Sponsor

Infopro Digital, the publisher of Risk Magazine and Risk.net, is a leading player in business-to-business information and services. It offers multimedia products and solutions such as analysis and insight, events, and training.

How Winners Are Chosen

The Risk Technology Awards focus on market risk, trading, and investment risk technology. The award winners are decided by a panel of judges selected by the editors of Risk.net. In 2019, the judging panel included technology users, risk management practitioners, and members of the Infopro Digital editorial team.

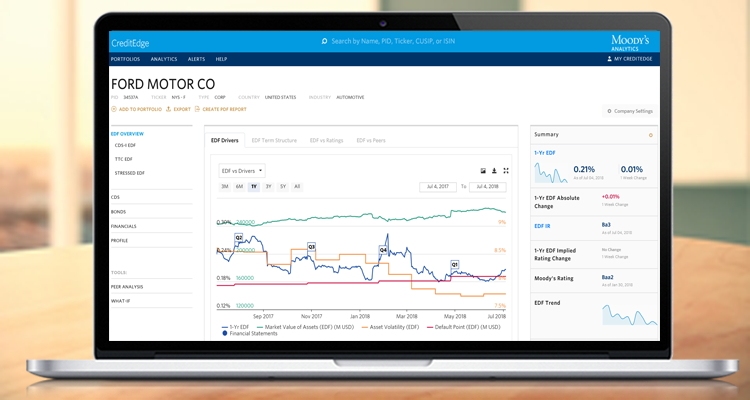

"The Moody’s Analytics suite of wholesale credit scoring models and solutions cover the market from small businesses to large private and public companies, to commercial real estate and project finance."...

“Moody’s Analytics, a global provider of financial intelligence, has won Wholesale Credit Modelling Software of the Year in the 2019 Risk Technology Awards. It’s one of six categories won, spanning finance, accounting, regulatory, and credit functions.”...

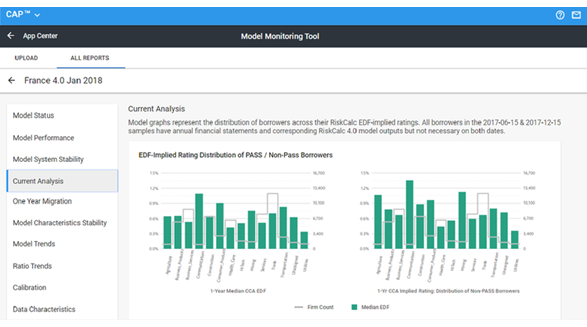

The RiskCalc solution offers a comprehensive approach to assessing the default and recovery of private firms, financial institutions, and project finance transactions. Our RiskCalc models generate forward-looking probability of default (PD) or Expected Default Frequency™ (EDF) calculations, loss given default (LGD), and expected loss (EL) credit measures.