Sponsor

InsuranceERM.com is an online service that has established itself as a source of information on all aspects of risk and capital management in the insurance industry.

How Winners Are Chosen

In the first round of judging, a small group of category judges reviews submitted material and then votes on a secret ballot, ranking the top three entries for each category. InsuranceERM’s editorial team then counts and verifies the votes. All judges are senior industry experts from across Europe and the United Kingdom.

"Firms using Moody's internal model software were able to configure system inputs in CSV files, export charts and underlying data more easily, upload large scenario files and enjoy improved performance when running the software on machines with several cores."...

"Moody’s Analytics has won two categories in the inaugural InsuranceERM Awards. The Moody's Analytics RiskIntegrity™ Suite earned the award for Best Solvency II Solution, while the Economic Scenario Generator (ESG) took the top spot in its category."...

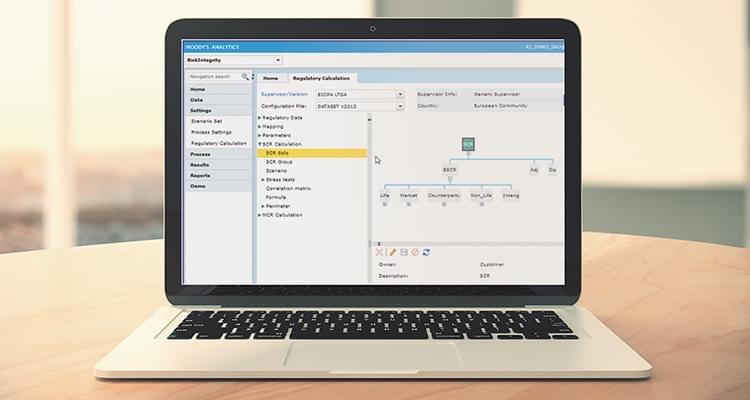

The Moody's Analytics RiskIntegrity Suite, our comprehensive Solvency II solution, helps insurers meet the calculation, data, and reporting requirements of Solvency II. The modular solution offers both standard-formula and internal-model approaches to support insurers with automation of regulatory capital calculations and reporting.

The Market-Consistent Economic Scenario Generator is a suite of stochastic asset modeling tools in a flexible framework that allows insurers to produce risk-neutral scenarios to value optionality in insurance liabilities, as required by regulatory and accounting regimes. Risk-neutral modeling is also used for hedging and risk management activities.