One of the key differentiators between the upcoming Current Expected Credit Loss and the current incurred loss accounting process is the formal incorporation of forward-looking forecast information. Under CECL, lenders will need to estimate, and set aside allowance for, the expected lifetime loss for each loan they book at the time of origination.

These estimates will need to consider historical information, current conditions, and reasonable and supportable forecasts. Institutions have a number of options with respect to selecting a reasonable and supportable view of the economy. They can use a single baseline scenario—reflecting their most likely forecast—or they can use multiple scenarios to present a fuller picture of the risks facing the economy.1

This paper compares and contrasts, through the CECL lens, the two baseline scenarios Moody’s Analytics produces monthly: the Moody’s Analytics baseline and the consensus baseline.

In 2016, Moody’s Analytics added a “consensus” baseline scenario to its repertoire of scenarios updated every month.2 The consensus scenario is produced for all countries and is based on the review of a variety of surveys of baseline forecasts for these countries. The surveys vary in date of latest vintage, number of updates per year, list of variables forecast, duration of forecast, frequency of data (quarterly or annual), and the number of respondents to a survey. The focus, in preparing the consensus scenario, is on the next one to three years, since that is the most typical duration of the forecasts provided in the surveyed results. Greater consideration is given to more recent surveys since they include the most up-to-date historical information and recognize the current risks, and to variables for which the number of surveyed responses is largest. However, there is no formal mathematical averaging or weighing.

For the U.S. economy, the surveys most commonly reviewed to construct the consensus scenario include the monthly survey by Focus Economics, the Philadelphia Federal Reserve’s Survey of Professional Forecasters published quarterly, and the quarterly Federal Open Market Committee members’ range of forecasts. The CBO and Federal Reserve CCAR baseline forecasts published semi-annually and annually, respectively, are also taken into consideration.

From these surveys, consensus information for the fed funds rate, the 10-year Treasury yield, unit car sales, housing permits, unemployment rate, CPI inflation, real GDP growth, and house price appreciation are extracted and fed into the Moody’s Analytics global macroeconomic model. The model is then simulated to expand the consensus information to the rest of the projected variables.

Variables that lack a consensus are set to be consistent with the Moody’s Analytics baseline scenario. These include population growth and other demographics, statutory income tax rates, payroll tax rates, and federal outlays required by law.

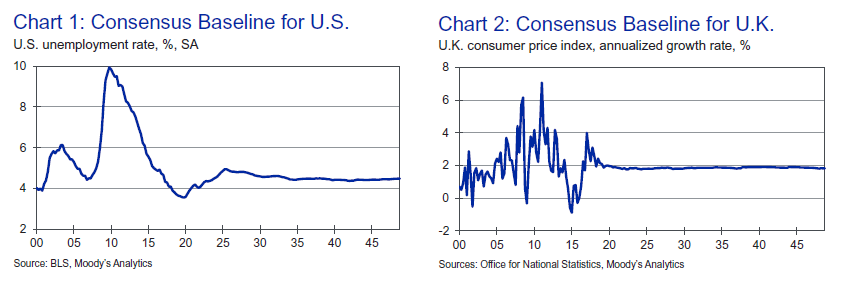

For countries other than the United States, sources for constructing the consensus include the International Monetary Fund, the World Bank, the USDA, central banks, and Focus Economics. Consensus information is most commonly available for real GDP, unemployment, consumer prices, and interest rates. Since consensus forecasts rarely exist beyond two to three years, the approach after this period is to trend the consensus variables to be consistent with the Moody’s Analytics baseline. Charts 1 and 2 show the consensus baseline forecast for the U.S. unemployment rate and U.K. inflation.

Comparing the consensus to the Moody’s Analytics Baseline

The consensus baseline is generally similar to the Moody’s Analytics baseline, particularly beyond the five-year forecast period. There are several reasons for this. First, the Moody’s Analytics baseline is the starting point for the consensus, with only a handful of variables adjusted to align with the consensus. Second, the consensus information is expanded to all forecast variables using the same model that is used to expand the Moody’s Analytics baseline scenario. In that sense, more than 95% of the forecast variables are model-driven. Third, the consensus forecast is made to converge to the Moody’s Analytics baseline within five years. Finally, Moody’s Analytics is part of the consortium contributing to the consensus view of the U.S. economic outlook. This all means that the consensus is not very different from the Moody’s Analytics baseline, especially when viewed over a longer forecast horizon.

Using the consensus baseline in CECL

There are arguments both in favor of, and against, using the consensus baseline in CECL. The obvious argument in favor of basing the “most likely” outlook of the economy on the consensus is that the consensus captures the average view of a group or consortium of professionals and is therefore less likely to be influenced by the views of one person or firm—even if that person belongs to the consortium providing the consensus. For example, a single person or firm might have a view that is too pessimistic or optimistic. This becomes a nonissue when considering the central tendency of the views of a group.

But there are counterarguments, too. The first has to do with the lack of consistency. There is no guarantee that the consensus information, which is just a set of numbers for a limited number of time series, will be internally consistent. By contrast, the Moody’s Analytics baseline forecast is the result of an integrated consistent analysis by a team of experts in monetary policy, fiscal policy, energy markets, consumer spending, housing markets, and state and local government, among other sectors. The consensus, since it contains the views of many who likely disagree on some things, also lacks an underlying narrative. Moody’s Analytics, on the other hand, publishes a detailed narrative every month outlining the assumptions for its baseline scenario.

The second argument against using the consensus in the CECL process is the lack of transparency. If the consensus shifts from one month to the next, there is no way to determine the reason for the shift or what the shift signals. For example, the change could be the result of a change in the respondent panel, and not because of any new risks facing the economy. On the other hand, any changes to the Moody’s Analytics baseline are well documented and published.

The third issue arises when the consensus scenario is used in CECL in conjunction with the Moody’s Analytics alternative scenarios in a probability-weighted multiple scenarios approach. Since the consensus is not too different from the Moody’s Analytics baseline, the consensus also falls in the middle of the distribution of all possible outcomes and therefore can be assigned a weight similar to what is assigned to the Moody’s Analytics baseline.3 However, mixing the consensus with the Moody’s Analytics alternative scenarios in the same analysis creates an inherent inconsistency because the alternative scenarios are based off, or anchored to, the Moody’s Analytics baseline, and not to the consensus. Any changes to the Moody’s Analytics baseline forecasts are carried over to the alternative scenario forecasts.

Summary

By projecting the market’s outlook of the economy, the consensus provides a useful “alternative” baseline to the Moody’s Analytics baseline. However, its use in the CECL process carries some risks that institutions need to be aware of so that they can reasonably support and defend their choice with auditors and regulators.

1 See DeRitis (2017) and Chowdhury & DeRitis (2018) for

a discussion of the various options for using scenarios in

CECL:

https://www.moodysanalytics.com/-/media/whitepaper/2017/economic-scenarios-whats-reasonable-and-supportable.pdf

https://www.moodysanalytics.com/-/media/article/2018/a-practical-guide-to-using-forecasts-for-cecl.pdf

2 See Moody’s Analytics “U.S. Macroeconomic Outlook Alternative Scenarios,” August 2008, for more details on how

the consensus scenario is constructed.

3 See Chowdhury & DeRitis (2018) for our recommendation

around scenario weights:

https://www.moodysanalytics.com/-/media/article/2018/a-practical-guide-to-using-forecasts-for-cecl.pdf