RiskConfidence™

Register for the Course

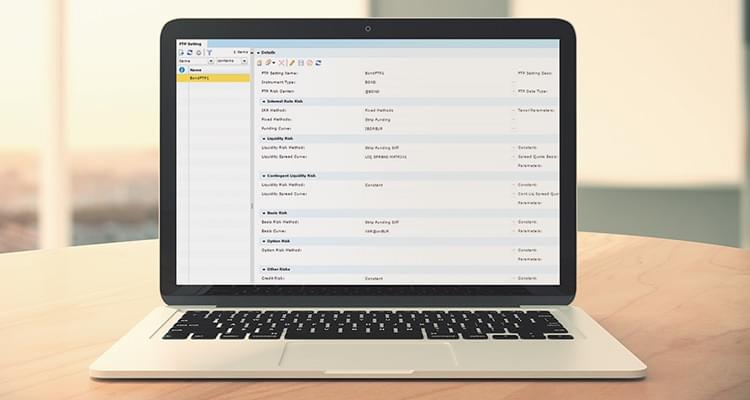

The RiskConfidence ALM system offers integrated enterprise asset and liability management (ALM), funds transfer pricing (FTP), liquidity risk management, market risk and Value at Risk (VaR), and business and regulatory reporting. These are all presented in a single unified platform, with a common data source and a single engine strategy.

Gain powerful tools for balance sheet management

- Organize and classify financial instruments on a balance sheet into a tree-like structure to input client behavior models and define business forecasts, using the chart of accounts (COA) structure.

- Set up and manage a rule-based strategy for specific balance sheet items with parameter deal mapping (PDM).

- Apply transformation logic to interest rate curves, macroeconomic indices, foreign exchange rates, transaction characteristics, and volatility matrices to use in scenarios.

- Model client behavior such as loan prepayments and renegotiations, loan commitments, transaction rollovers, and term deposit early redemption with the variables that influence them.

Manage enterprise-wide ALM and improve financial performance

- Manage liquidity risk and calculate key liquidity risk measurements, such as the liquidity gap or survival horizon, to create advanced liquidity funding strategies.

- Define multi-factor behavior models that allow users to apply their understanding of client behavior and embedded options.

- Compute and simulate net interest income across multiple scenarios.

- Manage FTP using a powerful matched-maturity and caterpillar capability that measures business unit performance.

- Perform advanced deposit modeling, including cash flow modeling of non-maturing deposits where balances and deposit rates change, and interest payments take place at different times.

- Compute VaR across many factors such as interest rates, economic factors, equities, volatilities, and spreads.

Take advantage of enterprise-wide analytics to deliver effective ALM and liquidity risk management

To remain competitive, banks must improve risk measurement and management for better alignment between risk and capital. Use the RiskConfidence ALM system to create a holistic and granular view of your assets and liabilities, and to help make fully informed commercial decisions.

Contact us for a demo

Product Brochure

Related Solutions

Bank Asset and Liability Management Solutions

Moody's Analytics offers a powerful combination ALM solution for banks that integrates enterprise ALM, FTP, business management, and regulatory compliance.

Basel I, II, and III

Moody's Analytics Basel solution delivers comprehensive, automated, and streamlined regulatory capital compliance and reporting for Basel I, II, and III.

IFRS 9

Moody’s Analytics offers a modular, flexible, and comprehensive IFRS 9 impairment solution that facilitates banks’ efforts to calculate and manage capital set asides for these provisions.

Liquidity Compliance

Moody's Analytics offers a liquidity compliance solution to help banks address the complex liquidity compliance requirements under Basel III.

Regulatory Capital

Moody’s Analytics offers automated, streamlined, and integrated regulatory capital calculation and reporting solutions for a wide range of banking regulations.

Regulatory Reporting

Moody's Analytics regulatory reporting solution delivers comprehensive, automated, and streamlined regulatory reporting.