Credit Coach

Register for the Course

Credit Coach is an innovative, scenario-based, eLearning tool that assesses a credit professional’s performance and decision making. It uses smart testing to diagnose the root cause of errors and provide immediate access to relevant online courses for remediation.

Credit Coach users and their managers benefit from:

- Scenarios that Assess Knowledge and Decision Making: Credit Coach is a unique diagnostic, assessing not only lenders’ knowledge, but also their ability to synthesize a variety of quantitative and qualitative data, perform integrated analyses, and make sound lending decisions based on those analyses.

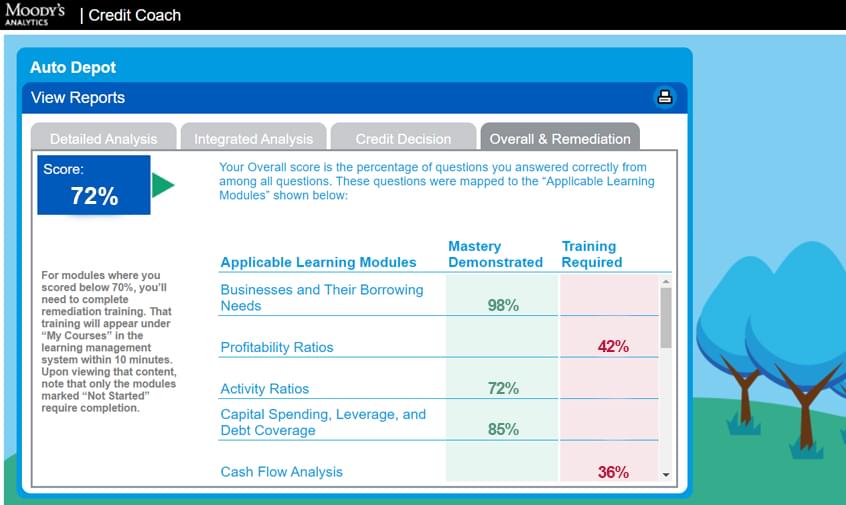

- Targeted Remediation: Credit Coach provides immediate access to focused, remedial eLearning training modules and/or activities relevant to the diagnosed skills gaps.

- Detailed Reporting: Credit Coach’s reporting highlights specific knowledge, skills, and performance gaps at the individual and group levels, then reports on the completion status of the targeted remediation training.

- Efficient Use of Training Dollars and Time: Most experienced lenders can complete a Credit Coach scenario in approximately two hours. Remediation training modules also take about two hours each to complete.

Identifying and closing performance gaps

What does the Credit Coach assessment entail?

- The credit professional is given a case study scenario and is then required to answer a series of questions within the allowed time (approx. 90-120 minutes).

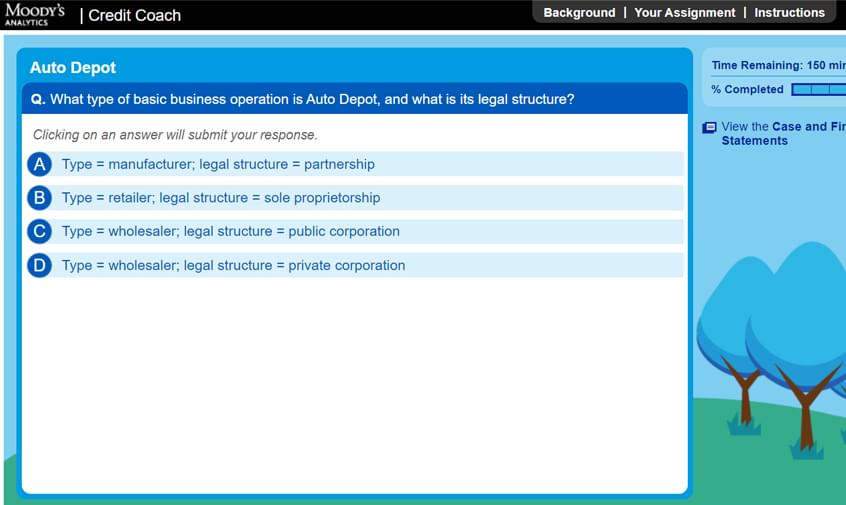

- The questions are dynamic, and the tool confirms understanding in the case of correct answers and probes for specific deficiencies in the case of incorrect answers.

- Diagnostics are conducted at three levels, including technical knowledge, synthesis and integrated analysis, and loan decision making.

- Results are immediately available for the professional and their manager. They include analyses at all three levels of diagnostics and a personalized learning path, highlighting where mastery has been demonstrated and where specific remedial training, if any, is needed.

- Due to its scenario-based paradigm, Credit Coach can be used for broad-based analysis/lending situations or focused performance areas, such as ratio analysis or cash flow analysis. It can also be used to assess skills in different credit-related business lines, such as commercial, consumer, and agribusiness.