A powerful solution to help you originate, spread, score, and decision commercial credit requests with more confidence and ease. Leverage AI-backed automation and integrated data analytics to drive smart, profitable growth at your bank.

Create a unified and digital process from origination to booking. Compile relevant documents and data in one location for simplified deal structuring. Streamlined workflows cascade deal information to the right team members for an efficient approval process.

A manual process that can take hours, now takes minutes. Accurately spread all financial statement information directly into CreditLens, freeing up your time to focus on customer relationships and strategy.

Pull together data from multiple sources for a 360-degree view of your client relationships. Identify risky applications early on with KYC pre-screening. Protect your loan portfolio with a better understanding of each borrower’s risk profile, cash flow position, repayment capacity and covenants.

Access Moody’s market-leading insights plus our award-winning credit models to make confident, forward-looking credit decisions.

Compile and share information across the business with flexible reporting and easy credit memo creation to help you keep the right people up-to-date.

For Ag Lenders

Our Ag lending solutions have unique offerings – including industry-specific financial templates, benchmarking tools and scorecards - to help you make informed credit decisions and strengthen your relationships with producers.

For CRE Lenders

Our CRE lender workflows deliver transparency and efficiency so you can evaluate deals faster and prioritize the right opportunities. A single integrated system for data, market insights, and forecast scenarios help you better anticipate default and quantify risk.

Better understand the risk and impact of each credit decision on your loan portfolio and execute that decision quickly across teams. Contact us today to see how we can help.

Moody's Analytics Lending Suite

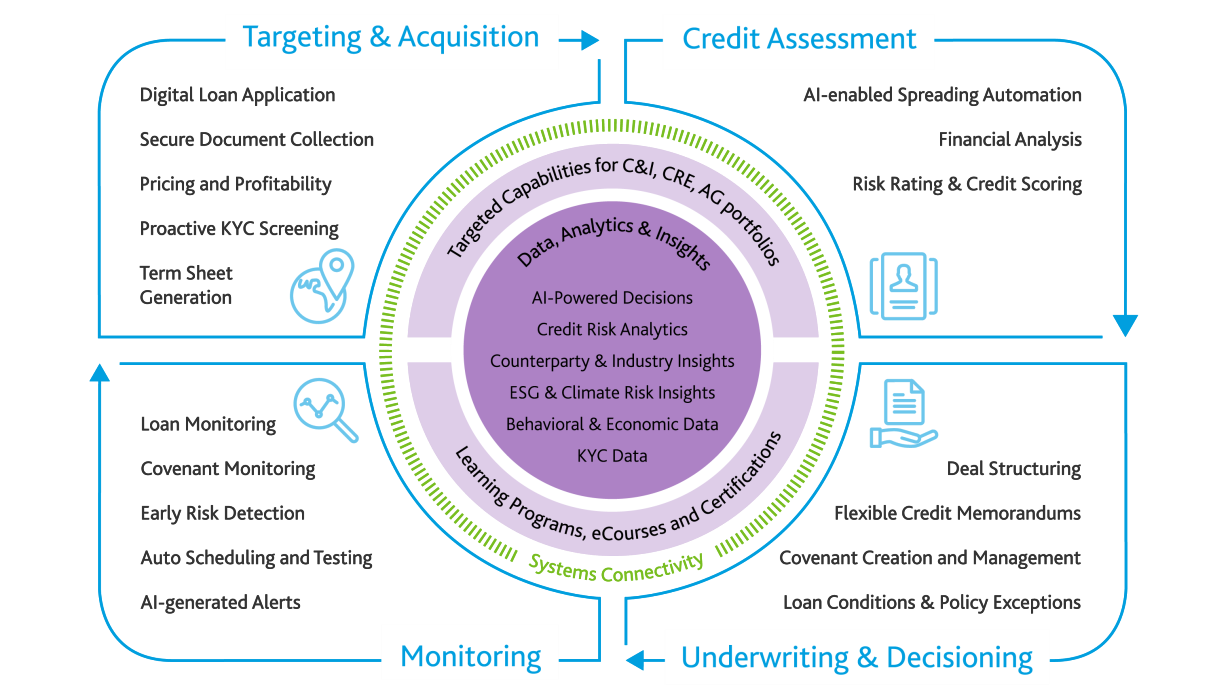

CreditLens is part of the Credit Assessment and Underwriting & Decisioning workflows within Moody’s Analytics Lending Suite. While a valuable standalone solution, it is most powerful when combined with our full software and data offerings.

Assessment, Underwriting & Decisioning

Integrated Data & Analytics

- Climate and ESG Risk Assessment

- EDF-X

- Data Solutions

- KYC & Compliance: GRID

Recognition

Moody’s Analytics is proud of the awards and recognition we’ve received from organizations around the world. Spanning all areas of our business — data, research, analytics and software — this recognition highlights our important role in the global capital markets and reflects the contributions of all our employees.

The Moody's Difference

Moody’s brings together the best of data, experience and best practice capabilities, with our specialized and agile intelligence, to empower banks like yours to have the confidence to act on plans.

Intelligence

We have more data and better insights than our competitors – from private and public financial statements, to award-winning models, economic scenarios to Climate and ESG data. The power of this data is integrated into all of our solutions giving you a superior understanding of your credit book.

Expertise

We’ve been a trusted collaborator for financial institutions for over 100 years. Our in-house industry and credit experts help direct our product development and are available to help clients through our advisory services. Your success is our success.

Guidance & Training

Leveraging our long history in risk expertise, our expansive resources, and an innovative application of technology, we offer a wide range of immersive training programs for retail and commercial bankers. We create confidence in thousands of organizations worldwide with our commitment to excellence, open mindset approach and focus on meeting customer needs.