We are proud to have earned the top overall ranking in the Chartis RiskTech100 2023, the most comprehensive, independent study of risk and compliance in the market. This win is a testament to our strategy, our deep customer engagement and our investments to provide integrated perspectives on risk. We’re grateful to our customers who trust our solutions to provide differentiated data, analytics and insights that solve the problems they are facing.

Hear from Steve Tulenko, President of Moody’s Analytics speak with Moody’s CEO Rob Fauber and Chartis Research Brand Director Mark Feeley on the win.

“Winning the top spot on this prestigious ranking is a tremendous achievement that reflects contributions from across Moody’s. The number-one ranking validates our continuous effort to help customers integrate data, analytics, and technology to decode risk and unlock opportunity.”

- Stephen Tulenko, President at Moody’s Analytics.

Together with its accompanying awards, the RiskTech100® ranking provides a valuable assessment and benchmarking tool for all participants in risk technology markets.

The awards for strategy and functionality demonstrate the success of our growth strategy and innovation to meet customer needs as a leading global integrated risk assessment firm. We combine strategic investment with a focus on customers to bring a multi-dimensional and integrated view of risk to the market.

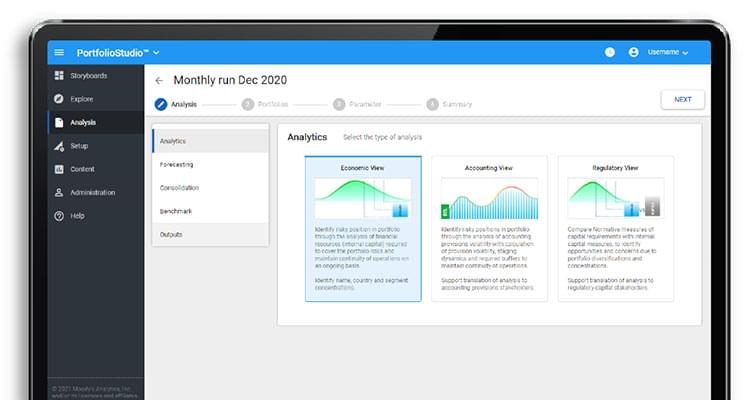

As experts in credit risk, Moody's Analytics offers credit risk solutions that help firms improve how they measure, manage, and mitigate the credit risk inherent in their loan and investment portfolios.

EDF-X, Moody’s Analytics flagship solution for credit insights and early warning signals, pre-calculates credit measures for 425+ million companies globally—public and private, rated and unrated—using the best data available and provides customized views for a range of credit decisions.

Moody’s provides software, solutions, data and intelligence that empowers banks to take action. At every step, banks have a meaningful view of data and a holistic view of risk in order to shine a light on opportunities. We bring together the best of experience and expertise in regulatory compliance, lending, credit and market risks to empower banks to have the confidence to act on their plans.

|

|

|

|

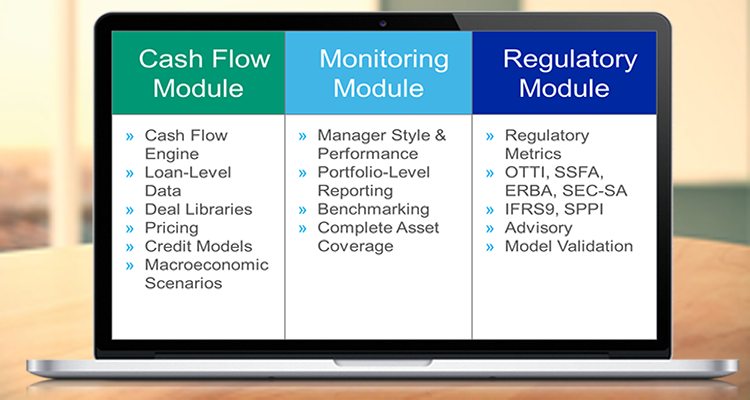

Our solutions bring together software, models, data and analytics, to create targeted solutions to meet industry challenges, including: KYC; underwriting; actuarial; regulatory & financial reporting; investment, ALM and capital management

|

|

|

|

Sponsor

Chartis analysts used a combination of sources to inform their decisions: user surveys, interviews with subject matter experts, customer reference checks, vendor briefing sessions, and other third-party sources.

More Awards

-

Chartis RiskTech100® 2022: Overall Ranking #2

Moody's Analytics won nine categories in the 2022 Chartis RiskTech100®, earning an overall ranking of #2 among the world's top 100 providers of risk management technology.

-

Chartis RiskTech100® 2022: Strategy Category Winner

At its core, the Moody’s Analytics strategy is to invest in both organic development and targeted acquisitions to serve our customers better.

-

Chartis RiskTech100® 2022: Banking Industry Winner

Moody’s Analytics won the Banking Industry category in this year’s Chartis RiskTech100®. This distinction honors the extensive global adoption of our solutions, which help banks with lending, regulatory and accounting standards, balance sheet management, and a host of other challenges.

-

Chartis RiskTech100® 2022: CECL Category Winner

For the fourth straight year in 2022, Moody's Analytics won the Current Expected Credit Loss (CECL) category in the Chartis RiskTech100®.

-

Chartis RiskTech100® 2022: Climate Risk Category Winner

For the second straight year in 2022, Moody's Analytics won the Climate Risk category in the Chartis RiskTech100®.

-

Chartis RiskTech100® 2022: Enterprise Stress Testing Category Winner

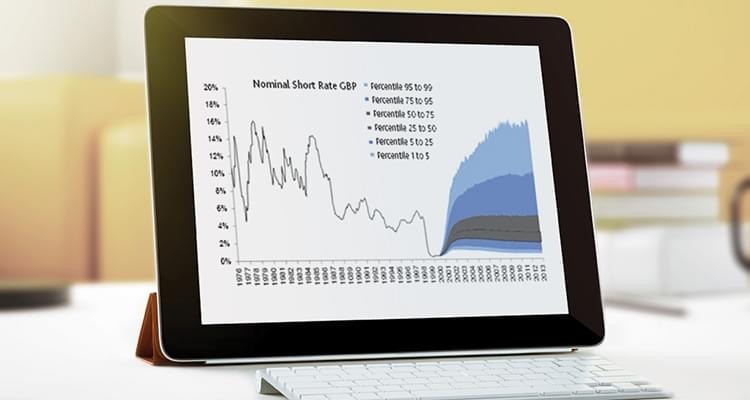

Moody's Analytics won the Enterprise Stress Testing category in the Chartis RiskTech100® for the sixth time in 2022.

-

Chartis RiskTech100® 2022: Wholesale Credit Data

Moody's Analytics won the Wholesale Credit Data category in the RiskTech100® 2022.

-

Chartis RiskTech100® 2022: Environmental Social and Governance (ESG) Category Winner

Moody's Analytics won the Environmental Social and Governance (ESG) category in the 2022 Chartis RiskTech100®.

-

Chartis RiskTech100® 2022: OpsTech: Securitization Services Category Winner

Moody's Analytics won the OpsTech: Securitization Services category at the Chartis RiskTech100® 2022.

.jpg?modified=20220608092925)