RiskFrontier™

Register for the Course

The RiskFrontier software is an industry-leading credit portfolio risk management solution that helps users understand portfolio risk dynamics, manage concentration risk, quantify risk appetite, and conduct stress testing. Our award-winning software and credit risk advisory professionals empower companies with tools for strategic and profitable decision-making.

A Comprehensive Solution to Support Business Analysis and Portfolio Optimization

- Consider effects of correlations on capital and profitability across a broad range of assets at both the granular and portfolio level with a comprehensive model.

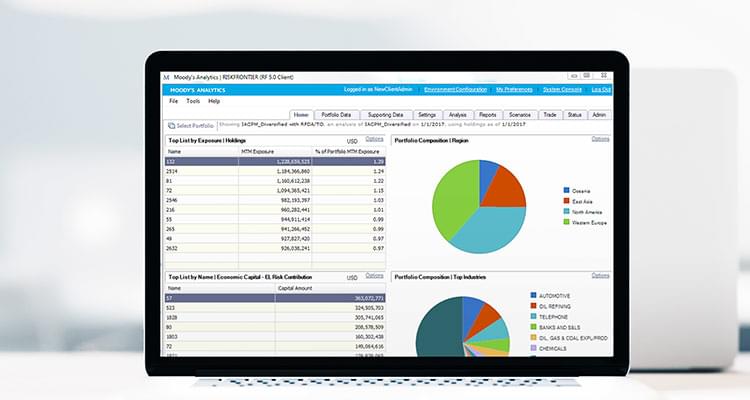

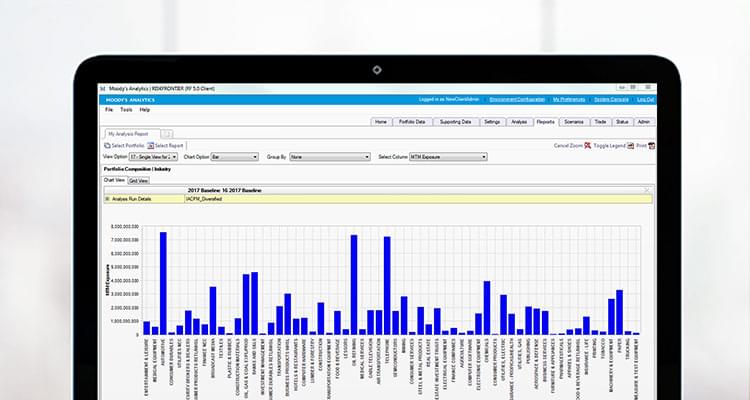

- Model portfolio and loan-level credit risk (expected and unexpected loss, distribution of values, losses, and capital) and analyze concentrations by industry, region, asset type, and counterparty.

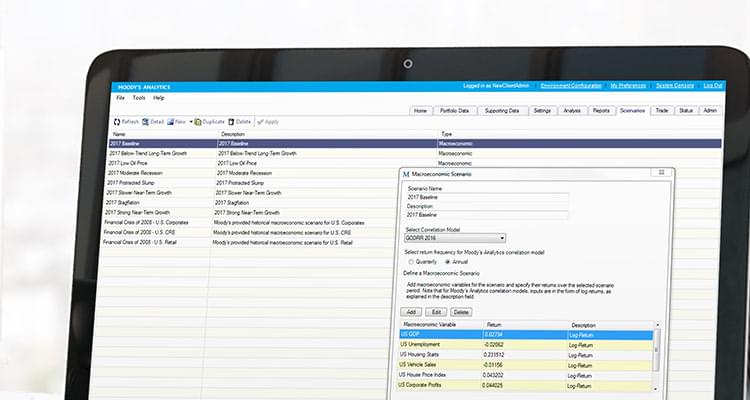

- Perform what-if analysis, stress testing, and reverse stress testing to determine losses and assess capital adequacy under various economic conditions.

- Quantify the impact of new deals or trades within a portfolio using real-time insight to improve loan origination and portfolio management.

- Monitor portfolio risk by comparing aggregated and granular views of the portfolio to identify exposures that are mispriced and start improving the risk profile.

Effective Portfolio Management for Improved Decision-Making and Transparency

- Enhance profitability by maximizing risk-adjusted returns and appropriately allocating capital to maintain adequate capitalization levels over time.

- Improve resource allocation and provide appropriate incentives to business lines to understand performance at a granular level with multiple risk dimensions considered.

- Support risk measurement and management by measuring the sensitivity of portfolio loss results to credit models, instrument pricing models, risk factor models, and credit assumptions.

- Address regulatory compliance needs, reconcile regulatory and economic capital calculations, consider concentration risks, and demonstrate in-depth understanding and control of covered risks.

An Industry Leader in Portfolio Management Research and Advisory Services

Moody’s Analytics credit risk specialists provide software implementation, custom modeling, economic capital and risk management consulting, regulatory and process support, and training customized to each client's unique requirements. These services, combined with our renowned credit research, empower clients to improve their credit portfolio risk management strategy and bottom-line performance.

Product Brochure

Related Solutions

Credit Economic Capital

Gain insights to manage credit risk, support regulatory compliance, and make active asset allocation decisions.

Credit Risk Modeling

Moody’s Analytics delivers award-winning credit models and expert advisory services to provide you with best-in-class credit risk modeling solutions.

Economic Capital

Moody’s Analytics insurance economic capital solution provides critical insights that help evaluate solvency positions and risk-based decision making.

Internal Capital Adequacy Assessment Program (ICAAP)

Our ICAAP solution enable implementation of a risk management framework with quantitative measures, addressing both internal and regulatory requirements.

Portfolio Optimization

Quantify diversification benefits across portfolios and define risk types that inform risk management and active asset allocation decisions.

Strategic Capital Planning

Moody’s Analytics strategic capital planning solutions provide key capital ratio and credit metric projections based on a variety of strategic and economic scenarios.

Stress Testing

Moody’s Analytics helps financial institutions develop collaborative, auditable, repeatable, and transparent stress testing programs to meet regulatory demands.