Executive Summary

Single Counterparty Credit Limits (SCCL) – a mandated by the Board of Governors of the Federal Reserve System (Board) – impacts credit decisions that limit concentration of exposure toward entities belonging to the same group or sharing economic interdependences. In the next few months, covered companies are rushing toward regulatory compliance. Their final decisions must balance this short-term need given the tight timelines for implementation, with longer-term strategic considerations.

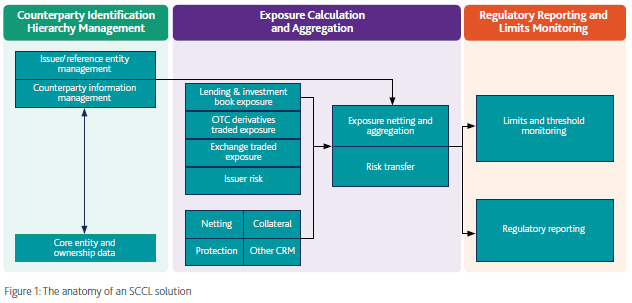

This paper is divided in two parts. After a brief overview of SCCL, the first part focuses on the three main challenges we anticipate for covered companies in their path toward compliance: the calculation of aggregated net exposures, the availability of economic interdependence and ownership information for counterparties, and the regulatory disclosures. In the second part of this paper, we show the anatomy of a hypothetical SCCL solution, while discussing strategic and tactical considerations given the looming regulatory deadlines.

SCCL at a glance

On June 14, 2018 the Board issued a final rule establishing Single Counterparty Credit Limits (SCCL) for:

»» US global systemically important banks (GSIBs)

»» US bank holding companies (US BHCs) with $250 billion or more in total assets

»» the US operations of foreign banking organizations (FBOs) that have $250 billion or more in total global assets

»» intermediate holding companies (IHCs) with $50 billion or more in total assets

The final rules impose limits on the aggregate amount of net credit exposure that a covered company might need an unaffiliated counterparty. Depending on the size and regulatory status of the parties, these limits range from 25 percent of total capital plus Allowance for Loan and Lease Losses (ALLL) to 15 percent of tier 1 capital.

To calculate the net credit exposure to a counterparty, companies subject to SCCL are to calculate the gross credit exposure to the counterparty for each credit transaction. Then, this amount is required to be reduced via the allocation of credit risk mitigants (CRMs), resulting on the net credit exposure at a granular level. Finally, all net credit exposures to a given counterparty must be added up by respecting other aggregation requirements.

As for the eligible capital base, it refers to total capital plus ALLL for smaller US IHCs or the tier 1 capital for the remaining covered companies. US G-SIBs and FBOs that are G-SIBs must comply by January 1, 2020, and other covered companies must comply by July 1, 2020.

From theory to practice: Key challenges in implementing SCCL

While financial institutions have largely improved their credit risk practices following the 2008 financial crisis, the SCCL final rule brings its own set of challenges even for the most prepared actors. In particular, the daily calculation of aggregate net credit exposures and their comparison with regulatory limits requires fine-tuned processes and regularly updated exposure and counterparty data.

Covered companies must assess economic interdependence and control relationship of its counterparties thoroughly. For example, if a counterparty net credit exposure exceeds 5% of eligible capital base, unconnected affiliates of the counterparty must be examined for economic interdependence and control relationships.

Finally, the rule requires covered companies to monitor those limits daily and produce regulatory reporting disclosures on a quarterly basis. The Single- counterparty Credit Limits Report (FR-2590) schedules require granular accurate data with focus on the top 50 counterparties. Given the short timelines, covered companies might consider both tactical and strategic approaches toward a successful implementation and full regulatory compliance.

Aggregate net credit exposures and compare with regulatory limits

The comparison of aggregated net credit exposures with regulatory limits requires daily gross and net exposure calculations at a granular level. This means both direct and indirect exposures and CRM must be considered. While Basel 3 Standardized calculation results might provide a solid starting point for SCCL calculation, there are some differences between the two frameworks. For example, differences include the impact of the credit conversion factor (CCF) on the off-balance sheet portfolio, and the calculation of derivatives exposures and the computation of funds and securitization.

The application of regulatory methodologies such as the netting advantage, collateral haircut approach, look through approach, and others are key to represent the risk transfer for each financial instrument. This results in an accurate depiction of the net exposure to each counterparty. For institutions used to sophisticated credit risk calculations, the requirement to monitor SCCL daily requires a highly automated process with minimum room for manual adjustments.

Economic interdependence and control relationship

The concepts of economic interdependence and control relationship are perhaps the most challenging aspect of data enhancement linked to SCCL implementation. This information does not exist in the public domain and is global in nature, with links spanning multiple levels and multiple countries. Moreover, both the concepts of economic interdependence and ownership are highly dynamic. Asking the counterparty about their ultimate parent is not enough to fulfill the requirements adequately. Some companies might not have the knowledge or the authority to disclose it.

Therefore, covered companies must enhance their existing data sources to capture these details but also to maintain regular updates that reflect the ownership and economic interdependence links at any given point in time. For covered companies with multiple subsidiaries, a global approach to collecting ultimate counterparty parent data from multiple, global sources, and networks are essential.

Regulatory reporting disclosures

Along with the SCCL final rule, the Board has published a proposal to implement the Single-Counterparty Credit Limits Report (FR 2590) with the intention to monitor a covered company’s compliance with the final rule. Schedules can be grouped in three main categories: Schedules G-x focus on identifying the exposures. Schedules M-x list eligible collateral and general risk mitigants. Finally, schedules A-x aim at providing transparency on economic interdependence and control relationships of main counterparties.

US G-SIBs and FBOs that are G-SIBs must begin filing the FR 2590 as of the end of the first quarter of 2020, and other covered companies by the end of the third quarter of 2020. While a draft of the templates and instructions has been published for comments, the Board has yet to publish finalized instructions for FR 2590. This means tight timelines to adjust from earlier drafts to the final requirements. The timeline creates a challenge for organizations to adapt during implementation time, favoring turnkey third-party solutions as opposed to inhouse development.

The anatomy of SCCL solution

The described challenges combined with the need for daily calculations require a well-engineered automated process. This starts with solid data sourcing that can combine up-to-date ownership information, an essential first ingredient of an SCCL solution. Then, at its heart, a calculation engine is responsible for combining exposure information for varied asset classes with the proper collateral attribution and eligible netting calculations. A configurable engine capable of receiving regulatory updates holds the advantage of enabling organizations to react quickly to changes imposed by the supervisor. Finally, raw results must be displayed not only as regulatory disclosures, but also in a way that enhances business processes. Figure 1 shows the proposed schema of components a comprehensive solution requires.

Tactical and strategic implementation approaches

When discussing implementation approaches, project teams might sometimes refer to “strategic” and “tactical” approaches as synonyms of “long-term” and “short-term” approaches, respectively. Implementation duration, however, is only one of the dimensions that differentiates a tactical from a strategic approach. Instead of thinking of these two concepts as incompatible, we urge covered companies to think of them as a complement to each other. Strategy is a set of choices used to achieve an overall objective whereas tactics are the specific actions used when applying those strategic choices. In other words, without losing sight of the overall strategy, covered companies can still engage in a shorter-term approach to enable full regulatory compliance in the little time left ahead of their deadlines.

More specifically, covered companies can use this exercise as an opportunity to enhance its own business processes around limits monitoring, with the intent of enabling a near-real-time impact analysis that could potentially drive credit decisions instead of simply being looked at after the fact and compiled solely for regulatory compliance. In other words, past the initial regulatory obstacle, covered companies could enhance their solutions to implement their own limits monitoring needs.

Conclusion

In conclusion, SCCL is not at all a trivial exercise. This paper discusses the nuances related to the calculation of net aggregate exposure, risk transfer, and the concepts of ownership and economic interdependence. It shows the potential for a greater challenge than covered companies expect.

The ability to manage the exposure calculation of complex instruments daily, allocate risk to collateral issuers, process economic links in addition to ownership links, and have the capability of monitoring such limits beyond simple regulatory reporting is required to meet those challenges.

With less than a year until the compliance deadline, the choice of technology to support the new SCCL regulation is a key decision for covered companies in the coming months.