Credit Research Database (CRD)

Register for the Course

The Credit Research Database (CRD) is one of the world’s largest and most comprehensive financial statement and default databases. It provides unique insight into private firm and commercial real estate credit risk through its robust, proprietary, and global datasets.

Access historical data and loan accounting information for creation, validation, and calibration of risk models and scorecards

- Contains more than 92 million financial statements representing more than 18 million global private firms, with over 2.2 million defaults.

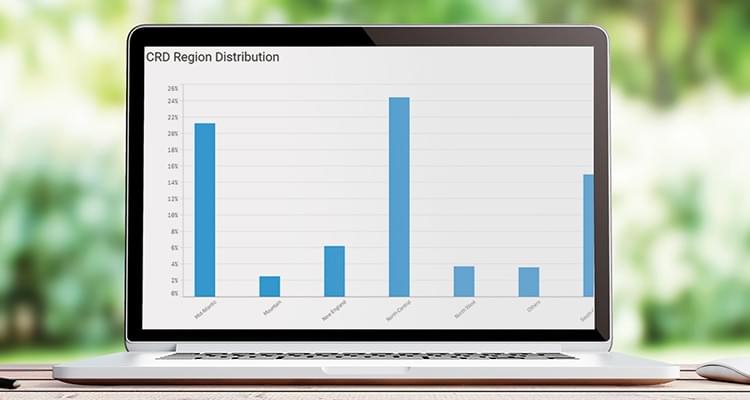

- Provides broad coverage across middle-market commercial and industrial (C&I), commercial real estate (CRE), and project finance transactions.

- Utilizes historical data spanning multiple credit cycles since 1990.

- Includes built-in partnerships with more than 90 global financial institutions.

Gain insight into the private firm credit risk market by leveraging our comprehensive data set

- Examine the financial performance of middle-market private firms across industries and size groups for market intelligence.

- Augment portfolio data for model validation and calibration.

- Benchmark internal portfolios against peers across multiple dimensions including industry, size, and region.

- Establish stress testing frameworks with a robust dataset that provides comprehensive coverage and minimizes data gaps.

Product Brochure

Related Solutions

Credit Research

Tap into comprehensive credit research from Moody's Analytics and Investors Service, and gain detailed insights into our views on credit-related topics.

Risk Data

Moody’s Analytics industry-leading global data solutions help financial institutions improve their strategic planning & risk management practices. Learn more now.