Credit Loss and Impairment Analysis Suite

Register for the Course

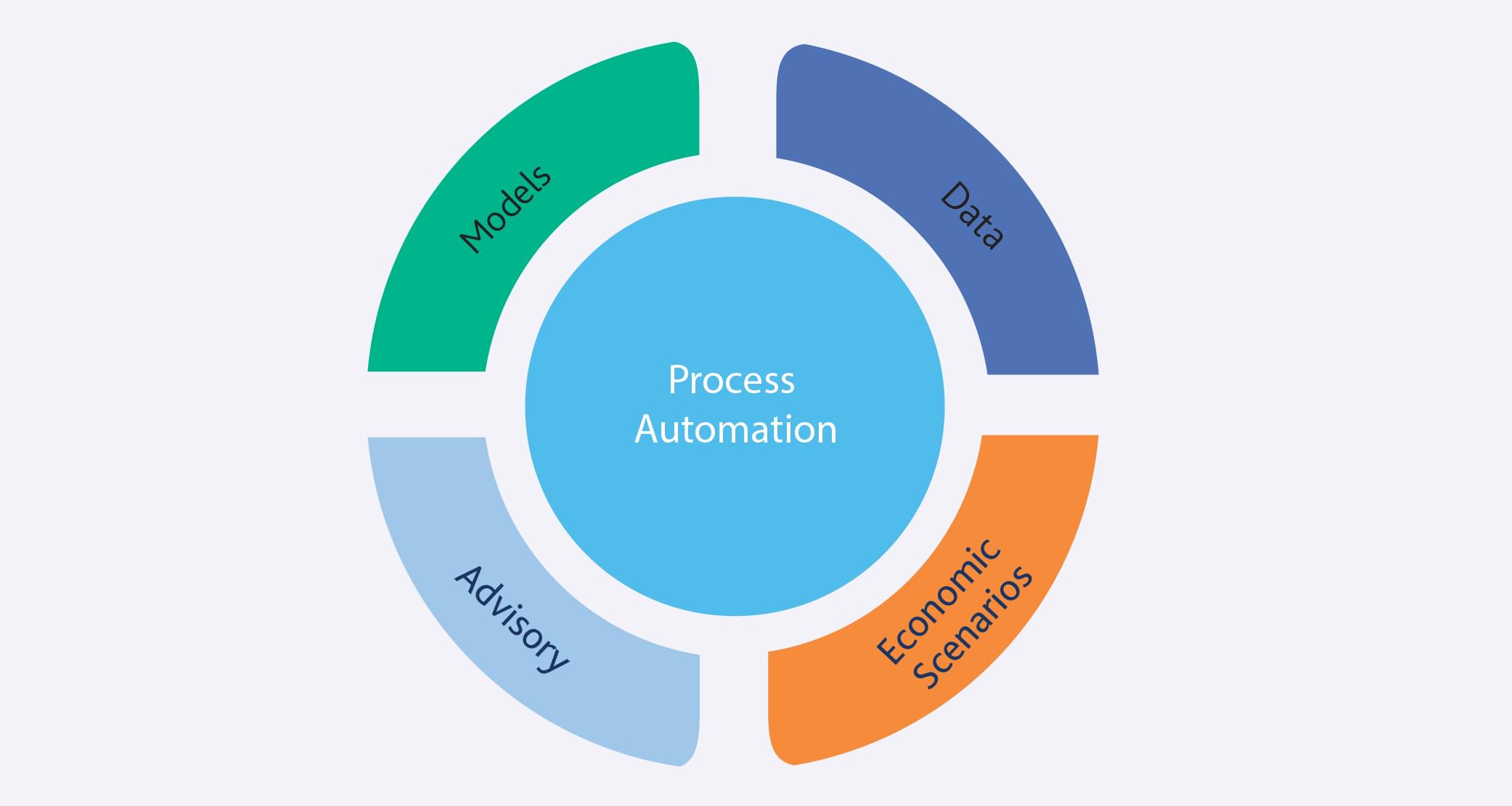

Moody’s Analytics suite of credit risk models and data, economic forecasts, advisory services, and infrastructure solutions assist with the implementation of expected credit loss and impairment analysis for IFRS 9 and CECL.

Perform credit loss impairment calculations on either a standalone basis or integrated into other processes

- Calculate expected credit losses (ECL), using industry-leading models across asset classes.

- Analyze granular credit risk data for portfolio segmentation and determination of significant credit deterioration.

- Rely on trusted economic scenarios for information regarding past events, current conditions, and forecasts of future economic conditions.

- Access expert advisory services for model development, governance, and advice on implementation strategies.

- Utilize credit impairment analysis software to enable orchestration and automation of IFRS 9 calculations.

Proactively manage provision calculations for repeatable, consistent impairment analysis and capital planning

- Data to support impairment modeling and calculations with the ability to aggregate and normalize the data into a formal data management platform.

- Macroeconomic forecasts include forward-looking assumptions into calculations.

- Modeling solutions to support internally developed or the integration of off-the-shelf models and the incorporation of forward-looking information into existing frameworks.

- A configurable software suite enables model calibration, cash flow generation, and workflow management for repeatable ECL forecasting.

Moody’s Analytics experience helping financial institutions successfully address their credit loss estimation and forecasting challenges, combined with deep domain expertise, in-house economists, extensive data and modeling capabilities, and award-winning regulatory and enterprise risk management software, provide the foundation for successful credit loss and impairment analysis.

Product Brochure

Related Solutions

Current Expected Credit Loss Model (CECL)

Moody’s Analytics provides tools for the most crucial aspects of the expected loss impairment model, with robust solutions to aggregate data, calculate expected credit losses, and derive and report provisions.

IFRS 9

Moody’s Analytics offers a modular, flexible, and comprehensive IFRS 9 impairment solution that facilitates banks’ efforts to calculate and manage capital set asides for these provisions.

Strategic Capital Planning

Moody’s Analytics strategic capital planning solutions provide key capital ratio and credit metric projections based on a variety of strategic and economic scenarios.