GlobalCapital US Securitization Awards 2021

Securitization Data Provider of the Year

About This Award

Sponsor

GlobalCapital is a leading news, opinion, and data service for people and institutions involved with the international capital markets.

How Vendors Are Evaluated

The list of nominees for each award is compiled from industry nominations, GlobalCapital's own research, and peer review. The editors of GlobalCapital then create a short list of nominees and let readers vote on the winners.

GlobalCapital is a leading news, opinion, and data service for people and institutions involved with the international capital markets.

How Vendors Are Evaluated

The list of nominees for each award is compiled from industry nominations, GlobalCapital's own research, and peer review. The editors of GlobalCapital then create a short list of nominees and let readers vote on the winners.

Article

Article

“The pandemic shone a light on asset quality,” says David Little, general manager of Structured Finance at Moody’s Analytics. “With swift deterioration in macroeconomic fundamentals, there was increased focus on the underlying assets in structured finance.” Market players wanted to know what would happen to a tranche or a portfolio if the unemployment rate tripled. They wanted to examine the impact of multiple different scenarios and they wanted the answers quickly. ”...

About the Structured Finance Portal

About the Structured Finance Portal

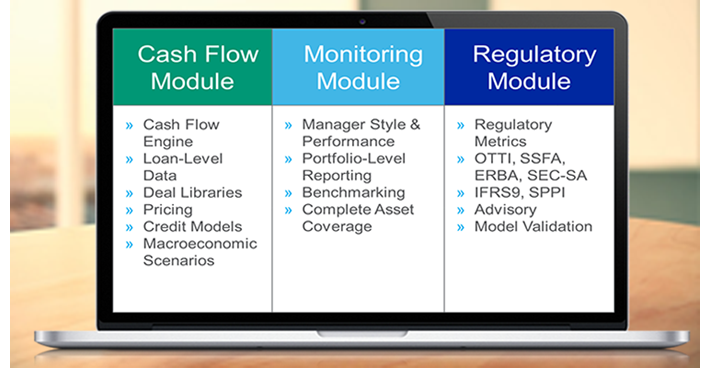

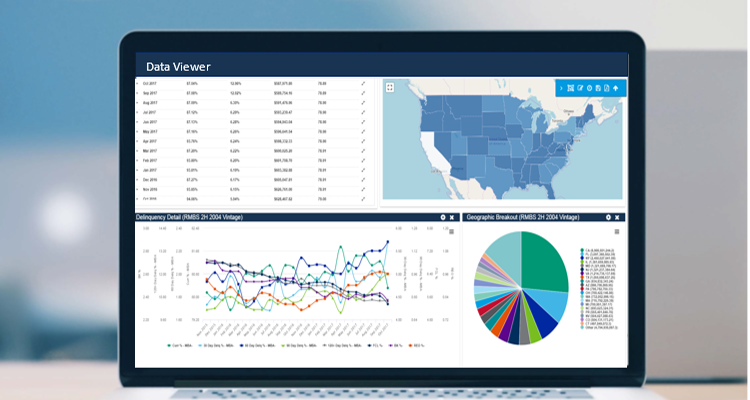

The Moody's Analytics Structured Finance Portal sets the standard for transparency, analysis, and reporting across structured finance. This premier web-based tool offers data and analytics across all structured finance asset classes with advanced reporting and time-saving data normalization and aggregation. It provides structured finance professionals with cash flows, regulatory metrics, comparative analytics, and data aggregation in one integrated platform.

About Structured Finance APIs

About Structured Finance APIs

Access Moody’s Analytics economic, credit, cash flows models, and data for a universe of global securitization asset classes via flexible contracting options and cutting-edge content delivery platforms such as local/hosted APIs, microservices, iFrames, and Excel® Add-In.

About Structured Finance Data Feeds

About Structured Finance Data Feeds

Moody’s Analytics Structured Finance data set includes historical loan, pool, bond, and property-level data collected across asset classes. The Structured Finance database is drawn from the monitoring reports of every major servicer/trustee and is further enhanced with extra data fields from various sources.