Many of our customers are well along their IFRS 17 journey while others are just starting. No matter what stage they are in, they trust Moody’s Analytics to help with their implementation challenges - Christophe Burckbuchler, Managing Director at Moody’s Analytics

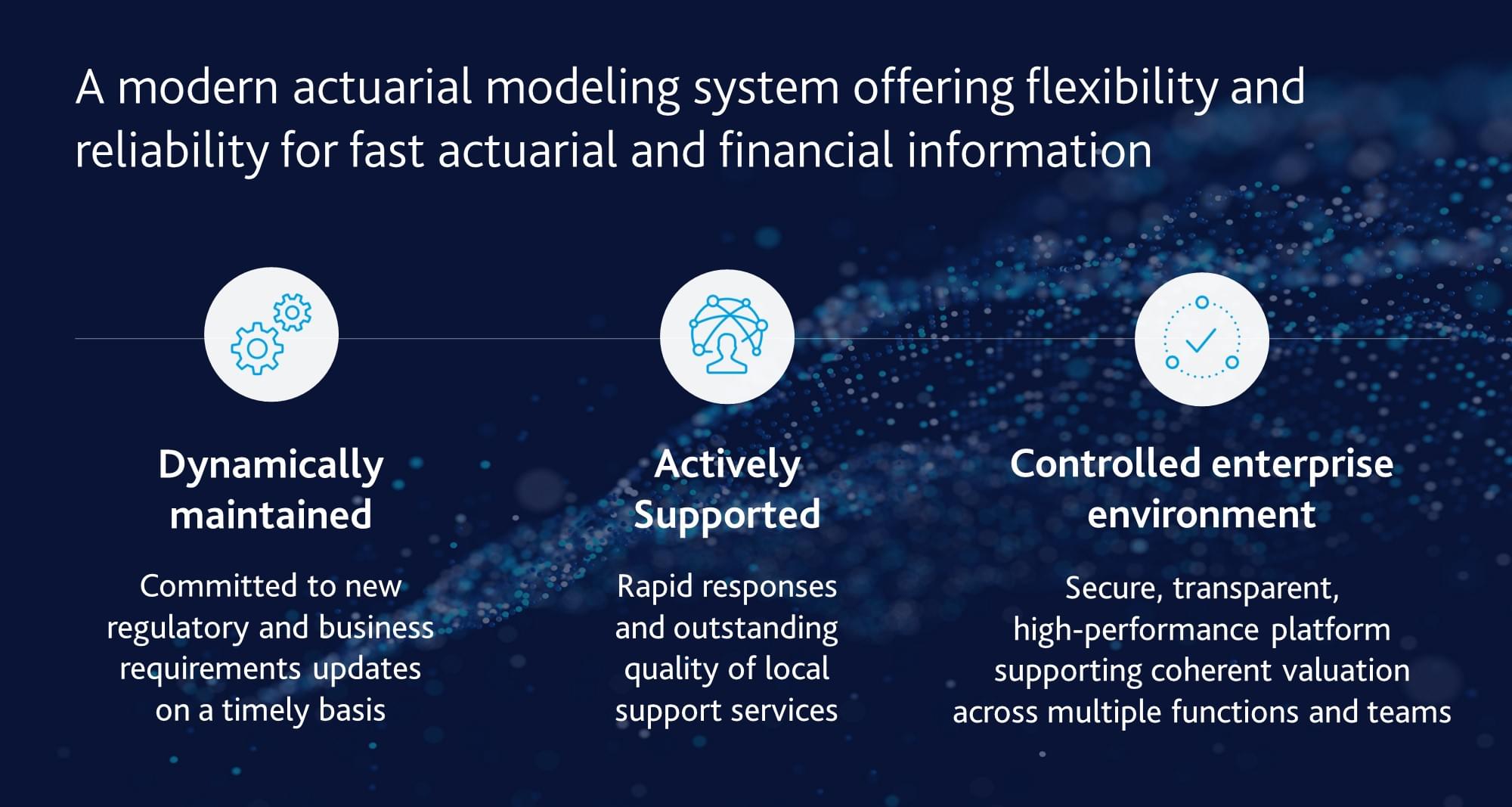

The RiskIntegrity for IFRS 17 solution integrates with your existing infrastructure to connect data, models, systems, and processes between actuarial and accounting functions.

More Awards

-

InsuranceERM Awards 2020: IFRS 17 Solution of the Year

This is the first year that these awards have included an IFRS 17 category. We won it on the strength of our RiskIntegrity™ solution for IFRS 17.

-

InsuranceERM Americas Awards 2020: Actuarial Modelling Solution of the Year

With the AXIS system, Scenario Generator, and other award-winning Moody’s Analytics tools, our clients are able to address increasingly challenging modeling requirements, such as those presented by IFRS 17 and LDTI.

Moody's Analytics, Moody's, and all other names, logos, and icons identifying Moody's Analytics and/or its products and services are trademarks of Moody's Analytics, Inc. or its affiliates. Third-party trademarks referenced herein are the property of their respective owners.