Cards and Payments II

Register for the Course

What is Cards and Payments II?

Cards and Payments II teaches you the holistic competencies required to manage a profitable and sustainable cards and payments business end-to-end.

You learn how to manage the features and components of service delivery in the entire card lifecycle - from best practices in sales and marketing strategies, operations and servicing infrastructure, fraud and data security - to risk management.

You will draw upon real industry scenarios and live portfolios managed by experienced professionals.

Upon completion, you gain the essential multi-disciplinary competencies to manage a profitable cards and payments business.

Having successfully completed the CP I examination, you may use the ACP II designation after your name.

What will you learn by taking this course?

- Launch and manage a profitable credit card, debit card, prepaid card and corporate card / purchasing card business

- Manage the key areas of service delivery and features in the card life cycle

- Conceive and execute winning Sales and Marketing strategies that address disruptive and competitive challenges

- Set up and manage a world class operations and servicing infrastructure which will enable the business to have a competitive edge and ensure delivery of all the promises laid out to the customer

- Identify the types of fraud that exist and review fraud best practices that have proven effective for Issuers in reducing their fraud losses and optimizing the revenue and profit generated from their card portfolios

- Manage the systems and software/ hardware across requirements of 24x7 functioning of all channels of card products and current best practices in card technology, security and data protection

- Manage the lifecycle of credit card risk and apply risk management best practices and metrics that need to be tracked and measured in the industry

With Moody’s Analytics eLearning:

- You take a flexible, convenient and scalable learning solution and align it to meet your organization’s strategic business and learning objectives

- You remain engaged in training, thanks to our interactive presentations and video content

- You elevate your professional currency by completing a course from a globally recognized leader in the retail banking space

- You develop skills you can immediately apply on the job, instantly enhancing your performance

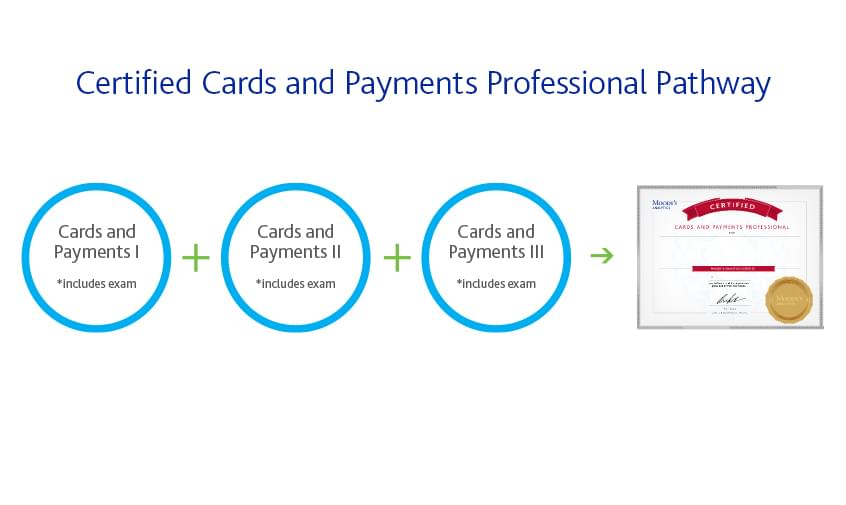

Is there a pathway?

Continue your learning journey and progress your career by entering the next level of the Certified Cards and Payments Professional (CCPP) curriculum.

Cards and Payments III is the final level of the CCPP curriculum, which is focused on the advanced competencies and strategic leadership skills required to build and sustain a profitable cards and payments business.

Product Brochure

What is the exam structure?

-

- The Cards and Payments I examination has two parts, each lasting two hours. There is an eight-minute break between each part. Each part of the examination is conducted independently.

- The first part (Part A) comprises 80 multiple-choice questions. Each question has only one correct answer. Each question is worth one mark for a total of 80 marks.

- Questions in Part A examine for mastery of key principles and concepts from every Cards and Payments I module.

- The second part (Part B) has six scenarios. Each of these six scenarios require answers to eight multiple-choice questions.

- Each scenario is worth eight marks for a total of 48 marks.

- Questions in Part B examine for mastery of key principles and concepts presented in Retail Banking I.

- The use of calculators is permitted.

-

- The Cards and Payments II examination has two parts, each lasting two hours. There is an eight-minute break between each part. Each part of the examination is conducted independently.

- The first part (Part A) comprises 80 multiple-choice questions. Each question has only one correct answer. Each question is worth one mark for a total of 80 marks.

- Questions in Part A examine for mastery of key principles and concepts from every Cards and Payments II module.

- The second part (Part B) has six scenarios. Each of these six scenarios require answers to eight multiple-choice questions.

- Each scenario is worth eight marks for a total of 48 marks.

- The use of calculators is permitted.

-

- The Cards and Payments III examination has two parts, each lasting three hours. There is an eight-minute break between each part. Each part of the examination is conducted independently.

- The first part (Part A) has 24 multiple-choice questions and lasts for one hour. Each question is worth one mark for a total of 24 marks.

- Questions in Part A examine for mastery of advanced key principles and concepts from every Cards and Payments III module.

- The second part (Part B) comprises eight compulsory scenarios. Each scenario has a set of open questions that are worth a total of six marks each for a total of 48 marks.

- Questions in Part B examine for mastery of advanced principles and concepts from the Cards and Payments III curriculum. Participants will be examined on their abilities to demonstrate how the subject matter areas covered in the Cards and Payments III curriculum are connected.

- The use of calculators is permitted.

Criteria for Passing the CCPP Examinations

- The passing score is 55%.

- In calculating the final grade (Pass/Fail/Distinction) equal weighting is given to each part of the examination. A minimum score of 50% is required in each Part to pass the examination.