Banking Industry Winner

Sponsor

Chartis Research is a leading provider of research and analysis on the global market for risk technology. It is part of Infopro Digital, which owns market-leading brands such as Risk and WatersTechnology.

How Vendors Are Evaluated

Chartis analysts used a combination of sources to inform their decisions: user surveys, interviews with subject matter experts, customer reference checks, vendor briefing sessions, and other third-party sources.

"Moody’s Analytics won the Banking Industry category in this year’s Chartis RiskTech100®. This distinction honors the extensive global adoption of our solutions, which help banks with lending, regulatory and accounting standards, balance sheet management, and a host of other challenges."...

Banking Cloud Credit Risk is a cloud-native calculation and reporting engine that helps banks comply with current and upcoming regulatory capital requirements, including the latest Basel Committee on Banking Supervision (BCBS) standards and European Banking Authority (EBA) Capital Requirements Regulations (CRR), as well as the national discretions of their domestic supervisors. It provides a comprehensive, streamlined, and cost-efficient regulatory compliance solution.

The Moody's Analytics CreditLens platform helps financial institutions make better commercial lending decisions, with increased speed and efficiency. Its innovative technology enables consistent spreading, which powers advanced analytics, including the ability to compare and benchmark your portfolio for enhanced risk assessment.

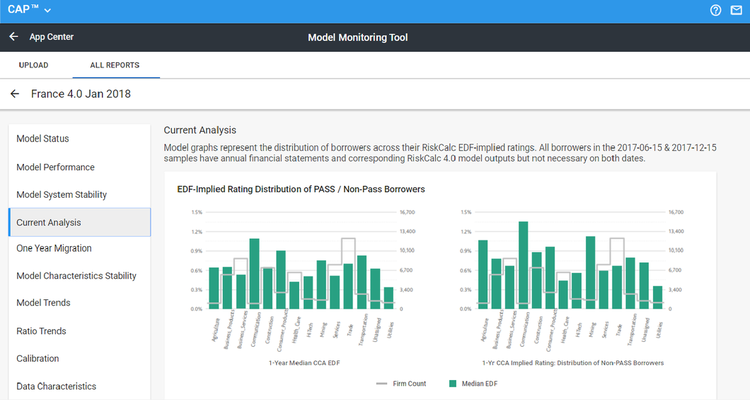

The RiskCalc solution offers a comprehensive approach to assessing the default and recovery of private firms, financial institutions, and project finance transactions. Our RiskCalc models generate forward-looking probability of default (PD) or EDF™ (Expected Default Frequency) calculations, loss given default (LGD), and expected loss (EL) credit measures.

The Moody's Analytics CAP solution delivers transparency and efficiency throughout the modeling lifecycle. Powered by Moody's Analytics proprietary data and proven modeling frameworks, it empowers organizations to tailor internal models or third-party models to their unique experiences, and to build, validate, and monitor models quickly and at scale.

Moody's Analytics, Moody's, and all other names, logos, and icons identifying Moody's Analytics and/or its products and services are trademarks of Moody's Analytics, Inc. or its affiliates. Third-party trademarks referenced herein are the property of their respective owners.