The Moody's Analytics Structured Finance Portal sets the standard for transparency, analysis, and reporting across structured finance. This premier web-based tool offers data and analytics across all structured finance asset classes with advanced reporting and time-saving data normalization and aggregation. It provides structured finance professionals with cashflows, regulatory metrics, comparative analytics, and data aggregation in one integrated platform.

“The inaugural Chartis STORM50 highlights our ability to deliver an integrated view of risk through robust and innovative solutions. I’m glad to see recognition of our ability to help our customers make better decisions amid uncertainty by quantifying the impact of possible future scenarios.” - Nick Reed, Chief Product Officer

Together with its accompanying awards, the STORM50 ranking provides a valuable assessment and benchmarking tool for all participants in risk technology markets.

More Awards

-

Chartis RiskTech100® 2021 #2 Overall Ranking

Moody’s Analytics is #2 in the 2021 Chartis RiskTech100® ranking of the world's top providers of risk management technology.

-

Chartis RiskTech100® 2021: Banking Category Winner

This is our second straight Banking Industry win, recognizing the range of banks across the globe that use Moody’s Analytics solutions to make better decisions.

-

Chartis RiskTech100® 2021: CECL Category Winner

Moody's Analytics has won the CECL award at Chartis RiskTech100® 2021 for the third year in a row.

-

Chartis RiskTech100® 2021: Climate Risk Category Winner

Severe climate events throughout 2020 underscore the importance and urgency for market participants to understand how climate change is already affecting—and will continue to affect—the risk and return of their portfolios.

-

Chartis RiskTech100® 2021: Credit Risk for the Banking Book Category Winner

This is the fifth year in a row that Moody's has won the Credit Risk for the Banking Book category at Chartis RiskTech100®.

-

Chartis RiskTech100® 2021: Enterprise Stress Testing Category Winner

Another repeat win for Moody's Analytics at the Chartis RiskTech100® 2021, this is the fifth time we have won the Enterprise Stress Testing category.

-

Chartis RiskTech100® 2021: Model Validation Category Winner

For the third year in row, Moody's Analytics has won the Model Validation category in the Chartis RiskTech100®.

-

Chartis RiskTech100® 2021: OpsTech: Securitization Services Category Winner

Moody's Analytics has won the OpsTech: Securitization Services category at the Chartis RiskTech100® 2021.

-

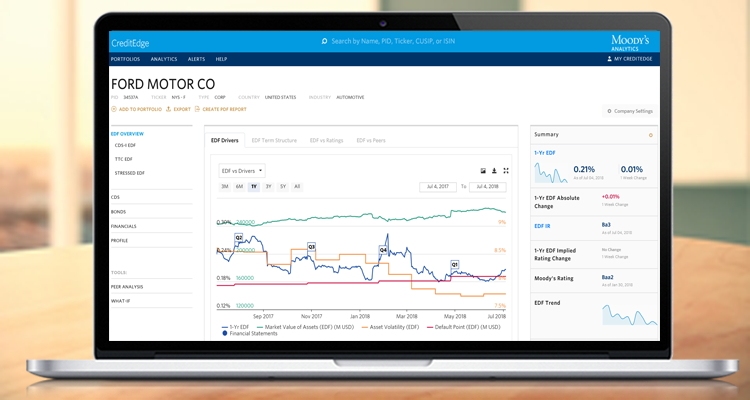

Chartis RiskTech100® 2021: Pricing and Analytics: Credit for the Banking Book Category Winner

Moody's Analytics has won the Pricing and Analytics: Credit for the Banking Book category at this year's Chartis RiskTech100®.

-

Chartis RiskTech100® 2021: Pricing and Analytics: Credit for CLOs

Moody's Analytics has won the Pricing and Analytics: Credit for CLOs category at the 2021 Chartis RiskTech100®.

-

Chartis RiskTech100® 2021: Strategy Category Winner

At its core, the Moody’s Analytics strategy is to invest in both organic development and targeted acquisitions to serve our customers better.