Globally Recognised

Credit Certification

TAILORED FOR INDIA AND APPROVED BY RBI

Globally Recognised

Credit Certification

TAILORED FOR INDIA AND APPROVED BY RBI

Do You Want to Get

Credit Certified?

Accelerate your career with our

RBI-approved credit certification.

Have questions? We can help.

Call +91-22-6258-1919

or log a ticket by clicking

Need Assistance

Have questions? We can help.

Call +91-22-6258-1919 or log a ticket by clicking

Need Assistance

A Trusted Global Leader in Credit and Risk Management

The Reserve Bank of India (RBI) and the banking industry have identified the need for demonstrated proficiency in bank roles. RBI has issued guidelines mandating certifications for specialised functions and has identified Moody's Analytics as an approved provider.

Award-Winning Solutions

Moody's Analytics has garnered top industry awards in enterprise risk management, financial technology, customer service, and training implementations.

An Established Presence in India

Moody's Analytics has extensive capabilites and resources across India and is actively engaged with major financial institutions and local partners, such as the National Institute of Securities Markets (NISM), to deliver certifications.

I Want to Get

Credit Certified

Accelerate your career with our

RBI-approved credit certification.

Why Our Certification?

Proven Capabilities

Moody's Analytics has extensive experience in designing and delivering a broad range of financial markets certifications.

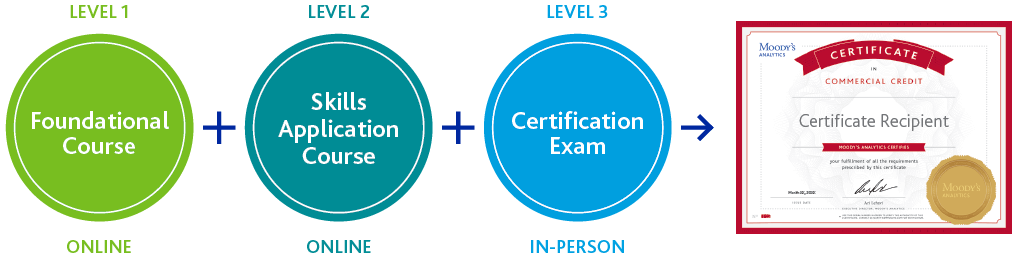

Best Practices in Setting Credentials

Our certification programmes have been designed by industry experts, applying global standards in the design and delivery of credentials that demonstrate proficiency in both knowledge and application.

Pass the Exam

Our programme is designed to help you pass the certification exam. We offer helpful examples, summaries and preparation tools. Our easy-to-follow exam is based on the syllabus provided to help you achieve success.

Aligned to the Indian Banking Needs

Our certifications represent global best practices in credit analysis tailored to the unique Indian context.

Cost-Effective Solutions

Our certifications are priced competitively and are in line with market expectations.

Cutting-Edge

Mobile ready. Accessible anytime, anywhere. The use of interactive online simulations offers individuals a rich learning experience.

Programmes and Brochures

Certifying the highest standards in credit analysis and lending decisions

Exam Information

To book a certification exam, please ensure you have your 'Application Number' handy. Your application number was provided to you at the time of registration. If you have not registered before, you will need to register first. If you have registered, you can proceed to the Online Exam Booking System.

Online Proctored exam schedule

28th January 2024

25th February 2024

31st March 2024

28th April 2024

26th May 2024

30th June 2024

28th July 2024

25th August 204

29th September 2024

27th October 2024

24th November 2024

22nd December 2024

Please Note: These locations are only applicable for the next exam date listed. Additional locations will be available for future exam dates. For assistance in booking your exam date please create a ticket. Just click on the "Need Assistance" icon and submit your request.

Ready to Enrol? Make Sure You Have This

Your Photo

Your Signature

Payment Method

Clear photos taken on your mobile phone, including a photo of your signature, up to 500 KB will be accepted.

Click here to enrol now

Our Customers

Contact Us

We stand ready to help you and your organisation achieve the mandatory credit certification.

If you have any questions about enroling in our programme, or if you'd like to enrol your organisation, call us at +91-22-6258-1919.

If you are already registered with us and need support, please create a ticket. Just click on the "Need Assistance" icon and submit your request. The primary language for communication and certification programme is English.

Meet Our Team

Jacob Grotta

General Manager

Abhishek Pundhir

Country Manager

Prakash Cariappa

India Certifications Director

Samantha Hall

eLearning Solutions Expert

Piyush Paul

Marketing Director

Marise Pimenta

Client Services Head

Ralf Wimmershoff

Subject Matter Expert

Cheryl Stewart

Product Strategist

Frequently Asked Questions

In The News

Moody's Analytics collaborates with Chandigarh University

We are proud to announce our collaboration with India's Chandigarh University to provide the university's MBA – Banking & Financial Engineering (BFE) program students access to Moody's Credit Skills for Bankers Certificate (CSBC). This certificate will be compulsory for all MBA BFE program students.

The CSBC programme—approved by RBI—leverages Moody’s Analytics global expertise in credit and is specifically designed for India’s banking context, covering the foundations of retail and SME credit management. Moody’s Analytics CSBC is the gold standard in credit certification. Certified professionals are recognized as being proficient in credit analysis and able to assess borrowing requests as well as ensure prudent risk.

SBI Launches Credit Certification in Collaboration with Moody's Analytics

The State Bank of India (SBI) and Moody's Analytics announced their collaboration to provide bank-wide credit certification to SBI's employees enabling them to source, appraise and monitor loans faster. The initiative enhances SBI's market-leading credit curriculum with the globally recognised expertise of Moody's Analytics.

About Moody's Analytics

Moody's Analytics helps banking, capital markets, and risk practitioners worldwide respond to an evolving marketplace with confidence. We offer unique solutions and best practices for measuring and managing risk through loan origination and risk infrastructure, credit and risk analytics, economic research, financial advice, and training and certification.

Learning Solutions is an internationally recognised training and certification provider that sets the standard for financial services education worldwide. Our practical, comprehensive programmes build competencies that help organisations improve their strategic and financial performance. As the training partner to many of the world's leading global and regional banks, we have proven experience and expertise in delivering world-class solutions that enhance staff proficiency and drive lasting business impact.

By the Numbers

Accomplishments & Awards

Moody's Analytics continues to be recognised for the solutions it provides to financial institutions in accounting, compliance, and risk management globally.