Structured Finance Portal

Register for the Course

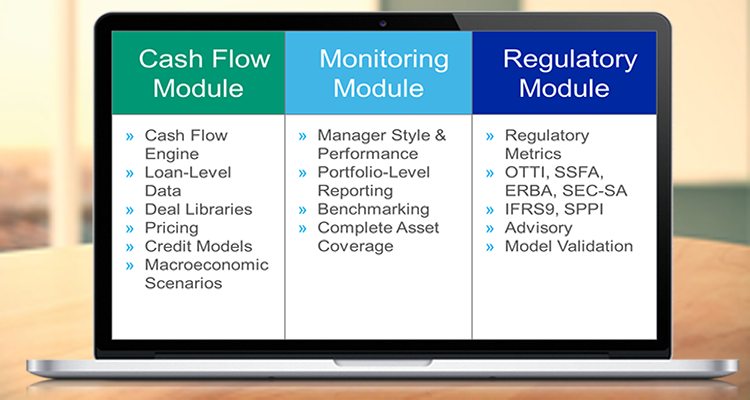

Moody's Analytics Structured Finance Portal sets the standard for transparency, analysis, and reporting across structured finance. This premier web-based tool offers data and analytics across all structured finance asset classes with advanced reporting and time-saving data normalization and aggregation. It provides structured finance professionals with cashflows, regulatory metrics, comparative analytics, and data aggregation in one integrated platform.

Complete Asset Coverage on an International Scale

Our extensive performance database allows for deal-to-deal comparisons to assist in buy/sell decisions and trend analysis, as well as the ability to aggregate all data to allow for surveillance on the entire market. Users have access to over 500,000 securities with coverage spanning all structured finance asset classes globally.

Market color, benchmarking and valuations

- Benchmark your tranche with a scatter plot against its cohorts across any given performance metric or see where a deal falls in the distribution.

- Project cashflows dynamically based on your own assumptions or Moody's Analytics credit models.

- Get a comprehensive picture of a tranche's estimated value with a suite of analytics and comparative metrics.

Loan-level data including default probabilities and financial ratios

- Dive deeper into your credit analysis using our full suite of data on the underlying loans.

- See which deals and managers are most exposed to a loan and who has been trading it recently.

- Get the history of Moody's Analytics EDFTM (Expected Default Frequency) measures for each issuer.

Portfolio-level reporting and analytics

- Understand your overall exposures with portfolio-level charts, graphs, and reporting.

- Project the estimated value of your portfolio all at once with dynamic, batch cashflow analysis.

- Determine your most significant industry categories, most risky underlying loans, etc.

Access up-to-date, estimated regulatory-based metrics

- SSFA, ERBA and SEC-SA capital charge calculations (Point-in-Time and Forecasted).

- Stress testing calculations for CCAR/DFAST banks (Point-in-Time and Forecasted).

- Other Than Temporary Impairment (OTTI) calculations (Point-in-Time and Forecasted).

- Solely for Payment of Principal and Interest (SPPI) Test and IFRS9 Impairment and Staging.

- Forecasted cashflows and metrics under selected scenarios.

Excel Add-In

- Allows you to call the most popular features of our cash flow analytics engines straight from the cells of an Excel Workbook.

- Uses Excel's in-cell formulas without any VBA code or advanced programming required.

- Use the report wizard to populate your spreadsheet in a few simple steps with structured finance content and analytics.

Product Brochure

Related Solutions

ABS Solutions

Moody’s Analytics has developed a Consumer ABS suite of comprehensive solutions and tools for all of your buy-side, monitoring, pricing, and research needs.

CLO Solutions

Moody’s Analytics provides CLO data with award-winning, end-to-end CLO solutions, available via multiple delivery methods. Find out more.

CMBS Solutions

Moody's Analytics CMBS Solutions provide market participants with advanced deal cash flow analytics, comparative deals and specific commercial loan and property income and valuation details.

Credit Research

Tap into comprehensive credit research from Moody's Analytics and Investors Service, and gain detailed insights into our views on credit-related topics.

Data Visualization

Moody's Analytics data visualization and discovery solutions deliver comprehensive, enterprise-wide visibility into risk and finance data.

Liquidity Compliance

Moody's Analytics offers a liquidity compliance solution to help banks address the complex liquidity compliance requirements under Basel III.

RMBS Solutions

Moody's Analytics provides market participants with end-to-end, customizable, and advanced solutions for Non-Agency RMBS and analytics.

Simplified Supervisory Formula Approach (S)SFA

Moody's Analytics Simplified Supervisory Formula Approach solution delivers advanced technology for calculating capital adequacy.

Structured Finance Buy-Side Solutions

Moody's Analytics provides dependable, integrated, and comprehensive solutions for Structured Finance investors.

Structured Finance Risk & Regulatory Solutions

Moody's Analytics produces regulatory analytics and best-in-class advisory services that create confidence and allow our clients to manage their structured finance risk via our Structured Finance Portal Regulatory Module.

Structured Finance Sell-Side Solutions

Moody’s Analytics offers a number of solutions for sell-side structured finance market participants