Certificate in Commercial Credit (CICC)

Register for the Course

The Certificate in Commercial Credit leverages Moody’s expertise in credit risk identification, assessment, and management to certify achievement of the highest standards of proficiency.

What will I gain with the CICC?

- Demonstrate that you have achieved a global standard in corporate and commercial credit assessment.

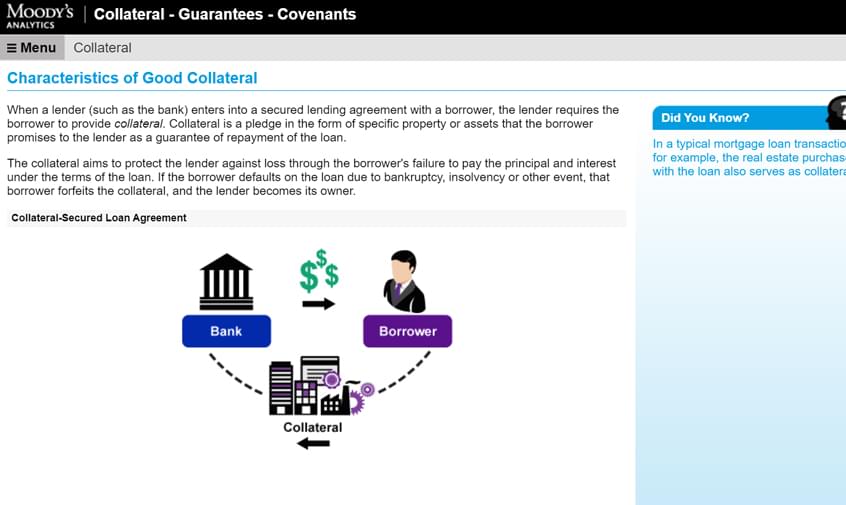

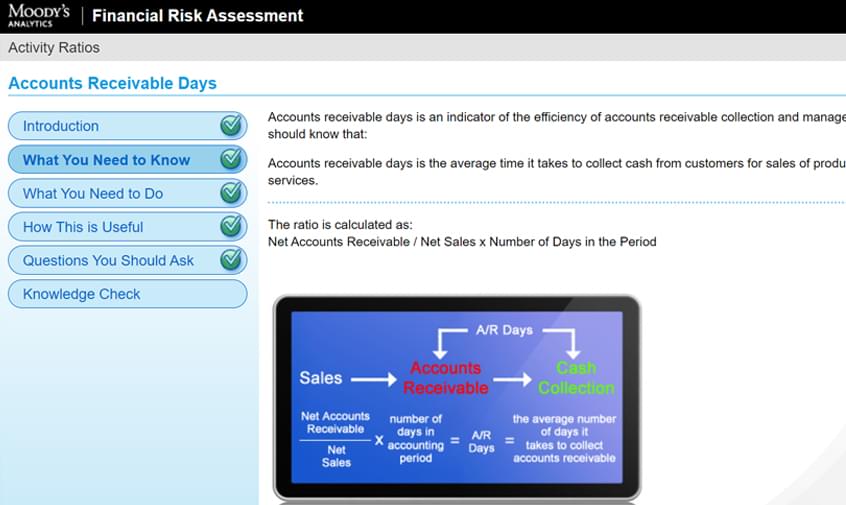

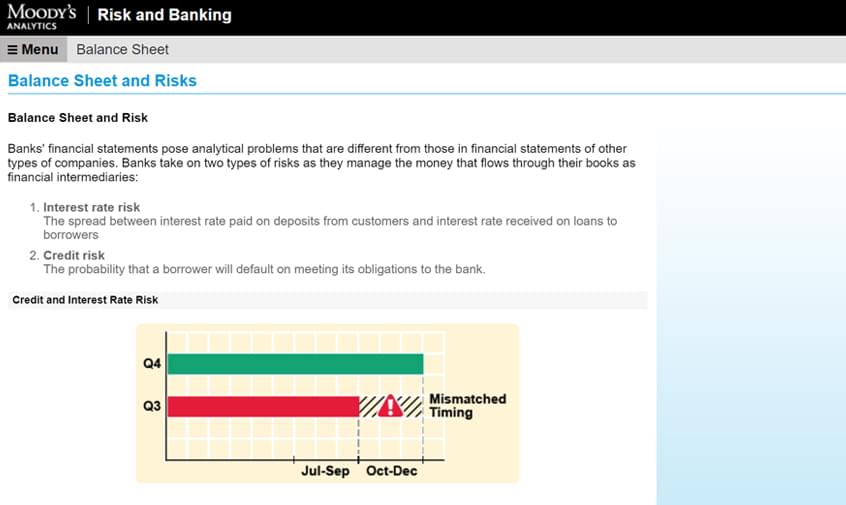

- Attain the skills to analyze an obligor, mitigate risk, and recommend the optimal loan solution.

- Learn how to price credit facilities to compensate for risk while maximizing profitability and competitiveness.

- Gain a strategic perspective of the lending business of your organization.

- Learn to carry out the bank’s risk policies and promote its culture.

- Build your personal brand by adhering to professional standards that establish trust.

- Open doors to career opportunities.

How is the CICC tailored to my learning needs?

- The CICC requires the completion of three eLearning courses: Commercial Lending, Problem Loans, and Profitability & Credit Risk, followed by an in-person exam.

- The entire program can be completed in 50 to 60 hours.

- Concentrate your learning on the areas where you have knowledge gaps, identified through our pre-course diagnostics.

- Optimize your learning time through our engaging, industry-leading online programs with interactive multimedia lessons featuring videos and quizzes.

- Build your confidence by practicing complex concepts, applying new skills, and demonstrating mastery with case studies and a robust simulation based on a real lending scenario.

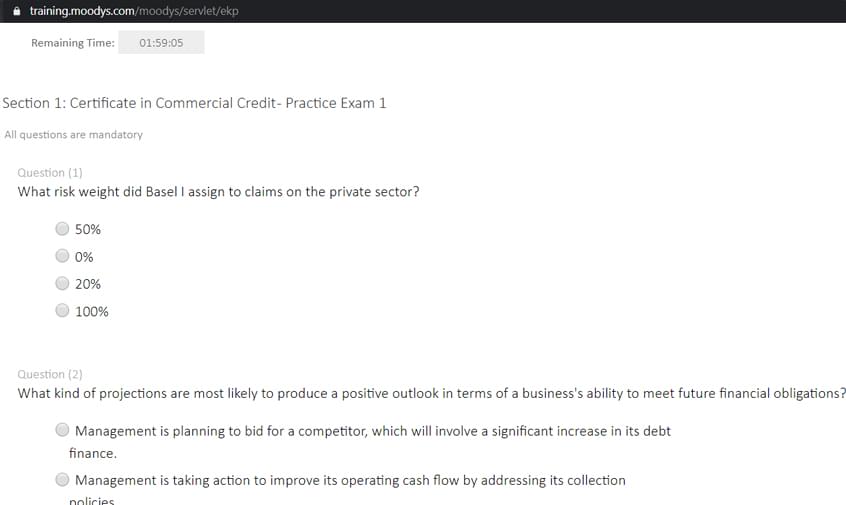

- Prepare for the certification exam with course reviews and practice exams.

- Program sponsors can monitor participation, assess performance, and access critical details to support measuring ROI.