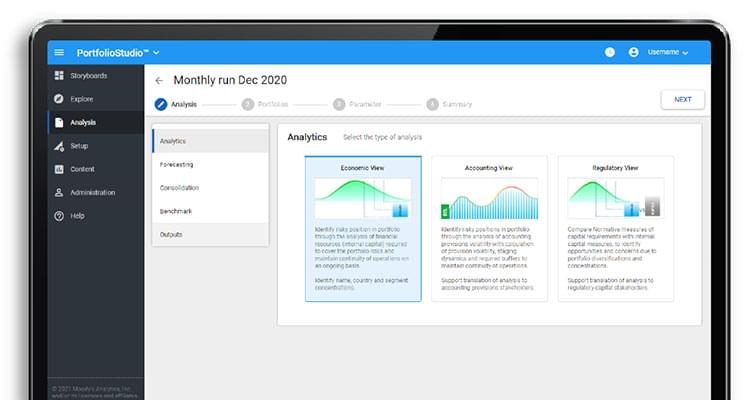

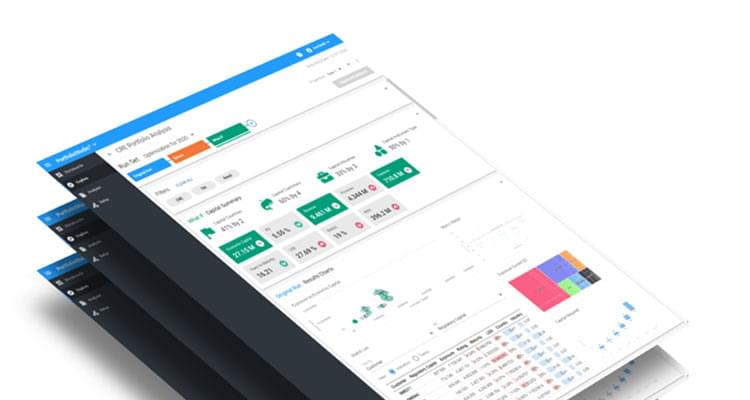

With constantly evolving, interconnected threats and opportunities, risk managers need a complete picture of portfolio risks, emerging risks, and mitigation strategies to advise the business confidently. Moody’s Analytics PortfolioStudio™ software combines portfolio analytics and decision enabling tools to effectively identify, measure, and manage risk.

The QuantTech50 ranks the world’s leading providers of quantitative solutions for the financial services industry.

"Moody’s QuantTech rankings are testament to the company’s overall breadth of solutions and continued innovation in new analytics and credit theory, Moody’s integration of climate data is a step towards a more holistic view of risk that insurers are looking for now.”

Sidhartha Dash, Chief Researcher at Chartis Research

- Benefit from an integrated ecosystem of risk, finance, and lending solutions sharing data, assumptions, and models—all contributing to accurate, intelligence-backed insights.

- Translate analytics into economic, accounting, and regulatory terms to ensure consistency across risk, finance, and business teams.

- Take full advantage of the solution through the user-friendly design plus advanced automation.

Head of Quantitative Analytics and Liquidity Risk Management

Momentum Metropolitan

-

To answer the need for active credit portfolio management, PortfolioStudio™ delivers:

- Credit models that provide a robust credit risk measurement

- Capabilities to anticipate emerging risks and test impacts

- Proactive credit decisioning at origination and loan transfer pricing

In this Risk.Net audiocast, Zoi Fletcher speaks to Biagio Giacalone and Alexis Hamar about how active credit portfolio management can be the linchpin of improved risk/reward ratios and how the efficient use of capital drives banks’ overall profitability.

Our SaaS offering joins our expertise with the benefits and flexibility of the cloud. Choosing SaaS, you outsource the hosting, managing, and maintenance of the solution. This means that your solution fits your business needs; comes with state-of-the-art business intelligence; is always up to date; and is scalable, flexible, and secure. With seamless upgrades, reduced total cost of ownership, and greater cost predictability, the subscription model is ideal for businesses looking to adapt to growing demands without revisiting their entire solution setup.

The PortfolioStudio tool is part of Moody’s Analytics cloud-native, integrated Risk and Finance platform. This suite of award-winning solutions combines leading risk analytics and highly scalable processing capabilities that enable you to address risks with speed and precision and drive growth.

Relevant resources

-

PortfolioStudio™ brochure

Moody’s Analytics PortfolioStudio software combines portfolio analytics and decision-enabling tools to effectively identify, measure, and manage risk.

-

PortfolioStudio™ Press Release

Moody’s Analytics is pleased to announce the launch of PortfolioStudioTM , new cloud-based credit portfolio management software. PortfolioStudio provides a whole portfolio view of current and emerging risks in one platform so users can scan for risks and opportunities, evaluate possible actions, and decide how to act.

-

Whitepaper: An Overview of Modeling Credit Portfolios

This document provides a high-level overview of the modeling methodologies implemented in Moody’s Analytics RiskFrontier™ and their business applications.

-

Whitepaper: Uncertainty in Asset Correlation Estimates and Its Impact on Credit Portfolio Risk Measures

Credit portfolio models rely on estimated and calibrated parameters. Users of these models must understand how various errors in the parameter estimates impact model outputs, for example Unexpected Loss (UL) or Economic Capital (EC). In this paper, experts address how these errors translate into statistical errors in the estimated UL and EC.

-

Whitepaper: Understanding GCorr 2020 Europe Retail

The European retail correlation model builds on the forward-looking, multi-factor global correlation model that has been extensively validated since its first release in 1997. This model adds a great level of granularity into our correlation framework, allowing for more accurate identification, quantification, and management of portfolio credit risk.

-

Whitepaper: Understanding GCorr® 2020 Europe CRE

Commercial real estate (CRE) exposures constitute a large share of credit portfolios held by financial institutions. In this paper, we provide an overview of the Moody’s Analytics Global Correlation model (GCorr) for European CRE instruments, GCorr 2020 Europe CRE.

Tell us a little more about your organization and request a demo of our PortfolioStudio solution today.

Let us know how we can best get in touch with you. One of our experts will be in touch shortly.