The RiskIntegrity for IFRS 17 solution integrates with your existing infrastructure to connect data, models, systems, and processes between actuarial and accounting functions.

Learn more about Moody's Analytics modern and scalable IFRS 17 solution.

Announcements

-

Caribbean’s NAGICO Group Selects Moody’s Analytics for IFRS 17

-

Optimum Reassurance Inc. Selects Moody's Analytics Solution for IFRS 17

-

iA Financial Group Selects Moody's Analytics Software for IFRS 17 Implementation

-

ivari Selects Moody's Analytics Solutions for IFRS 17 Implementation

-

Moody’s Analytics IFRS 17 Solution Licensed by Manulife

-

CLAL Insurance Israel selects the Moody’s Analytics Scenario Generator for IFRS 17

-

RSA Signs Up to Moody’s Analytics Discount Curve Service for IFRS 17

-

Moody’s Analytics Expands Insurance Footprint in Portugal, Crédito Agrícola Vida Chooses RiskIntegrity™ for IFRS 17 Solution

-

BNP Paribas Cardif Selects Moody's Analytics Solution for IFRS 17

-

KLP Selects Moody's Analytics Solution for IFRS 17 Implementation

-

MUA Selects Moody's Analytics IFRS 17 and Scenario Generation Solutions to Help It Meet IFRS 17 Requirements

-

Africa’s Nedbank Insurance Chooses Moody’s Analytics IFRS 17 Solution

Seguros RGA selected Moody’s Analytics for their IFRS 17 project. The AXIS™ system to support the company's actuarial calculations and processes. With the RiskIntegrity™ for IFRS 17 solution for the production of its financial statements under the new IFRS 17 standard.

Watch Carlos González, Chief Financial Officer at Seguros RGA, as he explains the reasons why they chose Moody’s Analytics for such a crucial project.

Read more about our actuarial modeling solutions.

The Moody's Analytics Discount Curve Service for IFRS 17 supports the valuation of an insurer's cash flows to meet the new accounting standard.

The Discount Curve Service for IFRS 17:

- Delivers comprehensive calibration content designed to support insurers with the methodology selection, approval processes, and production challenges associated with the discount curve under IFRS 17

- Helps insurers by providing flexible, granular calibration content they can customize to the specific characteristics of their liabilities

- Enables actuaries and accountants to navigate the approval process by providing a fully documented methodology

Thought Leadership

-

Preparing for IFRS 17, is Your Actuarial System Ready?

IFRS 17 represents the most significant accounting change to the insurance industry for more than two decades. The new standard requires updates to insurers’ actuarial systems and time is of the essence. Insurers should be using 2022 to address the software issues that arise when moving from existing reserving methodologies to those required for IFRS 17.

-

Using stochastic scenarios to assess VFA eligibility

This paper discusses the key criteria for VFA eligibility and how they could be assessed using stochastic scenarios.

-

Getting More from Your Actuarial Modeling

In recent years, actuarial modeling requirements have continued to expand to meet the ever-changing actuarial and business environment. Our latest insurance whitepaper explores opportunities that can add value to and increase efficiency of the actuarial modeling process. Download the whitepaper to learn more.

-

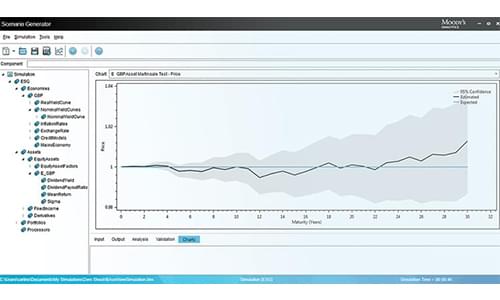

Scenario Modeling for IFRS 17

Insurers should review their choice of models and calibrations in their scenario generator and validate that they are appropriate for IFRS 17, regardless of whether an insurer is implementing a scenario generator for the first time or is an established user. Read this report to learn more.

-

IFRS 17 Accounting Readiness- Polling Results

In 2019, Moody’s Analytics held an IFRS 17 Roadshow across six cities in Europe and Africa. These roadshows were attended by 185 industry professionals. Download the infographic to learn more about the results from the audience polling during the roadshows .

-

Turning theory into practice

In this paper, we discuss a proposed accounting scheme for a non-onerous group under the GMM approach, which would be the most typical case for the life business. We suggest some names for accounts, explain which transactions affect the P&L, show how the CSM mechanics translate into journal entries, and propose using suspense accounts to add transparency to the analysis.

-

Permitted approaches for constructing IFRS 17 Discount Rates

In his IFRS 17 Insight whitepaper, Nick Jessop – Senior Director Research, decodes the impact, significance and use of discount curves in the IFRS 17 reporting process.

-

A Cost of Capital Approach to Estimating Credit Risk Premia

This research paper discusses the credit risk premium adjustment required for constructing discount rates specified by the IFRS 17 accounting rules. Calculating the credit risk premium is a key requirement in the ‘top down’ yield curve method. It may also be a useful input in computing (or benchmarking) the illiquidity premium for ‘bottom up’ discount rate construction.

-

Illiquidity and Credit Premia for IFRS 17

This research paper sets out our calibrations of corporate credit yield curves for selected economies at End December 2018 alongside our estimates of the split between credit risk premia and illiquidity premia for the same data.

-

IFRS 17 Credit and Illiquidity Premia Sensitivity and Backtesting

This new whitepaper in our discount rate series looks at Moody’s Analytics IFRS 17 discount curve methodology. It also shows how we backtested the methodology to understand the decomposition of corporate credit spreads into credit and illiquidity risk.

-

Implementing IFRS 17 Discount Curves

Applying the illiquidity premium to contracts where stochastic models are used for valuation, presents challenges to which insurers are now turning their attention. In this paper, Steven Morrison compare two potential approaches.

-

IFRS 17 Discount Curves: A Guide for Insurers

The discount curve is a key element of #IFRS17. There are significant challenges facing actuaries and accountants tasked with selecting and implementing the discount curve methodology for their organization. Download this three-part guide to learn more:

-

Unpacking LRC and LIC Calculations for P&C Insurers

For P&C insurers, the new IFRS 17 insurance contracts accounting standard has created unique challenges. To delve deeper into these challenges, download the new whitepaper.

-

Calculating the IFRS 17 Risk Adjustment

This paper provides an overview of the IFRS 17 risk adjustment and provides practical insights about calculation methods such as Cost of Capital, Value at Risk (VaR) and Margins for Adverse Deviation.

-

Aggregation and diversification of the IFRS 17 Risk Adjustment

This paper forms part of series of high-level papers designed to provide an introduction to different features of the risk adjustment that should be considered in advance of implementation.

-

Equivalent Confidence Level for the IFRS 17 Risk Adjustment

The IFRS 17 risk adjustment is an influential factor in the pricing of insurance contracts and in how profit from insurance contracts is reported and emerges over time. While the risk adjustment must satisfy certain conditions, the method for its calculation is not prescribed and is the choice of the insurer. As such, there are many potential methods of calculation.

-

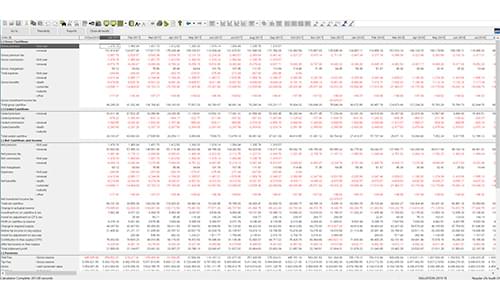

Profit Emergence under IFRS 17: Gaining business insight through projection models

The ability to project financial statements to understand their sensitivity to market risks, insurance risks, and methodology decisions is critical for an effective IFRS 17 implementation. Read this paper to learn why.

-

Profit Emergence under IFRS 9 and IFRS 17

This new whitepaper from our profit emergence series looks at the interaction between IFRS 9 and IFRS 17 and considers the impact of different choices of liability discount rate on profit emergence and earnings volatility.

-

Profit Emergence under IFRS 17 - The Variable Fee Approach

Steven Morrison’s second whitepaper, Profit Emergence under IFRS 17, turns its attention to the Variable Fee Approach (VFA). Explore his practical insights on financial risk and its impact on contracts with participation features.