Reporting Studio

The Next Generation Regulatory Reporting Solution

Reporting Studio: cloud-native Reporting-as-a-service (RaaS) solution

Moody’s Analytics Reporting Studio offers a comprehensive solution that helps banks address regulatory reporting requirements, such as the European Banking Authority (EBA) COREP and FINREP, as well as other local reporting requirements including: UK-specific reports for Bank of England (BoE), Prudential Regulation Authority (PRA), and Financial Conduct Authority (FCA).

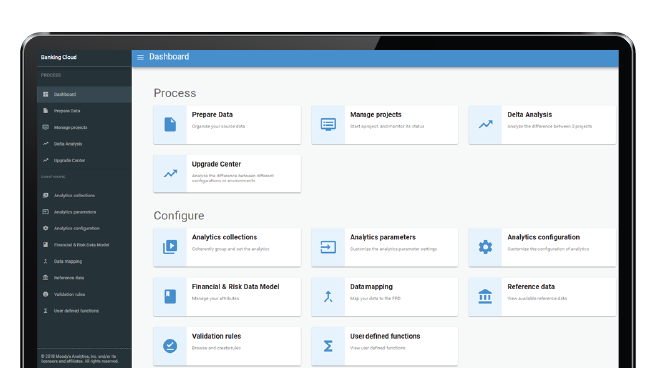

Reporting Studio is part of the Banking Cloud suite of Software-as-a-Service solutions, designed to combine the benefits of cloud-native technology and Moody’s Analytics regulatory expertise. The solution brings together effective regulatory compliance, enhanced data management, business intelligence, and industry-leading reporting capabilities to help financial institutions reduce their regulatory burden and the total cost of compliance.

Reporting Studio is part of the Banking Cloud suite of Software-as-a-Service solutions, designed to combine the benefits of cloud-native technology and Moody’s Analytics regulatory expertise. The solution brings together effective regulatory compliance, enhanced data management, business intelligence, and industry-leading reporting capabilities to help financial institutions reduce their regulatory burden and the total cost of compliance.

Introducing Reporting Studio

Industry Recognition

Industry Recognition

The rise of RaaS

The rise of RaaS

As Regulatory Reporting-as-a-Service gains momentum, Alain Maure explains how this service has changed the dialog between the market, the vendors and the regulators.

Reporting Studio Key Features

Data Preparation and Enrichment

Upload or refresh your source data in real time

Reduce implementation time by using data enrichment, mapping, and transformation capabilities

Use the intuitive data enrichment capabilities to see the difference between your source data and the data format required to match a reporting template

Track the progress of your data enrichment process by previewing its results every step of the way

Reduce implementation time by using data enrichment, mapping, and transformation capabilities

Use the intuitive data enrichment capabilities to see the difference between your source data and the data format required to match a reporting template

Track the progress of your data enrichment process by previewing its results every step of the way

Reports Validation and Submission

Use our off-the-shelf regulatory reports coverage to generate required reports

Resolve any potential conflicts by using smart adjustment capabilities

Preview the impact of your adjustments on other reports before applying them

Verify the reports using regulator’s validation checks before submission

Gain a comprehensive view of all your generated reports and their status

Submit your reports on time as well as in the required electronic format

Resolve any potential conflicts by using smart adjustment capabilities

Preview the impact of your adjustments on other reports before applying them

Verify the reports using regulator’s validation checks before submission

Gain a comprehensive view of all your generated reports and their status

Submit your reports on time as well as in the required electronic format

Live Reports and Business Insight

Benefit from our Live Reports technology to process data and receive a real-time view of your reports through the streaming architecture

Monitor all the important regulatory data points to better understand current situation of your portfolio

Identify the most significant differences in values between two reporting dates

Leverage all enriched datasets and data lineage information to better inform your business decisions

Monitor all the important regulatory data points to better understand current situation of your portfolio

Identify the most significant differences in values between two reporting dates

Leverage all enriched datasets and data lineage information to better inform your business decisions

Report Designer

Report Designer

Our Report Designer functionality gives you the flexibility to build additional reports that fit your unique business requirements.

-

Extend your reporting stacks and build additional ad-hoc reports using the designer tool

-

Take advantage of our built-in flexible and expansive reporting data dictionaries to design new reports even quicker

-

Test and preview your reports as you design them to ensure accuracy

-

Build new reports using the existing reporting logic to save time

Regulatory Coverage and Maintenance

Regulatory Coverage and Maintenance

Our solution comes with a set of regulatory rules for over 50 jurisdictions globally. We continuously monitor all regulatory updates, adjust the configuration, and publish it on time on your environment. We call it regulatory maintenance, and it helps you to stay up-to-date and compliant.

The off-the-shelf regulatory coverage includes:

Basel type reports coverage for over 50 jurisdictions, including EBA COREP and FINREP, as well as UK-specific reports for Bank of England (BoE), Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA).

The off-the-shelf regulatory coverage includes:

Basel type reports coverage for over 50 jurisdictions, including EBA COREP and FINREP, as well as UK-specific reports for Bank of England (BoE), Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA).

Reporting Studio Workflow

SaaS deployment benefits

SaaS deployment benefits

This SaaS offering combines our expertise with the flexibility of the cloud. Choosing SaaS, you outsource the hosting, managing, and maintenance of the solution. Moody’s Analytics ensures your solution fits your business needs, is always up-to-date with regulatory changes, and is scalable, flexible, and secure. With seamless upgrades, reduced total cost of ownership, and greater cost predictability, the subscription model is ideal for businesses looking to adapt to growing demands without revisiting their entire solution setup every time.

Secured and compliant cloud hosting

Compliant with EBA recommendations on outsourcing and cloud hosting

Aligned with the local data protection and data residency requirements (including GDPR)

Available across several data centers to match the highest business continuity standards

Relevant Resources

Operational resilience in the time of COVID-19: SaaS to the rescue

This whitepaper addresses the implications of the coronavirus on banks in terms of regulatory reporting. It illustrates how SaaS can provide solutions by enabling banks to be agile during the current crisis, future shocks, and remote working.

Governance: There is more to regulatory compliance than meets the eye

This whitepaper details why governance matters for banks, and discusses the implications it has across their organization while providing recommendations to support a sound governance framework.

Regulatory Compliance as a Service

This whitepaper explores the subject and various benefits of migrating regulatory compliance and reporting into the cloud, or how we call it 'Regulatory Compliance as a Service (RCaaS).

RaaS: reducing the regulatory burden

RaaS: reducing the regulatory burden

This webinar covers ways Reporting-as-a-Service (RaaS) can reduce your regulatory burden and transform compliance into an efficient and strategic tool while minimizing the cost.

Featured webinar: Minimizing the cost of regulatory compliance through RegTech

Featured webinar: Minimizing the cost of regulatory compliance through RegTech

Listen to Moody’s Analytics and UK Finance discuss how regulatory technology, coupled with regulatory expertise can transform your regulatory compliance.

Other Banking Cloud Solutions

Other Banking Cloud Solutions

Transactional Reporting, Credit Risk, and Regulatory-Reporting-as-a-Service are among the first offered on the Banking Cloud platform, bringing you hosted, flexible, and scalable regulatory solutions

REQUEST A DEMO

Contact our team to get a personalized demonstration of our solutions. A member of our relationship management team will follow up with you shortly.

If you require immediate assistance, please contact our Client Services desk.

Americas | +1.212.553.1653 | [email protected]

EMEA | +44.207.772.5454 | [email protected]

Asia Pacific | +852.3551.3077 | [email protected]

Japan | +81.3.5408.4100 | [email protected]

If you require immediate assistance, please contact our Client Services desk.

Americas | +1.212.553.1653 | [email protected]

EMEA | +44.207.772.5454 | [email protected]

Asia Pacific | +852.3551.3077 | [email protected]

Japan | +81.3.5408.4100 | [email protected]

FILL IN THE FORM BELOW