EXPLORE

Steven Morrison

Steven Morrison

Insurance Research

Steven Morrison and his team of actuaries and quantitative analysts generate modeling techniques and tools for insurers. Based on his research and advisory work on developing modeling methodology, insurers can project their financial statements, determine risk and capital assessment, and make sound decisions. Currently, Steven’s focus on IFRS 17 specifically helps insurers understand and communicate profits.

solutions

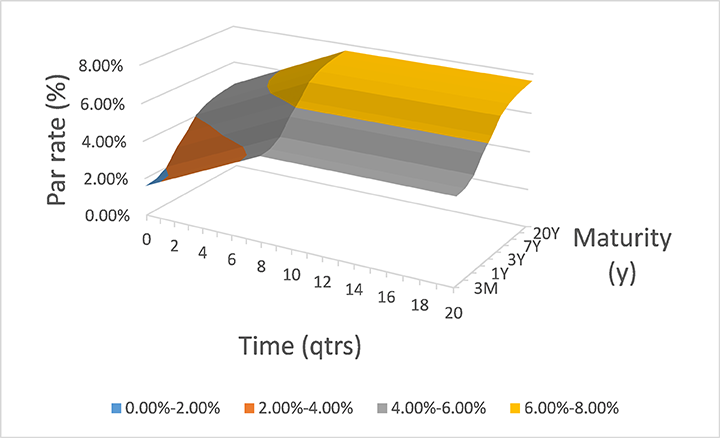

Economic Scenarios: Moody's Analytics provides internally & globally consistent economic, regulatory, and custom scenarios. Explore the economic scenarios tool.

IFRS 17 Insurance Contracts: The Moody’s Analytics suite of software solutions, models, content, and services helps support the new requirements of IFRS 17 Insurance Contracts.

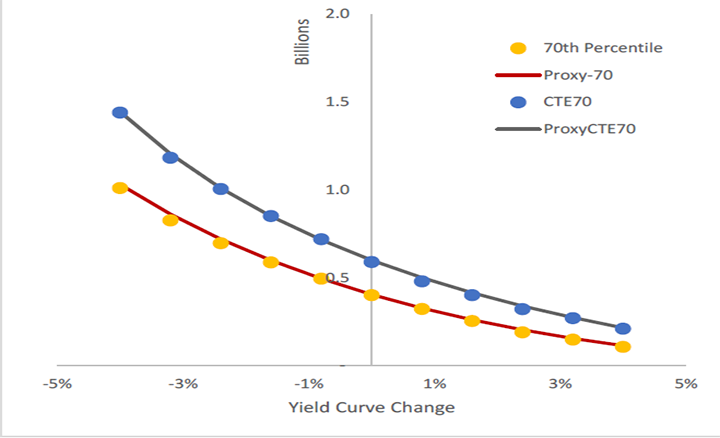

Regulatory Capital : Moody’s Analytics insurance regulatory capital solutions help insurers comply with Solvency II and other similar regulatory regimes.

TOPICS

Econometric Modeling: Fully transparent econometric and statistical models to assess performance of geographies, financials and various asset classes.

Liability Valuation: Process of valuing a company's liabilities for financial reporting purposes.

Economic Risk Assessment: Quantitative economic assessment to help you understand the impact of forward-looking changes on the performance of your business and portfolios.