Market-Consistent Scenario Generator

Register for the Course

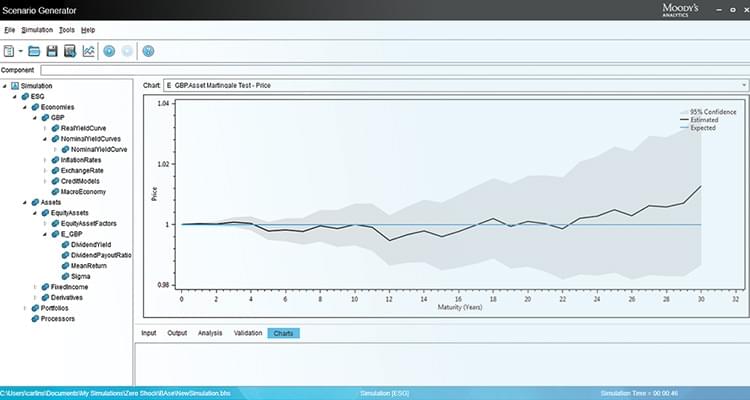

The Market-Consistent Scenario Generator is a suite of stochastic asset modeling tools in a flexible framework that allows insurers to produce risk-neutral scenarios to value optionality in insurance liabilities, as required by regulatory and accounting regimes. Risk-neutral modeling is also used for hedging and risk management activities.

Generate market-consistent scenarios

- Use risk-neutral scenarios for liability valuation. Models are calibrated to market data where appropriate, resulting in market-consistent liability values.

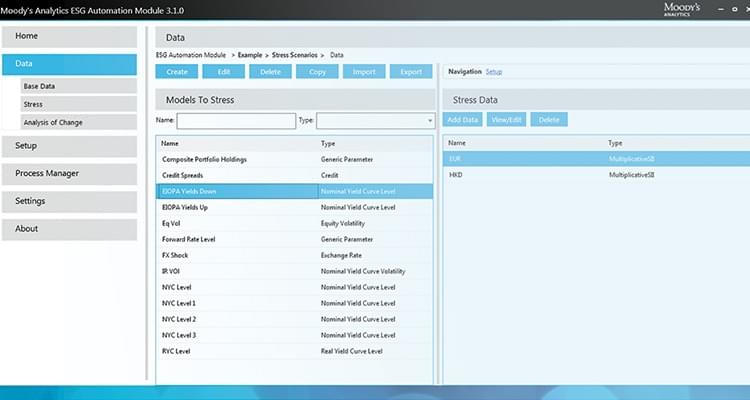

- Gain a robust and easy-to-use automation framework to support the production of many stress and sensitivity calibrations.

- Benefit from a comprehensive monthly calibration service covering a wide range of economies and asset classes, produced to exacting standards of governance and quality assurance.

- Receive comprehensive documentation of all models and calibrations, including calibration reports, model methods, calibration methods, assumption updates, and policy and compliance documents.

- Implement a suite of financial models covering many asset classes and sophistication levels.

-

Reduce run times from hours or days to minutes using the Cloud Burst Service to run the Scenario Generator in the Moody’s Analytics hosted cloud environment.

Get up and running quickly with modeling options to meet your requirements

- Combine easy-to-use software, calibration services, comprehensive documentation, and expert advisory services to get up and running quickly.

- Choose modeling options for the major risks and asset types, and also for your own requirements, considering the nature of your liabilities and level of sophistication.

- Model a wide range of assets in a flexible framework, including equities, nominal and real interest rates, corporate bonds, real estate, currencies, and hedge funds.

- Take advantage of an easy-to-use, standard Windows interface, allowing models to be built intuitively.

- Benefit from an ongoing and extensive R&D program which continually reviews and updates our models and methods as new techniques become available.

Product Brochure

Related Solutions

Economic Capital

Moody’s Analytics insurance economic capital solution provides critical insights that help evaluate solvency positions and risk-based decision making.

Insurance Asset and Liability Management

Moody's Analytics insurance asset and liability management (ALM) solution provide scenario-based asset and liability modeling for insurers.

Regulatory Capital

Moody’s Analytics insurance regulatory capital solutions help insurers comply with Solvency II and other similar regulatory regimes.

Solvency II

The Moody’s Analytics solution supports the solvency metrics and the associated reporting from both a group and solo perspective for Solvency II compliance.

Valuation

Moody's Analytics insurance valuation solution support valuing liabilities of complex insurance products that contain options and guarantees.